Solana pumped 17,100% in 8 months in 2021; These 3 coins could do the same

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Solana’s 17,100% surge in 2021 set the standard, and in 2025, coins like Little Pepe, Dogecoin, and Cardano are catching attention as the next big breakout contenders.

Table of Contents

- Little Pepe: A layer 2 memecoin with real utility

- Dogecoin: Renewed interest and strong community

- Cardano: Steady growth with strong fundamentals

- Outlook for 2025

In 2021, Solana gained attention after increasing its price by more than 17,100% in less than eight months. This rally demonstrated how quickly a cryptocurrency can gain value once it is backed by strong technology and community support. As 2025 progresses, several altcoins are emerging with similar growth potential. Investors are especially watching Little Pepe (LILPEPE), alongside Dogecoin and Cardano, for promising upside before the year ends.

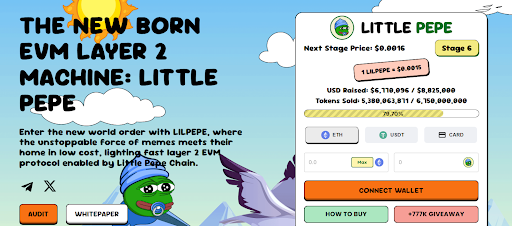

Little Pepe: A layer 2 memecoin with real utility

Little Pepe stands out among emerging coins by combining meme culture with solid blockchain infrastructure. The token has strong transaction speed, low fees, and is built on a custom Ethereum Layer 2 network. The presale has completed Stage 5, where $6.57 million was raised with 5.25 billion tokens sold out, and is now in Stage 6, priced at $0.0015 per token. So far, over $6.77 million has been raised, with 5.34 billion tokens sold out of the 6.75 billion allocation. The price is set to rise to $0.0016 in the next stage, signaling growing investment demand and strong market traction.

In contrast to other memecoins, Little Pepe aims to incorporate virality and real-world utility. The Layer 2 technology solves congestion and high gas fees within Ethereum, making it scalable and efficient. Little Pepe has a strong fan base that is rapidly growing on networks such as X (previously Twitter) and Telegram. This grass-roots momentum, combined with its tech foundation, makes LILPEPE a possible breakthrough candidate in 2025.

The presale structure incentivizes early participation with incremental price increases across stages. Investors buying now at the current price may benefit if demand is sustained and token scarcity drives price appreciation. With the project nearing a major milestone, Little Pepe exemplifies how next-generation meme coins can fuse entertainment and technology. On top of that, there’s a massive $777,000 giveaway still running, 10 winners will walk away with $77,000 worth of LILPEPE tokens each, and all it takes to qualify is a minimum $100 contribution.

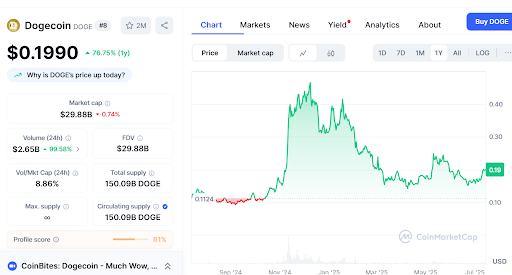

Dogecoin: Renewed interest and strong community

Dogecoin (DOGE) is currently one of the most well-known memecoins, with a market capitalization of almost $30 billion. Over the past twelve months, DOGE has increased by approximately 76% driven by an active and dedicated user community. The recent surge in trading volumes shows greater market participation.

Although the asset started as a meme, its prominence and regular hype among social media users help keep Dogecoin popular. The high circulating supply and unlimited maximum supply can limit long-term price growth. Still, DOGE’s resilience and new transactions strengthen its position as a major competitor in the meme coin space.

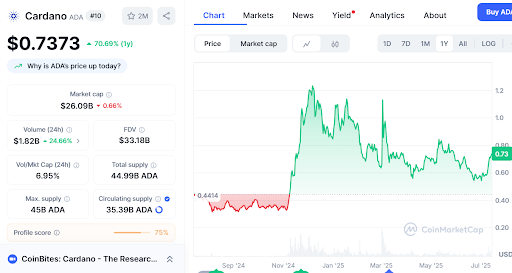

Cardano: Steady growth with strong fundamentals

Cardano (ADA) has shown consistent increases of over 70% in the past 12 months. ADA has a total supply limit of 45 billion tokens, with 35 billion circulating, and controlled inflation of the tokenomics is feasible. Cardano’s ongoing development of smart contracts and the DeFi ecosystem also attracts investor interest.

Price support near $0.60 and increasing trading volumes reflect solid market confidence. As the project matures, ADA may see further upside if it breaks key resistance levels, benefiting from ecosystem growth and broader market trends.

Outlook for 2025

The increase in Solana’s value by 17,100% in 2021 is evidence of how fast cryptocurrencies can rise and fall. The combination of meme-ability and the Layer 2 blockchain technology approach makes Little Pepe stand out as a serious contender for such success. Dogecoin and Cardano are also attractive opportunities that have developed communities and are strengthening fundamentals. Investors are advised to monitor volume, price action, and project developments closely. Although there are no guarantees, these three coins highlight the range of assets that can bring enormous returns by the end of 2025.

To learn more about Little Pepe, visit the official website.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Bitcoin ETFs record six-week inflow streak, topping over $10b in net additions

Altcoin Season Indicators: Ethereum Rockets 21%, XRP Hits ATH as Bitcoin Dominance Wanes