Nvidia becomes first $5 trillion company, expands into government AI, and next-gen wireless

Shares of Nvidia jumped over 4% on Wednesday, pushing the company to a $5 trillion valuation, the first time any company has ever hit that level.

This comes right after the stock had already surged 5% the day before, bringing its year-to-date gains to over 50%, as Cryptopolitan reported.

What started as a graphics chip company for gamers has turned into the most powerful force behind the current artificial intelligence explosion.

The latest rally kicked in after CEO Jensen Huang told investors Nvidia expects to lock in $500 billion in AI chip orders, while also revealing that the company will build seven new supercomputers for the U.S. government.

These machines are expected to handle national AI workloads and are part of Washington’s growing reliance on private sector tech muscle.

Nvidia expands into government AI and next-gen wireless

Also on Tuesday, Cryptopolitan reported that Jensen had announced that Nvidia is putting $1 billion into Nokia, forming a strategic partnership aimed at building 6G infrastructure.

The two companies plan to work together on tech that could power future wireless networks and connect AI devices in real time.

The effects didn’t stop with Nvidia. Apple and Microsoft also saw gains, with both companies crossing $4 trillion market values after their stocks rose during the tech-fueled rally.

By the end of Tuesday, U.S. stock markets hit new records, boosted by the AI trade. The Nasdaq added 0.6%, the S&P 500 climbed 0.3%, and the Dow Jones rose by 281 points, or 0.6%, pushing all three indexes to all-time intraday highs.

But the rush into AI stocks is raising red flags. Earlier this month, the International Monetary Fund and the Bank of England each warned that a sudden pullback in AI spending could slam global equities.

They said markets may be at risk if investor excitement fades. These warnings are landing at a time when valuations are running hotter than ever.

Still, some players in the market are trying to balance the hype. Cathie Wood, head of Ark Invest, said during a panel at Saudi Arabia’s Future Investment Initiative that while the AI boom might face a short-term correction, she doesn’t believe it’s a bubble.

“If our expectations for AI … are correct, we are at the very beginning of a technology revolution,” Cathie told CNBC on Tuesday.

Fed decision, Trump-Xi talks, and shutdown worries test traders

As markets break records, traders are also watching the Federal Reserve. The central bank is expected to cut interest rates by 0.25% on Wednesday.

But what matters more to traders is whether Chair Jerome Powell will sound soft in his follow-up remarks. Another cut is also expected in December, and many are betting on it.

The U.S.-China trade relationship is also calming down. After progress over the weekend, all eyes are on President Donald Trump’s upcoming meeting with Chinese President Xi Jinping in South Korea.

Some traders are betting that Trump’s renewed international engagement might reduce the chances of fresh tariffs. Thierry Wizman, global FX and rates strategist at Macquarie, said:

Thierry added, “The prospect of seeing very high tariffs, especially on China, has diminished. To some extent, this also plays to the prospect that the Fed will be dovish too, given there is a connection between lower tariffs and lower inflation.”

Even with all the excitement, not everyone’s confident. The government shutdown is still unresolved, and some investors worry that markets are priced too high.

Despite record-breaking gains, analysts are warning against complacency, especially with major macro risks still hanging over the market. But as of now, Nvidia’s breakout just rewrote the playbook, and everyone else is scrambling to catch up.

If you're reading this, you’re already ahead. Stay there with our newsletter.

You May Also Like

Privacy is ‘Constant Battle’ Between Blockchain Stakeholders and State

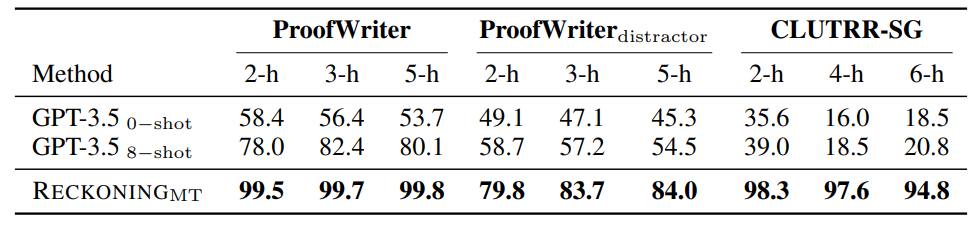

Technical Setup for RECKONING: Inner Loop Gradient Steps, Learning Rates, and Hardware Specification