Stablecoin Bill Divides Lawmakers as Senator Warren Warns of Trump-Linked Conflicts of Interest

The passage of the Guiding and Establishing National Innovation for U.S. Stablecoins Act, known as the GENIUS Act, has drawn sharp lines in Washington, with praise from industry leaders and regulators clashing against growing warnings from lawmakers, especially Senator Elizabeth Warren.

The bill was signed into law by President Donald Trump on July 18, 2025; the GENIUS Act marks the United States’ first federal framework dedicated to regulating payment stablecoins.

The White House hailed the legislation as a “historic moment for crypto and the U.S. dollar,” emphasizing that it would position the nation as a leader in digital assets.

The law introduces strict rules on who can issue stablecoins, how reserves must be backed, and the disclosures required to ensure transparency.

It creates a licensing pathway under the Office of the Comptroller of the Currency (OCC) for both banks and qualified non-banks, while excluding algorithmic or DeFi-native tokens for further study.

Supporters have described it as a long-awaited move to bring legal clarity to a market that had operated in a regulatory gray zone for years.

Crypto Leaders Call GENIUS Act “Beginning of a New Regulatory Era”

Executives from leading digital asset firms have largely praised the law. Ian De Bode, chief strategy officer at Ondo Finance, called it “the beginning of a new regulatory era,” citing bipartisan cooperation that he believes will boost institutional participation in crypto markets.

He also noted that Patrick McHenry, former chair of the House Financial Services Committee and current vice chair of Ondo Finance, played a key role in advancing the bill.

Similarly, Bitpanda deputy CEO Lukas Enzersdorfer-Konrad described the law as a “breakthrough” that has renewed market optimism, pointing to a recent rally in Bitcoin and altcoins.

Tae Oh, CEO of Gluwa, emphasized that the framework “signals a strong commitment to responsible innovation, consumer protection, and long-term industry growth.”

Federal regulators have echoed these sentiments. SEC Chair Paul Atkins called the GENIUS Act a “seminal step” for U.S. financial regulation, acknowledging that while many challenges remain, the law provides much-needed clarity.

Treasury Secretary Scott Bessent went further, describing it as “essential” for maintaining American leadership in digital finance, predicting that stablecoins will expand dollar access globally and increase demand for U.S. Treasuries.

However, the praise has not been unanimous. In recent weeks, major banking associations and lawmakers have voiced growing concerns about potential loopholes and systemic risks within the new law.

Warren vs. Trump’s Treasury: Stablecoin Law Sparks $6.6 Trillion Banking Panic

On August 13, a coalition of leading U.S. banking trade groups, including the American Bankers Association, Bank Policy Institute, and Financial Services Forum, urged Congress to tighten the rules.

They warned that the GENIUS Act’s language could allow stablecoin issuers or affiliated entities to indirectly pay yield to holders, even though the law explicitly bans issuers from doing so.

Such an arrangement, they cautioned, could divert up to $6.6 trillion in deposits from traditional banks into stablecoins, potentially driving up borrowing costs for households and businesses.

The most forceful criticism, however, has come from Senator Elizabeth Warren, the top Democrat on the Senate Banking Committee.

