Will Elon Musk’s frog post trigger the next PEPE pump?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

PEPE tests key support as Elon Musk’s frog post sparks speculation of a meme coin rally.

PEPE is currently facing a crucial test near the $0.00001050 level. As detailed in recent price reports, a break below this support could add another zero to its price, creating anxiety for short-term holders. Yet, with meme coin cycles often flipping sentiment fast, bulls are still watching closely.

The broader market is also waiting for a trigger, and it might have just arrived. Elon Musk recently shared a frog-themed post on his X profile, fueling speculation that a new PEPE rally may be incoming. The last time Musk hinted at frog memes, PEPE surged. Will history repeat itself?

Chart analysts signal rebound possibility

Despite the recent dip, analysts believe PEPE could stage a comeback. Technicals suggest a strong bounce if bulls defend the $0.00001000 region. If that level holds, PEPE could attempt to retest $0.00001300 and even reach new local highs.

FOMO is already building as social metrics show rising activity. Traders are being cautious, but the slightest market spark, especially involving influencers like Musk, could send the token moving fast.

Pepeto steps in: Exchange demo launching + meme coin power

Pepeto is building serious momentum in the memecoin space, with a real product to back the hype. A preview of its upcoming exchange goes live in two days, giving early investors confidence that this isn’t just another speculative play. Check the official announcement.

Pepeto Highlights:

- Meme tokens listed with zero fees on pepeto.io.

- Bridge-powered swaps across Ethereum, Solana, and BNB.

- 278% APY staking for early adopters.

- Over $5.3m raised during presale with growing attention.

- Rumors suggest a Pepe co-founder is behind Pepeto, aiming to finish the original vision left behind.

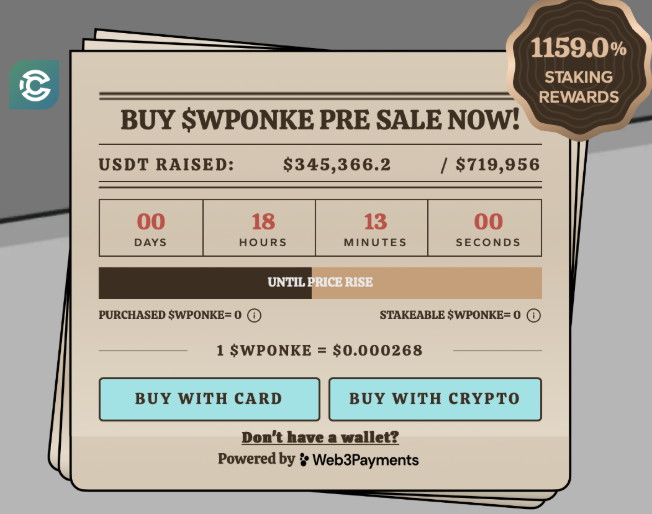

Wall Street Ponke: Venture-backed and trader-focused

Wall Street Ponke is another project catching eyes, especially among more serious investors. With $300k in VC funding and a roadmap that includes trader tools and an educational academy, it brings structure to the memecoin chaos.

Wall Street Ponke Key Points:

- Anti-whale AI bots warn users of manipulation.

- Full crypto learning hub for beginners and pros.

- Early-stage push supported by VC money.

- Campaign set to launch ahead of its exchange listing.

Keep watching these projects, millions are historically made by entering early when prices are still low.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

You May Also Like

Centrifuge COO Jürgen Blumberg: “DeFi Is Having Its ETF Moment”

Since the outbreak of the Israeli-Iranian conflict, Tether has frozen about 700 million USDT in 112 wallet addresses