Best Crypto to Buy Now as Bitcoin Price Rumors Point to a Possible $81K Crash

The Bitcoin price is slightly above $109K at the time of writing, and the macroeconomic conditions have made it clear that it is not the best crypto to buy now.

However, Donald Trump’s reimposition of tariffs has put the inflation wheels back into “turn on” mode. The Federal Reserve is stuck between keeping rates down while prices remain sticky. This has caused disturbing rumors to unfurl: Bitcoin could drop to $81K.

Will Bitcoin Price Drop to $81K?

When looking at the market from a pure macroeconomic point of view, the conditions are bearish. Inflation concerns are getting higher, as a survey by the Federal Reserve Bank of Philadelphia shows that the inflation rate will rise to 3.5% by year-end.

An artificial driver of this inflation has been tariffs. Surveys show that companies have passed on about 70% of the costs. As a result of these factors, the Bitcoin price has been bearish.

At the time of writing, Bitcoin is trading around $109.5K, with immediate resistance around $110.2K.

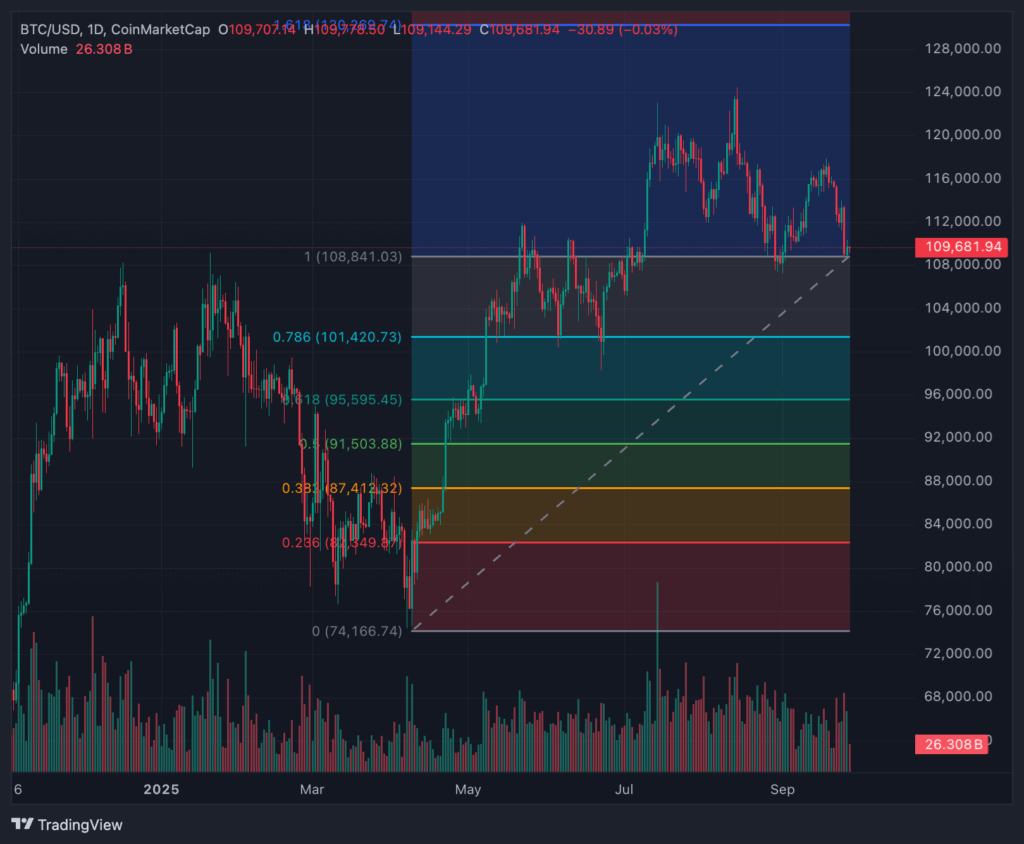

The next Fibonacci retracement levels are at $104K and $100K. Losing this range could push the BTC price into the $80K–$84K range.

The macroeconomic factors that could accelerate this drop include the Fed ignoring inflation, with the next reasonable stop being $96K. A drop to $81K would require even higher levels of inflation, which could be possible if the Fed delays easing or if a liquidity shock happens in the stock market.

While this triple threat hasn’t emerged yet, it could in the coming days, leaving investors to look for the best crypto to buy now elsewhere.

