Bitcoin, Ethereum, and Solana Witness High Whale Activity: 3 Best Cryptos to Buy Before Q4 Resurge

Amidst the ongoing downtrend in the crypto market, Bitcoin, Ethereum, and Solana witness significant whale activity, which includes purchases from renowned investment firms such as Strategy and BitMine. This has reignited the optimism around these assets, making them top investment options for various institutional investors.

This article delves into the market outlook of BTC, ETH, and SOL to check whether they qualify as the top 3 best and safest assets to buy before the Q4 bull run. Without further ado, let’s get started.

Whale Purchases Amidst the Correction Reignite Optimism in BTC, ETH, & SOL

BitMine, the Las Vegas-based company that focuses on the accumulation of crypto for the long term, has increased its $ETH holdings to 1,150,263 coins by accumulating 203,826 ETH over the past week. BitMine’s chairman, Tom Lee, remains in his stance that Ether is an undervalued asset. He notes that BitMine and Michael Saylor’s Strategy together generate 88% of the global digital asset treasury trading volume.

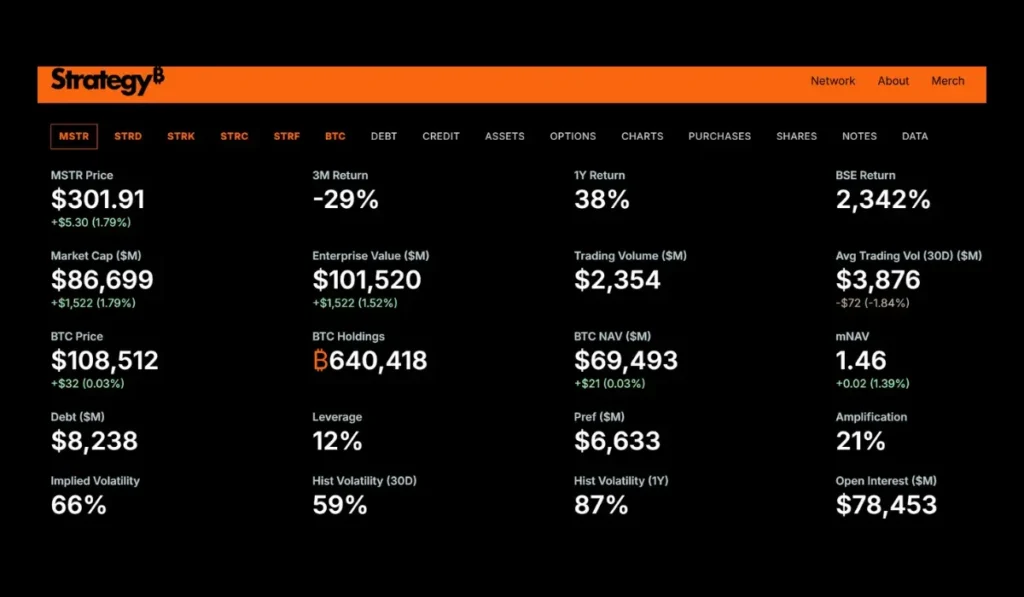

Source: strategy.com

Strategy has acquired 168 BTC for ~$18.8 million at ~$112,051, increasing the reserve holdings to 640,418 BTC. BitMine continues its position as the largest Ethereum treasury company in the world, while Strategy remains the largest Bitcoin treasury company in the world.

Solmate Infrastructure, the NASDAQ-listed company, has purchased $50 million worth of SOL, intended to power the foundation’s infrastructure in the UAE. “We bought the dip,” the company stated in the announcement tweet. Around the same time, Cathie Wood, the founder of Ark Invest, disclosed the 11.5% stake in Solmate. The purchases by these giants amidst the market downtrend have given confidence to the traders, making BTC, ETH, and SOL top contestants for the best cryptos to buy before the Q4 rebound.

