Shiba Inu in Salvage Mode as Burn Rate Rockets 1,431%

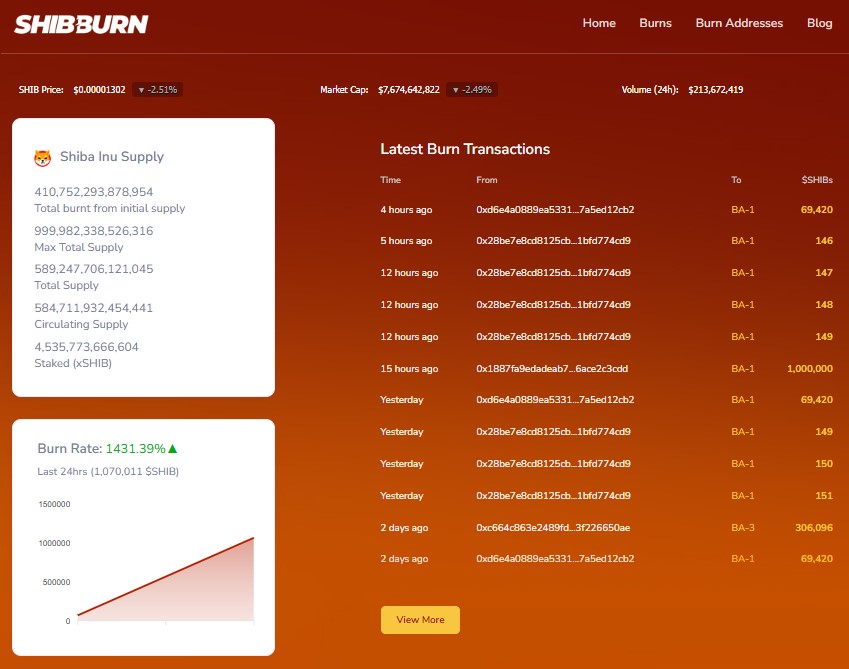

Data from Shibburn, the website dedicated solely to tracking the burning of dog-themed Shiba Inu SHIB $0.000013 24h volatility: 4.2% Market cap: $7.61 B Vol. 24h: $227.49 M , shows that the burn rate has hit 1,431%.

This action, which drops the circulating supply of the meme coin, is expected to trigger a price jump. At this time, no positive momentum of such has been recorded for Shiba Inu.

SHIB Price Yet to Capitalize on Burn Increase

According to Shibburn, the 1,431.39% increase in burn rate led to the destruction of 1,070,011 SHIB within the last 24 hours. Such huge burns often contribute upward pressure to the price of the meme coin.

Latest burn transactions on Shibburn. | Source: Shibburn

This follows the principle that says a crunch in supply, accompanied by steady or rising demand, generally drives an asset’s value higher.

SHIB is currently trading at $0.00001301, with a 2.39% decline within the last 24 hours. Its 24-hour trading volume is 20.09% down at $221.93 million, suggesting declining traders’ engagement. In the same vein, the SHIB market cap is pegged at $7.67 billion.

These key metrics are yet to capitalize on the recent burn activity in the ecosystem. Market experts opine that the next upside targets could extend toward $0.0000150 and $0.0000200.

However, this is dependent on whether SHIB can decisively close above the upper resistance line near $0.0000130.

Shiba Inu has a maximum supply of 999,982,338,526,316. So far, a total of 410,752,293,878,954 SHIB has been burnt from the initial supply of the token. This leaves the meme coin with only about 584,711,919,016,228 in circulation.

Maxi Doge Presale Raises $2.33M With 141% Staking APY

Maxi Doge (MAXI) is making waves after raising over $2.33 million in its presale at just $0.000258 per token. Investors are jumping in for the huge 141% staking APY, and with the next price adjustment less than two days away, excitement is at an all-time high.

The community is buzzing as more buyers join, and early supporters are already positioning themselves for potential rewards. With this momentum, Maxi Doge is quickly becoming one of the best crypto presales of 2025, combining strong growth with massive staking incentives.

Current Presale Stats:

Current price: $0.000258

Amount raised so far: $2.33 million

Ticker: MAX

If you’re interested in joining the presale, check out our guide on how to buy Maxi Doge.

nextThe post Shiba Inu in Salvage Mode as Burn Rate Rockets 1,431% appeared first on Coinspeaker.

You May Also Like

Trump sues New York Times for $15B, $TRUMP token

‘KPop Demon Hunters’ Rewrites Animated Film Music History