How Ozak AI Presale at $0.012 Could Turn $500 Into $50,000 by 2026

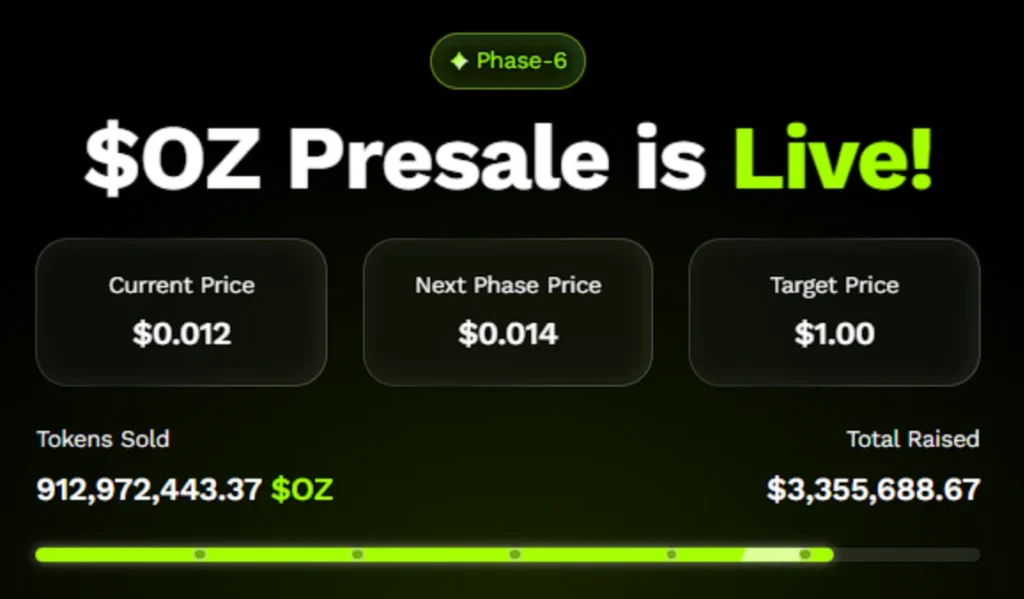

Ozak AI has quickly become one of the most anticipated presales in 2025. With tokens currently priced at just $0.012, investors are rushing to stabilize their positions earlier than the price rises in addition. The mission has already raised over $3.3 million, a clear signal that both retail and institutional traders see strong capability. At this kind of low entry price, Ozak AI offers buyers a rare chance to invest in a project that mixes blockchain with artificial intelligence—two of the fastest-developing sectors in the world.

The $500 to $50,000 Example

One of the most attractive elements of Ozak AI’s presale is the math behind its growth capability. At today’s price of $0.012, a $500 investment would buy more than 41,000 tokens. If Ozak AI climbs to $1.20 through 2026, which many analysts accept as true and is possible in the next bull cycle, that bag of tokens would be worth nearly $50,000. This example suggests how small investments can potentially turn into life-converting gains when timed correctly with a promising presale.

Why Ozak AI Has 100x Potential

The buzz around Ozak AI isn’t simply hype—it’s backed by means of fundamentals. The mission is designed to combine artificial intelligence with blockchain, providing traders and businesses with superior tools together with predictive analytics, statistical modeling, and decentralized AI-powered answers. This software guarantees that demand for the token goes past the hypothesis. As AI adoption quickens globally, Ozak AI positions itself as a gateway for traders who need exposure to each AI and crypto in a single investment.

Learning from Past Market Successes

Crypto history is filled with examples of small investments multiplying into huge returns. Early Ethereum buyers at under $1 watched their tokens surge into the thousands. Solana, once available for under $2, hit highs above $200. Even meme tokens like Dogecoin turned modest investments into fortunes during peak hype cycles. Ozak AI is now being discussed in the same light—an early-stage token with the ability to follow a similar trajectory if adoption and market momentum align.

Timing Is Everything

Market timing plays a huge role in crypto success, and Ozak AI seems perfectly positioned ahead of the next potential bull run in 2025–2026. With Bitcoin’s halving cycle historically sparking strong rallies, analysts expect the altcoin market to experience explosive growth. Narratives such as AI integration are expected to dominate, giving Ozak AI a unique edge. Entering now at $0.012 could be the difference between modest gains and once-in-a-cycle returns.

Investor Sentiment and Growing Community

The strength of a crypto project is often reflected in its community, and Ozak AI has already built strong momentum. From social media buzz to OZ presale demand, investors are signaling high confidence in its potential. This grassroots support is critical because projects with strong communities often experience faster adoption, increased visibility, and higher trading volumes when they list on major exchanges.

From Presale to Major Exchanges

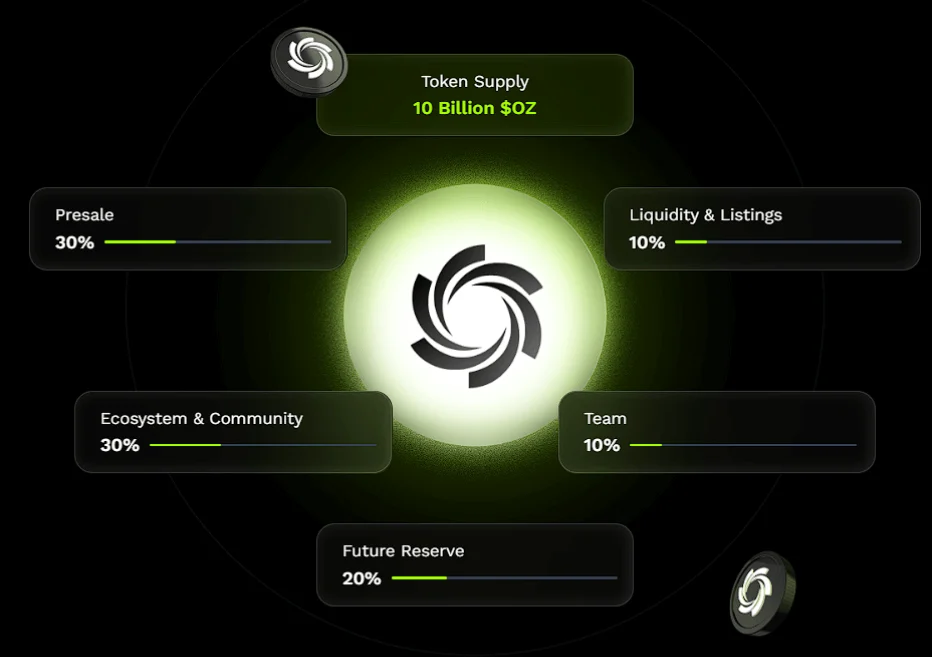

Another factor fueling optimism is Ozak AI’s listing roadmap. Once the presale concludes, the token is anticipated to debut on each centralized and decentralized exchange, growing liquidity and accessibility. Historically, presale tokens with sturdy fundamentals tend to rally drastically after their release. With demand already high, analysts trust Ozak AI’s fee ought to climb hastily in its early trading days.

Opportunities like Ozak AI don’t come around regularly. With the presale still priced at $0.012, early traders have the chance to position themselves before broader market publicity drives expenses higher. The possibility of turning $500 into $50,000 via 2026 illustrates simply how transformative this mission could be for those willing to take the risk. While no funding comes without uncertainty, Ozak AI’s combination of low access charge, sturdy basics, and booming AI narrative makes it one of the most compelling performers in the market these days.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

This article is not intended as financial advice. Educational purposes only.

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Cyberattack Hits Major European Airports, Causing Flight Delays and Cancellations

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?