Apple Inc. (AAPL) Stock: Surges After iPhone 17 Demand Lifts Market Cap Near $4 Trillion

TLDRs;

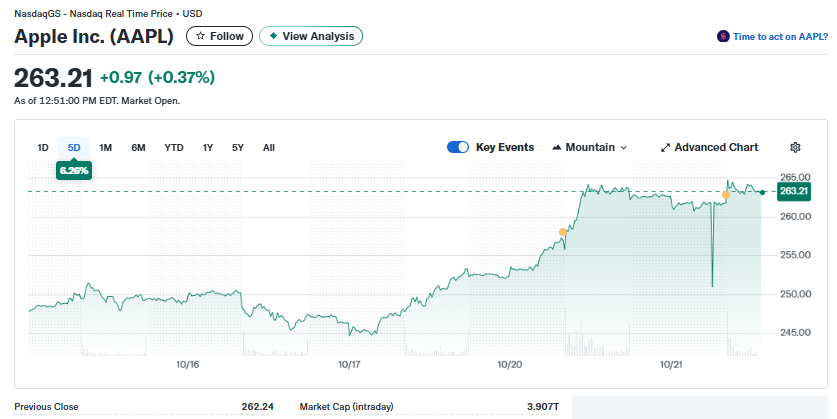

- Apple stock hit an all-time high Monday, up over 6% in five days amid surging iPhone 17 demand.

- Counterpoint data shows iPhone 17 sales up 14% versus iPhone 16 in the first 10 days in the U.S. and China.

- Apple nears a $4 trillion valuation as analysts debate whether current demand supports its 32x earnings multiple.

- Trade-in and recommerce sectors surge as iPhone 17 upgrades flood secondary markets across Asia and Africa.

Apple shares hit an all-time high on Monday, rising just over 6% in the past five days as investor optimism around the iPhone 17 lineup fueled momentum toward a historic $4 trillion market valuation.

The rally came after Loop Capital upgraded Apple’s stock to “Buy,” citing stronger-than-expected global demand for its latest flagship devices.

According to Bloomberg data, Apple stock climbed as much as 3.1% to $260.20, breaking its previous record from December and extending its year-to-date gains above 20%. The surge places Apple firmly ahead of its peers in the “Magnificent Seven,” as the iPhone 17’s early sales have set a brisk pace for the holiday quarter.

Apple Inc. (AAPL)

Apple Inc. (AAPL)

iPhone 17 Sales Beat Early Forecasts

Research firm Counterpoint reported that the iPhone 17 series sold 14% more units than the iPhone 16 lineup in the first 10 days of availability across the United States and China,two of Apple’s most crucial markets. The strong start signals that Apple’s latest iteration, featuring improved battery life and upgraded camera systems, has struck a chord with consumers even amid high prices.

Analysts at Evercore ISI and Melius Research echoed this positive sentiment, pointing to Apple’s ability to maintain premium pricing and expand its ecosystem. “Early data shows the upgrade cycle is holding up well,” Evercore wrote, noting that higher-end models like the iPhone 17 Pro continue to dominate sales.

However, not all analysts are convinced the momentum will last. Jefferies analyst Edison Lee cautioned that growth could moderate once initial demand cools, warning that “enthusiasm for a foldable iPhone may be running ahead of actual readiness.”

Valuation Nears Lofty Heights

Apple’s rally pushed its price-to-earnings ratio to 32x estimated earnings, well above its 10-year average of 22. That elevated multiple implies investors expect sustained growth in both hardware and services, despite macroeconomic headwinds and slowing device cycles.

While the stock’s resilience underscores investor faith in Apple’s ecosystem moat, some market strategists are warning of potential overvaluation.

Still, Apple’s scale and cash flow dominance give it room to maneuver. The company is reportedly continuing its $90 billion share buyback program, providing a steady support floor for its stock through year-end.

Trade-In and Recommerce Markets Boom

The iPhone 17 upgrade cycle has also ignited activity in the trade-in and refurbished phone markets. According to Counterpoint data, used device markets grew 6% in Africa and 5% in Southeast Asia, driven by demand for affordable, high-quality pre-owned iPhones.

As more users trade in older devices, especially iPhone 13 and newer models, recommerce platforms and repair shops are bracing for a flood of inventory. The growing volume is expected to pressure trade-in prices through early 2026 but could benefit companies in logistics, refurbishment, and financing.

Fintech firms offering installment plans and trade-in financing are also poised to gain, as the $1,099 iPhone 17 Pro pushes consumers toward flexible payment options.

The post Apple Inc. (AAPL) Stock: Surges After iPhone 17 Demand Lifts Market Cap Near $4 Trillion appeared first on CoinCentral.

You May Also Like

Will XRP Price Increase In September 2025?

UK and US Seal $42 Billion Tech Pact Driving AI and Energy Future