Bitcoin (BTC): Strong Whale Signals and Market Momentum Suggest Huge Surge

Bitcoin has historically performed well in the fourth quarter, with analysis highlighting November as the best month for the asset. If the current whale accumulation continues till the end of the year, we will likely witness new all-time highs for BTC. Additionally, the emerging renewable mining energy sources, the ETF momentum, and the ease in the U.S.-China trade tensions will also likely contribute to the rally.

Bitcoin (BTC) Price Forecast: October, November, December 2025

The Q4 forecast suggests that BTC will reach a new all-time high of $144,814 by December 2025.

| Month | Min. Price | Avg. Price | Max. Price | Change |

|---|---|---|---|---|

| Oct 2025 | $ 108,923 | $ 116,640 | $ 124,596 | 14.56% |

| Nov 2025 | $ 112,319 | $ 120,408 | $ 136,001 | 25.04% |

| Dec 2025 | $ 139,258 | $ 141,536 | $ 144,814 | 33.15% |

Ethereum (ETH): Strong Fundamentals & Increased User Participation

Apart from the heavy accumulation of institutions, Ethereum boasts qualities such as strong network fundamentals, institutional ETF demand, advanced staking dynamics, and the whole layer 2 ecosystem. Ethereum’s roadmap ensures technological upgrades, including the Fusaka Upgrade (3 December 2025) and zkEVM Integration (Q4 2025–Q2 2026), which will likely increase its user base in the coming months.

Ethereum (ETH) Price Forecast: October, November, December 2025

Ethereum’s Q4 forecast suggests that the asset will likely reach a maximum value of $6,436 by December 2025.

| Month | Min. Price | Avg. Price | Max. Price | Change |

| Oct 2025 | $ 3,880.44 | $ 4,276.72 | $ 4,677.32 | 19.43% |

| Nov 2025 | $ 4,093.06 | $ 4,983.38 | $ 5,919.15 | 51.14% |

| Dec 2025 | $ 5,368.37 | $ 5,921.33 | $ 6,436.85 | 64.35% |

Solana (SOL): Advanced Ecosystem Potent to Ignite Sudden User Surge

Solana is the strongest competitor for ETH, with its technological advantage of executing more than 65,000 transactions per second at low gas fees. Additionally, 75% of the supply locked in the staking pools decreases the selling pressure, making it a perfect asset for the Q4 holding. Also, late 2025 will witness SOL’s Alpenglow Consensus Upgrade, which is claimed to achieve 150ms transaction finality.

Solana (SOL) Price Forecast: October, November, December 2025

While Solana will not likely cross the previous ATH of $294.33, it has the potential to reach a maximum value of $275.17 by the end of the year.

| Month | Min. Price | Avg. Price | Max. Price | Change |

|---|---|---|---|---|

| Oct 2025 | $ 184.04 | $ 189.07 | $ 196.58 | 4.70% |

| Nov 2025 | $ 196.95 | $ 204.94 | $ 231.64 | 12.72% |

| Dec 2025 | $ 208.78 | $ 223.40 | $ 275.17 | 14.60% |

Disclaimer: These crypto price forecasts are based on predictive modeling and should not be considered financial advice.

The Bottom Line: Things to Consider Before Investing in BTC, ETH, & SOL

The market outlook and the price forecasts suggest that Bitcoin, Ethereum, and Solana will likely become the top-traded assets of Q4 2025. However, a reversal can also occur due to unexpected occurrences.

Since the cryptocurrency market is inherently volatile, it is important to proceed with caution while investing. Always try to do your own research before finalizing the buy and sell points.

The post Bitcoin, Ethereum, and Solana Witness High Whale Activity: 3 Best Cryptos to Buy Before Q4 Resurge appeared first on BiteMyCoin.

You May Also Like

Best Altcoins to Buy Before the Next Crypto Market Rebound

Analysis: The 15,965 BTC transferred by the Prince Group's criminal mastermind today are not previously disclosed seizures by the US