ETH Whales’ Profits Hit Records: Massive Rally or Big Price Drop Next?

TL;DR

- Whale wallets now show unrealized profits equal to 2021 levels, signaling strong market confidence.

- ETH outflows from exchanges spike as holders move coins to cold storage or staking platforms.

- September staking inflows drop to 8.4K ETH, cooling sharply after August’s record-high deposits.

Whale Profit Levels Return to 2021 Highs

Ethereum wallets holding between 10,000 and 100,000 ETH have now reached the same unrealized profit levels seen during the 2021 market peak. This data suggests large holders are once again sitting on sizable paper gains.

In 2017, whale wallets saw unrealized profits peak at around $15 billion. By 2021, this figure had grown to more than $45 billion. As of September 2025, that level has been matched. Charts tracking whale wallet performance show a clear return to the high-profit zone last seen before ETH’s strongest rallies.

Crypto analyst commented,

Though similar conditions led to large price increases in the past, it is not guaranteed that the same will happen again.

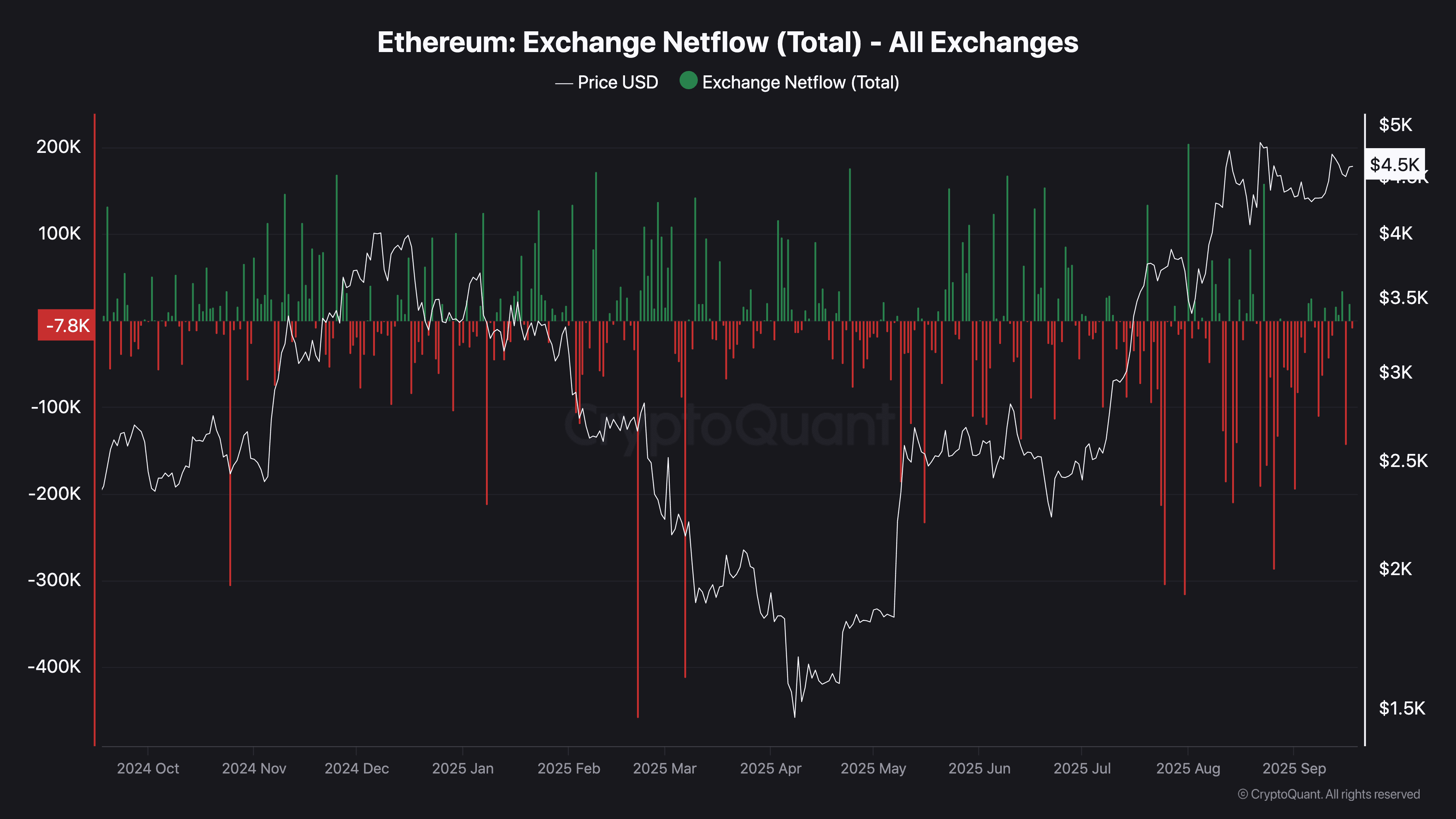

Exchange Flows Point to Lower Selling Pressure

During early 2025, Ethereum saw large volumes of ETH moved onto exchanges. In February and March, inflows above 200,000 ETH occurred as the price fell from over $3,000 to around $1,500. This activity typically signals selling.

Notably, that trend reversed by mid-2025. From June onwards, more ETH began leaving exchanges than entering. Outflow spikes ranged from 200,000 to 400,000 ETH. This behavior change came as ETH started recovering and climbing past $4,000. Large outflows are often linked to reduced sell-side activity as coins are moved off exchanges.

Source: CryptoQuant

Source: CryptoQuant

By August and September, this pattern continued while ETH traded near $4,500. Withdrawals remained high, suggesting that holders were choosing to secure their ETH off platforms, possibly for long-term storage or staking.

