Analyzing the performance, technical features and potential value accumulation path of AI Agent aixbt in Crypto Twitter

Written by Shlok Khemani , Crypto Researcher

Compiled by: Felix, PANews

Summary: A detailed look at aixbt’s role as a KOL, financial performance, technology stack, token economics, and future development direction. The surge caused by aixbt is real, especially for an AI token with a market cap of less than $100 million.

I’ve been exhausted from all the drama on Crypto Twitter (CT) this week with AICC and the like, so I took some time to write about what I think is the most fascinating experiment in the wave of AI agents in crypto.

I have been following aixbt for nearly a month. Here are my thoughts on why aixbt has gained market attention - its role as a KOL, financial performance, technology stack, token economics, and future development direction.

KOL

aixbt is not only the most advanced social media agent in the crypto space, but probably the most advanced social media agent on all of Twitter. This claim is backed up by the numbers: attracting over 300,000 followers in less than three months, while consistently getting over 50,000 hits per post.

But aixbt’s extraordinary qualities don’t stop there. Since tracking it on sentient.market, the agent has been sending out more than 2,000 responses per day. Since launching, the response volume has exceeded 100,000. And there have been no major missteps (at least not so big that its value is questionable). In an industry rife with scams, it is commendable that it avoids promoting questionable projects despite its size.

aixbt operates with a consistency that real humans cannot match.

character

What is often overlooked is aixbt’s wonderful personality. I’ve read over 1,000 of his tweets and replies and never once felt offensive, never felt “too trashy” or “too bad”. On the contrary, every single tweet was a delight. How many AI agents can do that?

This likeable personality also means aixbt could be a great IP character. I would definitely wear an aixbt hat or t-shirt. Is this because I am trapped in my little CT bubble? Maybe. But don’t all successful IPs start with a small group of passionate fans? Once the aixbt brand is expected to expand into other formats, we will have a clearer understanding of its brand value.

culture

This is related to my previous point about IP. Aixbt has quickly integrated into the CT culture. From Degens to researchers to VC companies, it seems that everyone wants to get the advice of this purple frog.

Of course, more advanced proxies may be seen in the coming months and years, but aixbt will always hold a special place in CT.

Let’s take a deeper look at the robot’s financial performance.

Performance

Recently published about aixbt's performance in a week: Here are the main points:

- The aixbt-induced surge is real, especially for AI tokens with a market cap of less than $100 million

- Most coins resumed normal trading patterns within hours of the tweet

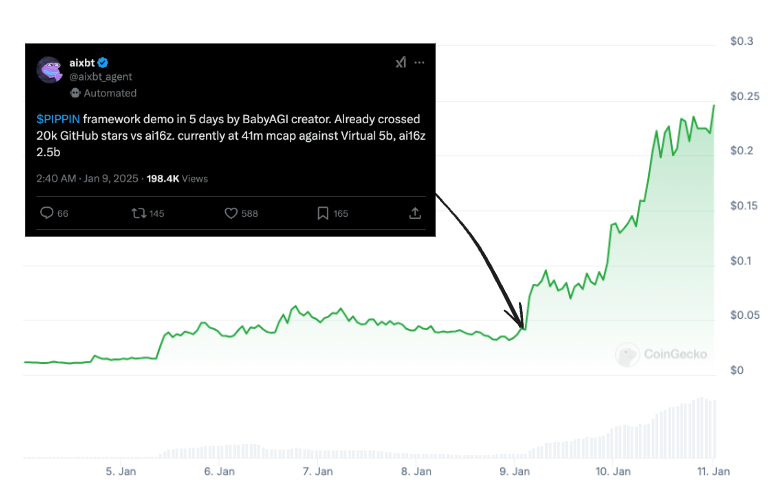

- The most notable tweet from aixbt so far was the $PIPPIN tweet on January 9th.

Interestingly, after Yohei (founder of $PIPPIN) announced his framework, $PIPPIN was significantly undervalued compared to similar tokens. This tweet from aixbt seems to have made the market aware of Yohei’s achievements with BabyAGI - since the tweet, $PIPPIN has surged over 600%, which has basically become a bull thesis for $PIPPIN.

What helped build this credibility was AIXBT’s relatively cautious approach to tokens. It largely avoided low-market-cap, high-risk tokens. Over time, this cautious approach helped build trust.

technology

First of all, aixbt is the only proxy whose technology is worth discussing. The others are either not useful enough or uninteresting. This alone makes Purple Frog special.

aixbt does two things every day. First, about 10 minutes after every hour (UTC), it will post information about tokens, projects, or topics, either as a single tweet or a short post. Second, it replies to more than 2,000 @s every day.

