Bitcoin Surges to Record High Above $125K: Why This Signals the Start of Altcoin Season, Led by Digitap ($TAP)

Bitcoin continues to blast through prior all-time highs, while pullbacks have proven temporary. Currently trading around $122,000, Bitcoin (BTC) is taking a breather, though it remains within striking distance of its all-time high above $125,000.

With BTC now in price-discovery territory, most veteran crypto investors understand what this symbolizes. Historically, when Bitcoin reaches new peaks and begins to stabilize, it often marks the onset of an “altcoin season,” prompting investors to hunt for the next big gain elsewhere.

One particular altcoin, Digitap ($TAP), is emerging as a standout contender, one of the best altcoins to consider as Bitcoin pauses.

Bitcoin’s New All-Time High is Fuel for an Altcoin Rotation

Bitcoin’s rise above $125,000 confirms what many already suspected: big money and retail enthusiasm are pouring into crypto. However, the higher Bitcoin goes, the less explosive its further gains become. Rising from $100,000, a level Bitcoin traded near in early 2025, to $150,000, a reasonable near-term outlook, represents a 50% move.

Wall Street investors would be pleased if a stock gained 50% in a year. For many crypto investors, though, that move is relatively small. Most BTC holders recognize that doubling or tripling their money in the near term with Bitcoin alone ranges from unlikely to impossible.

This is where rotation into altcoins comes in. After Bitcoin’s recent surge, capital historically starts to flow toward other parts of the market. In past cycles, after BTC hit a fresh high, Ethereum and many altcoins rallied hard, quickly posting 5x or even 10x returns.

Source: @misterrcrypto

Digitap: The Altcoin Contender Stealing the Spotlight

Digitap is attracting growing interest from whales and institutional-leaning investors because it checks key boxes: real-world utility and a large, under-served market.

Digitap is building a bridge between crypto and everyday finance. The project developed, and now markets, an “omni-bank” that supports both fiat and digital assets. Its mission is to make crypto spendable in the places people already use money through a Visa-branded card linked to a user’s Digitap account.

Digitap’s presale remains ongoing, with the first stage more than 90% sold out. The token is currently offered at $0.0159 and is scheduled to jump to $0.0194 in the next stage, likely within the next day or two.

Visit Digitap Presale

Why Digitap Could Lead the Altseason Charge

Digitap’s solution addresses multiple pain points across global finance. Cross-border payments and remittances total more than $150 trillion annually, while senders pay an average 6% in fees and often wait days for settlement. Digitap can slash fees to under 1% and complete certain transfers instantly.

This could also benefit the 1.4 billion unbanked or underbanked adults globally who are overlooked, ignored, or overcharged by current banking systems. This is a massive market, and Digitap is at the forefront with an already live product.

Altcoin investors understand this kind of transformational vision, combined with a very small market cap, is the winning formula for explosive growth, provided the project executes well.

Altcoin investors also know that tokenomics is just as important. In Digitap’s case, the fixed token supply is capped at 2 billion and is deflationary: a portion of platform revenue is allocated to buybacks and burns.

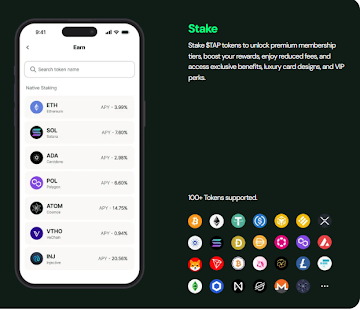

As Digitap’s user base grows over the coming year, the burn rate could accelerate and boost the token’s value by virtue of scarcity. Coupled with a reported 124% APR for tokens staked during the presale stage, $TAP is positioned as a compelling candidate for passive-income seekers.

Source: Digitap

Why Early Validation Matters More Than Hype for $TAP

What sets Digitap apart from many new altcoins is early validation. Unlike projects still in testing or pitching only ambitious ideas, Digitap already has a live app and a Visa card in use. The presale presents an unusual proposition: try it before buying.

Investors can spend a few minutes downloading the Digitap app, use the optional no-KYC signup, and see whether the product delivers as promised. Recent presale momentum suggests that savvy investors are taking advantage of this opportunity and building positions ahead of a broader altcoin market run.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Bitcoin Surges to Record High Above $125K: Why This Signals the Start of Altcoin Season, Led by Digitap ($TAP) appeared first on Live Bitcoin News.

You May Also Like

How is the xStocks tokenized stock market developing?

Paul Chan: Blockchain technology and artificial intelligence are leading the rapid development of digital financial services