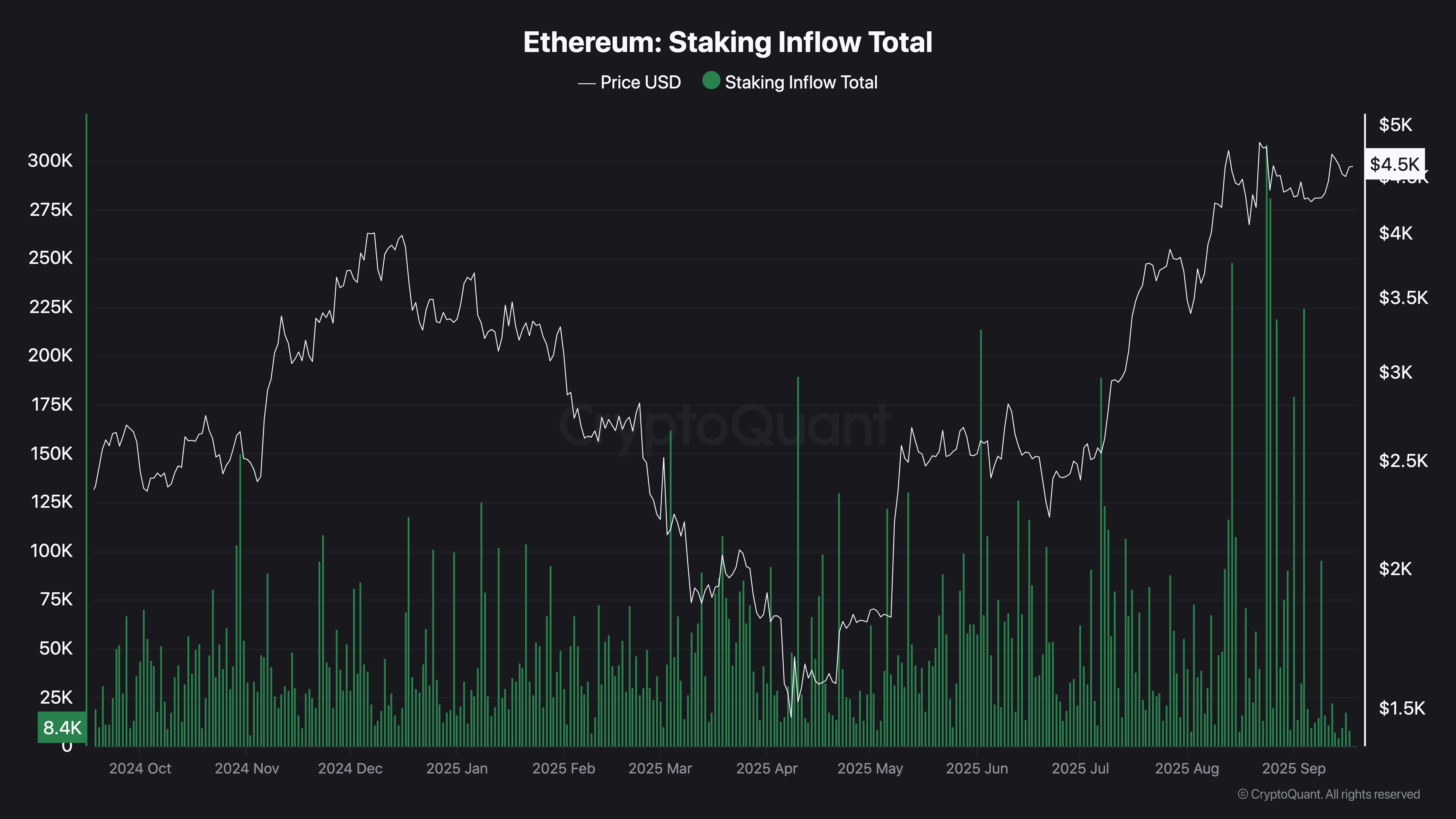

Staking Inflows Rise, Then Drop in September

In late 2024 and the first half of 2025, daily displays of staking deposits would range from 20,000 to 100,000 ETH in amount. November 2024 and March 2025 saw some massive spikes, with ETH trading between $2,000 and $2,500.

Big inflows began around mid-2025, as ETH had formed a bottom in April. In August, there were days with staking inflows between 250,000 and 300,000 ETH, the largest in that year. As deposits came in substantial sizes with ETH going above $4,000, this is probably reflective of a stronger commitment to the network on the part of participants.

Source: CryptoQuant

Source: CryptoQuant

However, the latest data shows a sharp decline. In September 2025, staking inflows dropped to around 8,400 ETH, based on current chart readings. This marks the lowest daily level since late 2024. The recent pullback could reflect a cooling period after heavy deposits in the previous month.

ETH Approaches Key Price Level

At press time, ETH was trading around $4,600. It has gained over 4% in the past seven days and is approaching its previous all-time high. This level is now acting as resistance.

A report by Milk Road noted,

In the last cycle, ETH rose by over 240% after breaking through its old highs. If the same pattern occurs again, the price could move toward $16,500.

For now, traders are watching whether ETH can hold current levels and close above resistance. If it does, a new upward phase could follow. If not, the market may remain in consolidation until further signals appear.

The post ETH Whales’ Profits Hit Records: Massive Rally or Big Price Drop Next? appeared first on CryptoPotato.

You May Also Like

Big Day Tomorrow: ETF Including Bitcoin and 4 Altcoins to Hit the Market

Will Dogecoin Hit $0.31 by October? BullZilla’s 1000x Path Examined – Top New Meme Coins to Buy for 2025