Comparison of Base, MegaETH and Solana pre-confirmation mechanisms: How to balance speed and security?

Author: Shiva

Compiled by: Tim, PANews

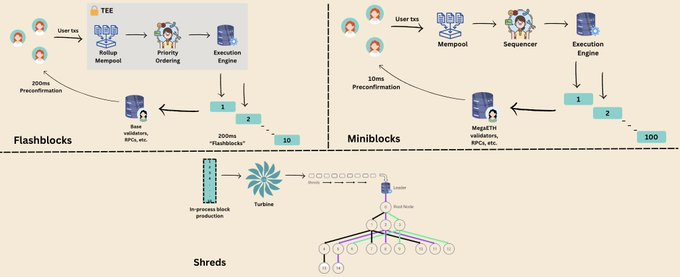

The pre-confirmation mechanisms of Base, MegaETH and Solana are Flashblocks, Miniblocks and Shreds respectively.

Who is the fastest?

Who is the safest?

Who will win?

Here’s everything you need to know:

TLDR:

- Flashblocks, miniblocks and shreds are the "pre-confirmation" mechanisms on the Base, MegaETH and Solana chains respectively.

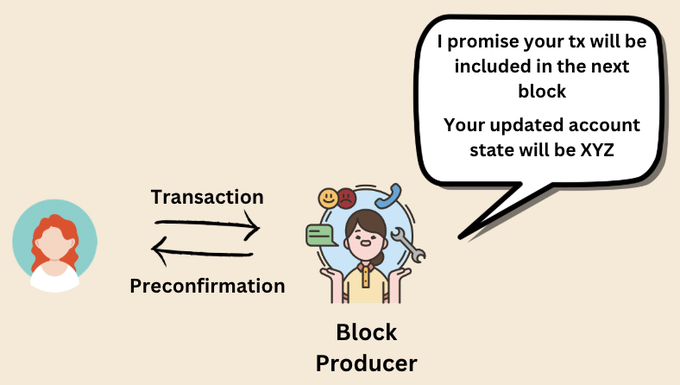

- The pre-confirmation mechanism provides users with an "inclusion guarantee" that their transaction will be included in the next block.

- The pre-confirmation mechanism can improve the user experience, but it requires users to temporarily believe that the block producer is honest and reliable.

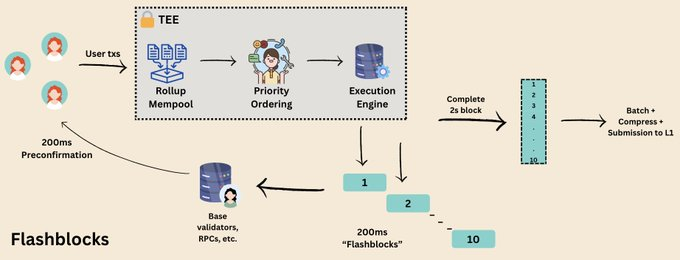

Base Flashblocks

The current block confirmation time on Base is 2 seconds.

Every 2 seconds, all tools such as block browsers, RPC, wallets, etc. will obtain status updates of blocks and databases and share them with users.

The above state updates lack "finality" (immutability), but are "pre-confirmed" by the sorter.

A 2 second update delay does not provide a good user experience because users are accustomed to higher speeds.

Flashblocks directly addresses this user experience problem by reducing the pre-confirmation time to 200 milliseconds:

- The sorter runs in a Trusted Execution Environment (TEE) and sorts transactions based on priority fees.

- Every 200 milliseconds, the sorter creates a child block (Flashblock) and broadcasts it to the L2 nodes.

- L2 nodes verify the TEE signature and issue pre-confirmations to the user, they also apply Flashblocks to the local state.

- After 2 seconds, the sorter compiles a complete block, generating a Merkle digest for submission to L1.

- Once L1 is finalized, L2 nodes update their hard state to finalize the block.

Although it still takes 2 seconds for the entire block to be confirmed, users can see the updated status within 200 milliseconds, which significantly improves the user experience.

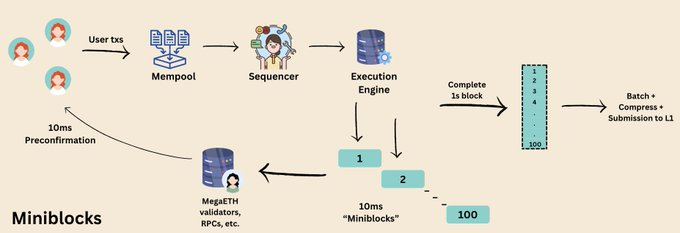

MegaETH Miniblocks

MegaETH currently plans to set the block time to 1 second.