Best Crypto to Buy Now: Top list of Today

Given that there is even a possibility for the BTC price to venture into the 5-digit zone, investors looking for the best investment opportunities should look among the crypto ICOs.

Best Wallet Token

Best Wallet Token has already raised over $16 million in its presale, showcasing strong investor confidence and interest in the ecosystem it powers. At the center of this ecosystem is Best Wallet, a leading cryptocurrency application that has been gaining traction thanks to its wide range of features and intuitive design.

Best Wallet provides users with the ability to buy and sell cryptocurrencies with fiat, making it a highly accessible option for both new and seasoned investors. It also supports staking opportunities, giving users the ability to earn passive income by locking up their assets. The platform’s decentralized nature sets it apart from traditional exchanges, ensuring greater control and transparency for its users.

Among all of its features, the Token Launchpad stands out as the most impactful, especially in today’s bearish market conditions. This launchpad allows investors to gain early access to high-potential crypto presales before they are publicly available. In times when large-cap tokens are struggling to deliver strong returns, this feature gives retail investors an edge in spotting and entering early-stage projects with parabolic upside potential.

Best Wallet Token itself enhances the experience of the entire ecosystem by lowering transaction fees, providing higher staking rewards, and offering governance rights within the platform’s DAO. These benefits ensure that token holders are not just passive investors but active participants shaping the wallet’s future direction.

Bitcoin Hyper

The Bitcoin market touching the five-digit zone has set off alarms among investors, as it signals potential instability. Much of this volatility comes from Bitcoin’s limited utility, as its narrative remains centered around being a “store of value.” This gap is where Bitcoin Hyper positions itself as a better alternative, designed to add utility and scalability to the Bitcoin ecosystem.

The project has already raised over $17 million in its presale, a sign of strong community support and investor confidence. At its core, Bitcoin Hyper is not just another meme coin. It blends real-world use cases with a meme-based identity, aiming to bring Bitcoin out of a speculation-only framework and into a utility-driven future.

Its technological framework is one of the strongest in the meme coin market. It integrates features like the Solana Virtual Machine (SVM) for scaling, the Lightning Network for faster transactions, and the Canonical Bridge for interoperability. Together, these tools transform Bitcoin Hyper into a potential Layer 2 solution for Bitcoin, something the broader crypto ecosystem has been waiting for.

On top of this strong technical base, Bitcoin Hyper adds memetic appeal through its visuals and branding. The combination of recognizable Bitcoin themes with creative meme culture gives it both viral potential and long-term relevance.

Analysts have pointed out that this unique mix of utility and community power makes Bitcoin Hyper one of the most promising meme coin projects currently on the market.

Pepenode

Pepenode is a meme coin project with a unique spin on mining, making it more accessible and engaging through gamification. Instead of relying on physical rigs or technical know-how, Pepenode turns mining into a virtual Mine-to-Earn ecosystem where investors can buy “meme nodes” and build their own mining rigs in a game-like environment.

The project’s gamified presale has already captured attention, raising over $1.4 million so far. The presale experience itself feels similar to classic strategy games, where users can upgrade their rigs and unlock higher-tier nodes. This approach makes Pepenode both entertaining and rewarding, ensuring engagement during the presale phase.

Adding to its appeal is the Pepe-inspired imagery. The project keeps the frog’s iconic design intact while giving it a miner’s twist, portraying Pepe as a hardworking figure digging for meme coin wealth. This mix of humor and utility makes it stand out from other meme coins that focus solely on aesthetics or speculation.

Once the presale concludes, Pepenode will shift all mining from off-chain to on-chain, giving users real blockchain-based returns. Early investors also receive an added perk: a 20% bonus in Pepe tokens, showcasing Pepenode’s multi-crypto nature and increasing its long-term value proposition.

Conclusion

Since Bitcoin may not be the best crypto to buy now, investors looking for high-potential assets that could peak on the price charts should consider other available options. Among them, certain crypto ICOs are cut from a different cloth.

Best Wallet Token is associated with an already popular project, Bitcoin Hyper introduces more utility into the Bitcoin network, Pepenode offers a gamified version of mining, and with Snorter, users can take advantage of Solana’s meme coin ecosystem.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

También te puede interesar

Harvard Endowment Takes Rare Leap Into Bitcoin With $443M Bet on BlackRock's IBIT

Is 2025 Worse Than 2022 for Crypto? Nic Carter and Kevin McCordic Offer Differing Views