VanEck Reports 16% Drop in Crypto Network Revenue in September

September proved to be a quieter month for the blockchain industry, with network revenues across major cryptocurrencies declining due to diminished market volatility. While some networks experienced sharper drops, others maintained resilience amid shifting investor sentiment. This trend sheds light on how market dynamics influence the economic activity on blockchain platforms, impacting everything from transaction fees to DeFi and NFT markets. Experts continue to monitor these shifts to assess the broader health of the crypto ecosystem amid ongoing regulatory and technological developments.

- Blockchain network revenues fell by 16% MoM in September, influenced by lower market volatility.

- Ethereum’s revenue dropped 6%, Solana’s 11%, and Tron’s fees decreased 37% after gas fee reductions in August.

- Reduced volatility led to fewer arbitrage opportunities, impacting transaction fees and network income.

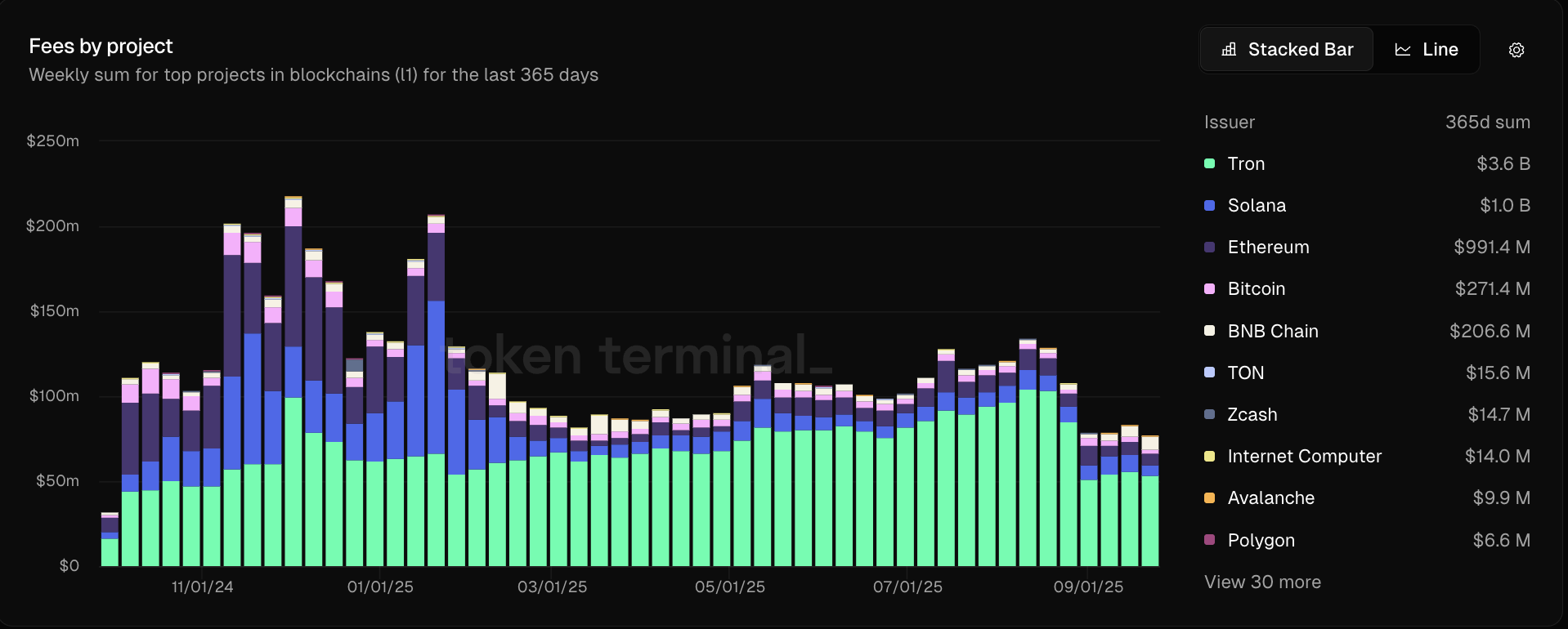

- Tron remains the top revenue-generating blockchain, with over $3.6 billion in annual earnings, surpassing Ethereum.

- Stablecoin activity on Tron continues to grow, with over half of Tether USDT supply issued on its network, supporting the global digital dollar infrastructure.

Network revenues across the blockchain ecosystem experienced a 16% month-over-month decline in September, driven largely by a slowdown in market activity. According to asset manager VanEck, this downturn aligns with reduced volatility in key cryptocurrencies. Ethereum’s revenue fell by 6%, while Solana’s dropped by 11%. Tron, however, saw a significant 37% decrease in fees following a governance proposal that cut gas fees by over 50% in August, which temporarily boosted transaction volume.

The decline in revenues was primarily linked to lower price swings in underlying tokens. Ethereum (ETH) volatility decreased by 40%, Solana (SOL) by 16%, and Bitcoin (BTC) by 26% during September. As the report explains, “With reduced volatility for digital assets, there are fewer arbitrage opportunities to compel traders to pay high priority fees.” This decrease in market activity translates into fewer incentives for increased network fees, which are a critical metric for measuring economic activity within crypto ecosystems.

Market analysts and investors closely monitor network revenues and fees to gauge overall health and growth prospects within the crypto space. Despite recent declines, these metrics provide valuable insight into blockchain activity, DeFi, and NFT markets, which continue to evolve against a backdrop of ongoing crypto regulation debates.

Related: Ethereum’s revenue dropped 44% in August despite reaching an all-time high

Tron’s Revenue Dominance Continues

Tron remains the leader in revenue generation among crypto networks, with data indicating it earned over $3.6 billion in the past year — significantly surpassing Ethereum’s $1 billion, despite ETH reaching record highs. Tron’s revenue is primarily driven by its prominent role in stablecoin settlements, with more than 51% of all circulating Tether USDT issued on its blockchain.

The stablecoin market has seen sustained growth, with a valuation surpassing $292 billion in October 2025 — a trend that has persisted since 2023, according to RWA.XYZ. Stablecoins are increasingly vital in the crypto ecosystem, facilitating seamless cross-border transactions with minimal fees, near-instant settlement times, and 24/7 trading — all without traditional banking infrastructure.

A comparison of crypto network fees over the last year. Source: Token Terminal

A comparison of crypto network fees over the last year. Source: Token Terminal

As regulatory scrutiny increases globally, blockchain-based stablecoins like Tether and USD Coin continue to solidify their role in the digital economy. The ability to transfer assets across borders quickly and efficiently positions stablecoins and blockchain protocols like Tron at the forefront of the next phase of financial innovation, with widespread implications for the future of crypto regulation and global markets.

This article was originally published as VanEck Reports 16% Drop in Crypto Network Revenue in September on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Stablecoin Yields Force Banks to Provide Genuine Customer Interest

UK Lifts Crypto Ban, Opening Regulated Market Access for Retail Investors