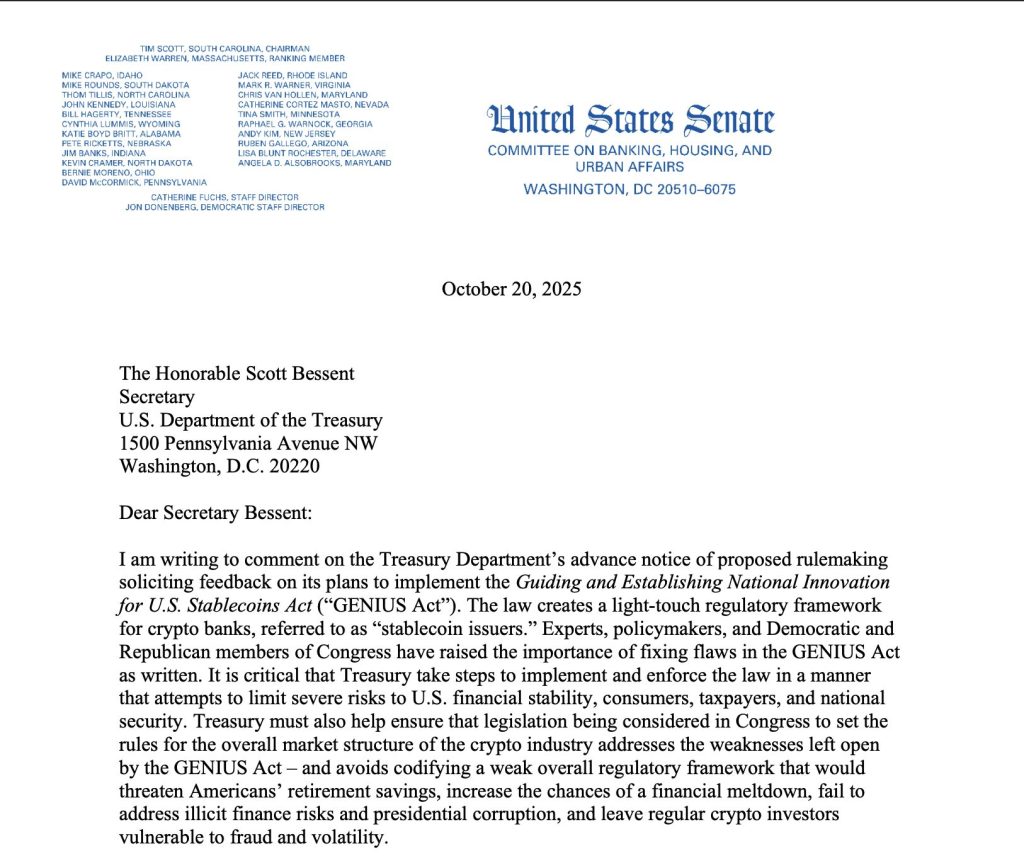

In a letter to Treasury Secretary Bessent, Warren accused the administration of overlooking corruption and conflicts of interest tied to Trump-linked allies involved in shaping the legislation.

Source: U.S. Senate

Source: U.S. Senate

She argued that Treasury must insulate its proposed rules from these influences and strengthen oversight to prevent “rogue states, drug cartels, terrorists, and criminals” from exploiting stablecoins to move illicit funds.

Warren Blasts GENIUS Act as “Dangerous and Deregulatory,” Says Treasury Ignoring Risks to Everyday Americans

Warren also warned that the GENIUS Act fails to provide adequate consumer protections, leaving users vulnerable to scams and losses in stablecoin transactions.

Unlike traditional banking apps such as Venmo, she said, the law lacks provisions ensuring that consumers receive the same safeguards or that the Consumer Financial Protection Bureau (CFPB) retains enforcement power.

She further criticized the bill’s failure to prevent Big Tech and large conglomerates from issuing private currencies, saying it risks allowing corporations to “take control over the money supply.”

Warren added that the absence of stronger financial stability guardrails could make “destructive runs and demands for bailouts” more likely, urging Treasury to issue clear guidance barring the use of the Exchange Stabilization Fund (ESF) or any Federal Reserve 13(3) emergency facility to rescue the stablecoin industry.

In addition, the senator called for the Treasury to reject any reciprocity agreement with El Salvador that would allow Tether, the world’s largest stablecoin issuer, to bypass U.S. compliance obligations under the GENIUS Act.

“The Treasury has an opportunity to address these risks through bipartisan negotiations over broader crypto legislation,” Warren wrote, urging the department to act swiftly to close regulatory gaps and strengthen enforcement.

She also warned back in August that the current crypto framework could ‘blow up’ the U.S. economy while blasting GENIUS Act and Trump’s cryptocurrency business ventures as corruption risks.

Despite these divisions, the GENIUS Act remains a milestone in U.S. digital asset regulation. Supporters view it as a foundation for mainstream adoption, while critics argue it leaves key vulnerabilities unaddressed.

Former White House Crypto Council executive Bo Hines, who helped craft the legislation before joining Tether as a strategic advisor, described the GENIUS Act as the “first piece of the puzzle” in modernizing America’s financial system.

He credited the White House’s rapid pace in passing the bill, saying it was designed to make U.S. payment rails “fair and robust.”

You May Also Like

Reddit sues Perplexity for copyright infringement

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release