However, they will adopt a pre-confirmation mechanism similar to Flashblocks to improve the user experience.

The MegaETH sequencer will output transactions as blocks are constructed (in an arbitrary order of transactions).

MegaETH plans to perform pre-confirmation every 10 milliseconds, and they call this format "Miniblocks".

Similar to Flashblocks, Miniblocks can significantly improve the user experience without increasing trust in the 1-second block.

(Note that when using Flashblocks, users also need to trust the TEE (Trusted Execution Environment) to run the prioritization correctly.)

Solana Shreds

Solana is a blockchain pioneer with good user experience and high-speed transactions.

Solana’s normal block time is 400 milliseconds.

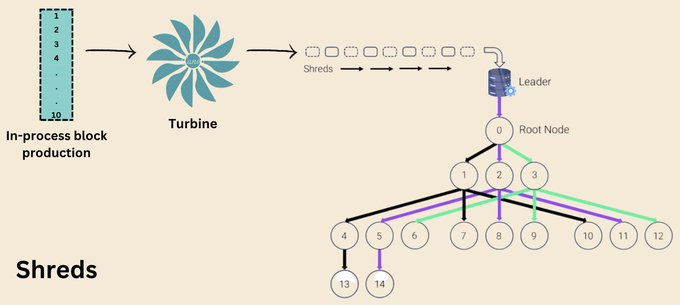

However, during the block generation process, Solana block producers split blocks into smaller parts, called “Shreds”, and submit them to the Proof of History (PoH), which are then propagated to the rest of the network.

Other validators can start replicating transactions once they receive the shreds and send transactions immediately after validating the shreds (in less than 400 milliseconds).

Now two problems arise:

- In each case, how secure are these “pre-confirmations”?

- What does “block time” actually mean for a rollup when transactions are not finalized until they are batched and sent to L1?

Pre-confirmed safety

a) Solana

Assume a Solana validator receives 2 Shreds from a block producer, but these Shreds do not become part of the final block. This could be due to two reasons:

- Block producer is offline: no final block is produced and the slot is skipped. In this case, the next block producer will take over these shreds and include them in their own blocks (copying on the longest fork).

- Malicious behavior by block producers: Block producers propagate different shreds to different validators with the intention of splitting the network.

So, inclusion guarantees simply mean trusting that block producers are not malicious or corrupt.

b) MegaETH

There is only one collator. Therefore, the inclusive guarantee is to trust that the collator is not malicious.

Two other risks are:

i) The sorter is offline: In this case, when it comes back online, it will contain the pre-confirmed transactions.

ii) Ethereum L1 reorganization occurs: any unfinalized L2 transactions will be replicated by the sorter on the new fork.

c) Base

Similar inclusion guarantees as MegaETH.

The inclusive guarantee here is to trust that the sorter is not malicious and that the TEE (Trusted Execution Environment) is secure.

However, even if the TEE is hacked, the only thing that can be changed is the priority order of transactions.

In all cases, users get faster pre-confirmations, but at the risk of corrupt block producers.

Since a single block producer has a monopoly on the construction of a block at any given time, it is reasonable to assume that corrupt behavior has the same probability in each block construction.

What does L2 block time mean?

L1 blockchains have a consensus mechanism, while most L2 blockchains do not.

In the L1 public chain, fixed block time can improve consensus efficiency because the voting behavior of validators is concentrated at the key time nodes of block generation. Validators will confirm the correctness of all transactions in the entire block through voting.

Do L2 block times make sense?

The answer is yes.

Although L2 block times are freely set and represent only "pre-confirmation" rather than finality, fixed block times still have the following key values:

- When implementing a fee mechanism similar to EIP1559, operating at the block level will significantly improve execution efficiency compared to the frequent miniblock/flashblock level.

- If L2 plans to implement a decentralized sorting and verification process, setting clear block boundaries can significantly improve efficiency because voting and verification activities can be completed in a specific time window.

As blockchain performance improves, faster sub-second pre-confirmations will become the norm.

The main chain that ultimately wins will also ensure that the probability of corruption is effectively resisted.

You May Also Like

Bitcoin Investment Firm B HODL Makes Pioneering Debut on London’s Aquis Exchange

Unlocking Dormant Bitcoin: BitcoinOS Unleashes Revolutionary Yield Protocol