Ethereum breaks through $4,600 to hit a multi-year high as corporate and institutional interest continues to grow

On August 12, Ethereum (ETH) rose more than 5%, breaking through $4,600, setting its highest price since December 2021.

The rally coincided with corporate treasury purchases of currency, record inflows into U.S. spot ETFs, and growing expectations of a possible interest rate cut at the Federal Reserve's September policy meeting.

The latest price movements followed the release of U.S. Consumer Price Index (CPI) data, which showed annual inflation above the central bank's 2% target but generally in line with expectations.

The data prompted market participants to increase bets that the Federal Reserve will implement its first interest rate cut since 2020, which would ease lending conditions across financial markets.

Bitmine Immersion Technologies has disclosed plans to raise up to $20 billion to fund further Ethereum acquisitions. The company already holds approximately $5 billion in ETH, making it one of the largest known corporate holders of the second-largest cryptocurrency.

Its large-scale increase in holdings is in line with the general trend of companies incorporating digital assets into their treasury strategies. As the channels for institutions to enter the crypto market continue to expand, this trend is accelerating.

On August 11, the U.S.-listed Ethereum spot ETF saw net inflows of $1 billion, setting a single-day record since its launch this year. This is also the second time since August that its net inflow has exceeded that of the Bitcoin spot ETF.

Ethereum has strengthened against Bitcoin over the past month, with the ETH/BTC ratio rising nearly 50% to above 0.37, although it remains 15% lower than it was a year ago.

After a period of decline relative to Bitcoin, Ethereum's share of the crypto market has continued to rise in recent weeks.

The network accounts for a significant share of activity in asset tokenization, DeFi, and blockchain-based settlement systems that emulate traditional market infrastructure. These applications are supported by recent software upgrades designed to increase scalability and reduce transaction costs.

Regulatory dynamics have also shaped the current environment. In the United States, the passage of the GENIUS Act, which provides clearer guidance for certain digital asset activities, is believed to be a factor in the renewed engagement of institutions.

At the same time, other digital asset treasuries, including Sharplink, also increased their ETH holdings, further driving market demand. The combined effects of increased corporate holdings, strong ETF inflows, and the potential for looser monetary policy have pushed Ethereum prices to their highest level in nearly five years.

While previous rallies have often been followed by high volatility, the current market environment reflects a confluence of drivers, with funds continuing to concentrate on buying the asset in recent weeks.

You May Also Like

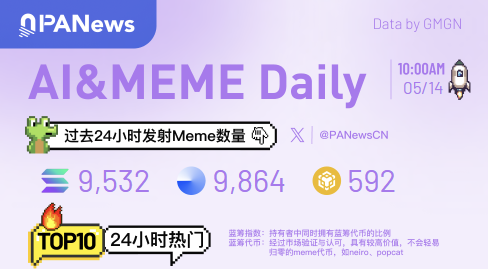

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.5.14)

Pacific nation Nauru passes law to establish a crypto regulator