U.S. equity funds log biggest inflows since 2024 as Fed rate cut looms

U.S. equity funds recorded increased inflows at the beginning of October as the likelihood of another rate cut by the Fed looms this month. LSEG Lipper data revealed that U.S. equity funds received $36.41 in net inflows during the week, their largest weekly net purchase since November 13, 2024.

The large-cap equity funds recorded net weekly inflows of $40.75 billion, the largest amount since around 2022. Small-cap and mid-cap funds experienced outflows of $2.59 billion and $2.28 billion, respectively.

Bond funds record outflows for the week

LSEG data also showed investors offloaded a net $5.8 billion worth of bond funds, ending their 23-week-long trend of net purchases. They invest more in short-to-intermediate government and treasury funds to a total of $9.37 billion in their largest weekly sales since at least January 2022.

U.S. short-to-intermediate investment-grade funds saw $1.95 billion in inflows, while general domestic taxable fixed-income funds recorded net inflows of $1.55 billion. Money market funds also recorded an increase in net investments, surging to a four-week high of $47.08 billion during the week.

LSEG Lipper data revealed that global equity funds saw a net $49.19 billion worth of inflows, the most since November 13, 2024. European equity funds recorded weekly inflows to the tune of $7.36 billion, while Asian funds saw $3.94 billion in weekly inflows. Equity sectoral funds saw $11.56 inflows last week, the largest since January 2022. Tech led the net purchases with $4.15 billion, followed by financials with $3.43 billion.

Global bond funds recorded positive net inflows for 24 weeks straight, but weekly net investments plummeted to a 14-week low of $6.06 billion. Euro-dominated bond funds saw $7.37 billion in inflows, and high-yield bond funds recorded $2.41 billion in weekly inflows.

Short-term bond funds ended their 13-week period of inflows with net $8.52 outflows for the week. Money market funds received a net of $8.84 billion, posting the first weekly net purchase in three weeks. Global equity funds recorded strong demand in the week through October 1, following an inline U.S. inflation report and a weaker-than-expected jobs report.

U.S. economy regains momentum in Q3

U.S. equity funds surged as the U.S. consumer spending increased slightly more than expected in August. The U.S. Commerce Department reported last Friday that the economy has so far regained most of its momentum from the third quarter.

The government shutdown witnessed on Wednesday suggested that the Bureau of Labor Statistics is closed and unable to release the official government jobs report on Friday. The weak labor report also came as chances of the Federal Reserve cutting interest rates again this year rose after the U.S. central bank resumed policy easing in mid-September. At the time of publication, the CME FedWatch tool shows a 97.8% probability that the central bank will cut rates by 25 bps during the upcoming October 29 Fed meeting.

The U.S. labor market declined, with U.S. companies shedding 32,000 jobs in September. Payroll processing company ADP’s private sector employment report on Wednesday showed lower than the expected job report of 45,000 in the month.

ADP Chief Economist Nela Richardson argued that last month’s release validated that U.S. employers have been cautious with hiring, despite the strong economic growth witnessed in the second quarter. The weak labor report followed a slightly more positive GDP and unemployment claims report for the U.S. economy.

Sharpen your strategy with mentorship + daily ideas - 30 days free access to our trading program

You May Also Like

ABD’de Hükümet Kapanma Krizinde Yeni Gelişme! Bir Sonraki Kritik Tarih Belli Oldu

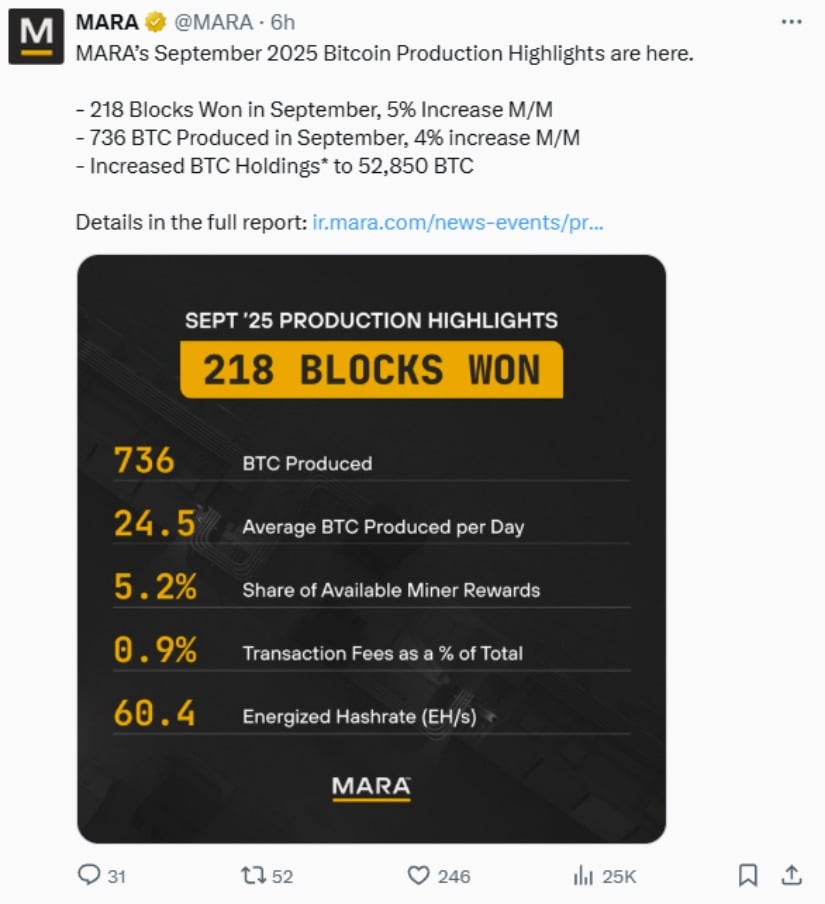

MARA Holdings Reaches 52,850 Bitcoin Worth Over $6 Billion