Uniswap (UNI) Consolidates After Sharp Pullback as Open Interest Drops Over 50%

The token’s price action reflects diminishing volatility and weaker speculative participation, signaling a cautious phase for the decentralized exchange token as market participants await renewed direction.

Open Interest Decline Highlights Cooling Market Momentum

Uniswap was trading near $6.07, showing muted movement after slipping from the $8 region earlier in the week. TradingView’s Open Interest data shows a steep contraction from above 300 million to around 140 million, suggesting widespread liquidation and profit-taking. Such a rapid decline in OI typically reflects traders exiting the market or closing leveraged positions amid rising uncertainty.

Source: Open Interest

This structural shift points to reduced participation and a slowdown in speculative momentum. Unless the token reclaims the $6.50 resistance zone with increasing open interest, the token risks sliding further toward the $5.80 range. A sustained drop in participation would likely reinforce this cautious sentiment, indicating that the market remains risk-averse until clearer confirmation of recovery appears.

Market Data Reflects Ongoing Market Caution

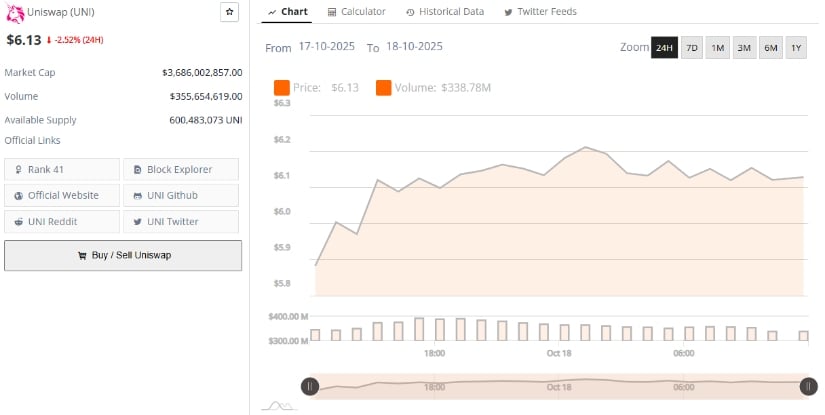

According to BraveNewCoin data, Uniswap currently trades at $6.13, marking a 2.52% decline over the past 24 hours. The token holds a market capitalization of $3.68 billion with a daily trading volume of $355.6 million, ranking it 41st among global cryptocurrencies. With an available supply of 600.48 million tokens, liquidity remains sufficient despite the prevailing market slowdown.

Source: BraveNewCoin

The pullback aligns with the broader altcoin market trend, where several assets have seen retracements following early October rallies. The continued decline in trading activity underscores a transitional period for the coin, with sentiment shifting from neutral to slightly bearish. For momentum to recover, both spot and derivative metrics need to reflect renewed capital inflows and stronger buyer conviction.

Technical Indicators Suggest Sideways Bias

At the time of writing, Uniswap was trading around $6.06, maintaining a narrow range between $6.00 and $6.20. The Bollinger Bands on the daily chart have begun to contract, reflecting decreasing volatility and a consolidation phase following prior declines. The crypto is currently positioned below the middle Bollinger band at $7.26, reinforcing a bearish bias as long as it remains under this threshold.

Source: TradingView

The Relative Strength Index (RSI) stands at 34.16, hovering near oversold territory but showing early signs of flattening. This suggests potential stabilization, although not yet signaling a reversal. A move above the RSI-based moving average at 37.49 could indicate momentum shifting back toward buyers.

For now, the overall structure remains neutral-to-bearish. A decisive close above the $6.50 resistance could set the stage for a short-term rebound toward $7.00, while failure to hold current levels may expose the asset to further downside pressure toward the $5.50–$5.80 region.

You May Also Like

Aave DAO to Shut Down 50% of L2s While Doubling Down on GHO

Bitcoin Price Prediction: BTC Projected to Clear $112,000 This Week as This $0.035 Token Tops Altcoin Watchlists