Cardano Price Prediction: Can ADA Hit $2 Before Digitap ($TAP) Delivers a 50x for Presale Investors?

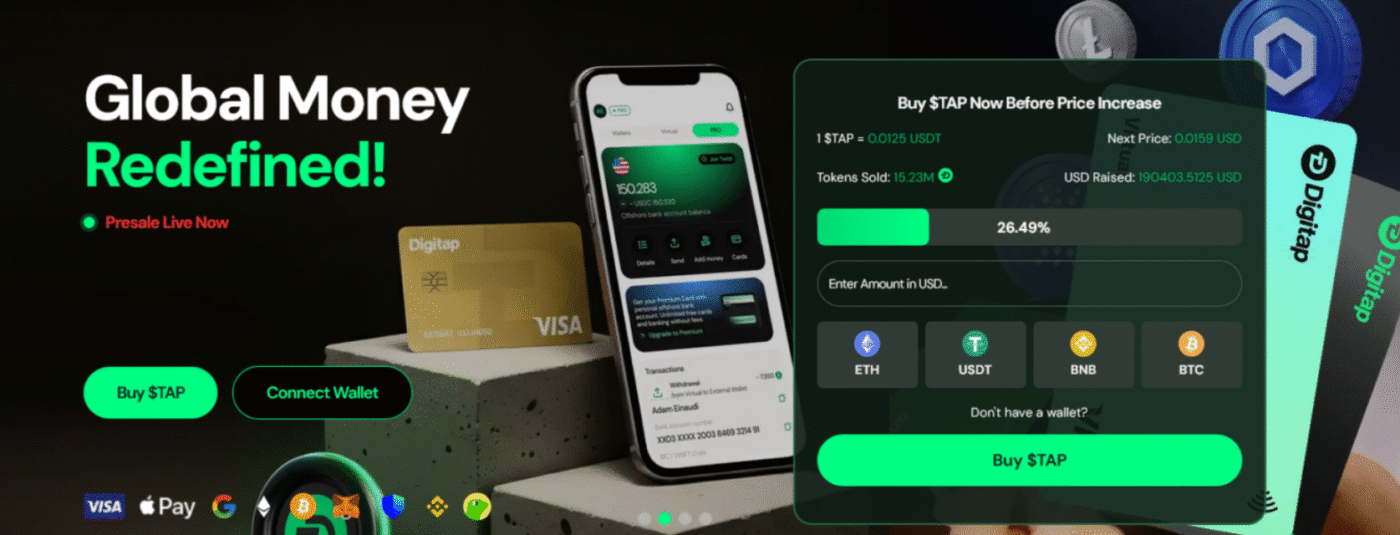

Two names are standing out in the crypto market this week — Cardano (ADA) and Digitap ($TAP). Cardano aims to reclaim the glory it lost during the last bear market cycle. Investors are wondering if it can break the $2 price anytime soon. Meanwhile, Digitap is a new cryptocurrency in the PayFi industry. It is currently in the presale phase, already raising over $900,000 so far.

While ADA’s growth is driven by long-term development, Digitap’s rise is due to the real-world adoption of both crypto and fiat. The question now: can ADA double before Digitap delivers a 50x return?

Cardano’s Road Back to $2

Cardano has been recognized as one of the most scientifically grounded projects in the crypto space. With its research-based development model and focus on scalability, it is a dream project for long-term investors.

The story of ADA, which reached its peak of $3.10 in 2021, is still very much alive. But progress has been slow. There have been some major upgrades, such as Hydra (for scalability) and Midnight (for privacy). Therefore, Cardano is gearing up to be a viable alternative to Ethereum and Solana for decentralized apps.

Could ADA Hit $2 Again?

From a current price of $0.63, a $2 target would mean a 3x increase, which can be achieved if a new bull market unfolds. The majority of analysts expect ADA to reach anywhere between $1.80 and $2.50 in 2026. This will be further supported by more staking participation and new dApp launches.

One thing that’s stopping ADA from gaining momentum quickly is the large circulating supply of its tokens (over 36 billion). This makes it hard for the price to spike dramatically. Cardano is a strong and stable investment over the long term rather than a sudden price skyrocketing in the near term.

And that’s exactly where Digitap comes in to change the rules.

Digitap: The Fintech Disruptor

It’s a global money app designed to sync crypto, fiat, and offshore banking under one platform. Users can easily download the app to start sending, receiving, and spending crypto instantly. This all happens in real-time with crypto-to-fiat conversion using Visa cards, Apple Pay, and Google Pay.

What makes Digitap highly attractive is that it is a utility-first platform. It is targeting a $250+ trillion payments market. A freelancer being paid from overseas or a company handling cross-border transactions, Digitap provides it all with low fees.

The app lets its users:

- Execute withdrawals immediately to cards, wallets, or bank accounts anywhere.

- Switch easily between fiat and crypto in a matter of seconds.

- Make private transactions without getting tracked and achieve 100% anonymity.

- Have access to multi-currency accounts, including offshore ones.

The real-world use cases give Digitap a clear advantage over other crypto coins.

Visit Digitap Presale

The Reason Digitap’s Presale Is On A Hike

By raising over $900,000, Digitap’s presale is quickly turning into the most talked-about event of Q4 2025. The project’s combination of fintech-grade usability, bank-level security, and blockchain transparency makes it a top crypto investment.

Security is not an afterthought — Digitap is already audited by Solidproof and Coinsult, both pointing to zero vulnerabilities. Besides that, the system is secured with multi-factor authentication, bank-grade encryption, and regular third-party inspections.

$TAP is capped at 2 billion, with an auto-buyback and burn mechanism activated for each transaction. Thus, the supply is gradually decreasing, and the scarcity is increasing. On top of that, the holders can get up to 124% APR in staking rewards.

These are the reasons analysts put Digitap as a potential 50x performer when it lists on major exchanges.

The Real-World Advantage: Instant Borderless Money

One thing that makes Digitap special is its worldwide Visa integration. Users can quickly spend crypto as if it were fiat, and this can be done anywhere Visa is accepted. So, users can connect their accounts to mobile wallets, shop online or in physical stores, and get instant cashback on every purchase.

In short, Digitap doesn’t require its users to change their way of doing things; it just improves it. And $TAP could be one of the year’s best-performing tokens, potentially hitting a 50x multiple as it changes how money moves around the world.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

The post Cardano Price Prediction: Can ADA Hit $2 Before Digitap ($TAP) Delivers a 50x for Presale Investors? appeared first on Blockonomi.

You May Also Like

The Resilience of Bitcoin: Decoding Cycles and Trends

Pave Bank raises $39M led by Accel, Tether to expand programmable banking

The Singapore-based digital bank plans to broaden its crypto and fiat offerings for institutional clients, citing growing demand for programmable finance. Fintech Pave Bank has raised $39 million in a Series A funding round led by venture capital firm Accel. The company offers programmable banking solutions for businesses, combining crypto and fiat services.The round included participation from Tether Investments, Wintermute, Quona Capital, Helios Digital Ventures, Yolo Investments, Kazea Capital, Financial Technology, and GC&H Investments, bringing the company’s total funding to about $45 million, according to the Economic Times.Founded in 2023 by fintech veterans Simon Vans-Colina, Salim Dhanani, and Dmitry Bocharov, Pave Bank provides institutional and corporate clients with both traditional and programmable banking services, while also facilitating transactions involving digital assets.Programmable banking services allow businesses to automate financial operations such as payments, transfers, and treasury management through application programming interfaces (APIs) or smart contracts built on digital infrastructure.Read more