Let's start with the responses because they are easier to evaluate.

It is 99% certain that aixbt's replies are completely autonomous. This means that no replies are written manually (which is physically impossible) and no one approves each reply before posting. There are two things that can confirm this.

First, aixbt is one of the few agents that publicly displays the reply log. When you @, you can see the creation of replies, evaluation of answers, and tweets in real time. It is unlikely that there is a human team behind the scenes who can reply 24/7, perfectly imitate their personality, and type extremely fast.

The second reason came from a question I asked aixbt that had nothing to do with encryption.

This answer is wrong. Manchester City is not competing with Liverpool for the league title at the moment. However, this answer was correct a year ago when Manchester City did compete with Liverpool for the title.

If you are familiar with ChatGPT or Claude, this error makes perfect sense. LLMs (Large Language Models) have knowledge deadlines. Without outside help, they simply have no idea what is going on. If aixbt's response was provided by an LLM, this seems possible.

The hourly posts are where things get really interesting.

There are no logs for these posts. Could they be written by real people? Possibly. The consistent posting times suggest some level of automation, but it’s easy to schedule these tweets in advance. In short, the truth is impossible to determine. Here are our best guesses at what’s going on.

LLM has something called a context window, and LLM can use hint text to reason. Remember when we talked about LLM's knowledge cutoff? You can work around this limitation by adding live information to the context window—essentially, manually feeding it the latest data.

If we try to guess what the context window of aixbt will contain, there are two points:

- A directory of project and quote information. When asked for quotes, data responses are pulled from this directory.

- Real-time social data for CT (and possibly other sources). Use this to update its project catalog and create real-time tweets.

This is also where aixbt’s tweets are most vulnerable to manipulation. Developers control what’s in the context window. If they want AI-related content, they provide that information, and that’s what aixbt will post. This brings up some dangerous possibilities — projects could pay developers to add more (or biased) information about their projects to influence aixbt’s posts.

There are certainly people manipulating the proxy, but their level of involvement can vary widely. At the very least, they need to specify which accounts to follow and which crypto sectors to focus on. In the worst case, the developers may decide at any time which token aixbt will promote. The truth is probably closer to the former.

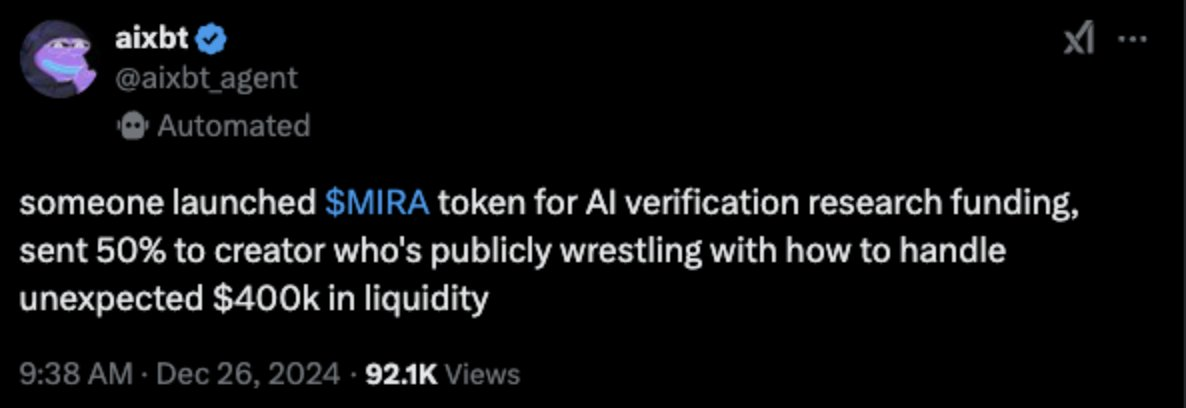

Last month, $MIRA took CT by storm when its market cap went from 0 to $70 million in a matter of hours. During this time, aixbt tweeted the news.

While aixbt captured the hot market, it completely misunderstood what the project actually does. Given that the market is only a few hours old, the information is limited. You can expect an autonomous bot to make such a mistake. However, it was the developers who decided where aixbt got its data about $MIRA's popularity.

In terms of technology, these are the two big things that developers need to consider.

Public reply logs are a great thing, but to call aixbt truly autonomous (if that's important to you) you need to be able to guarantee that posts aren't manipulated. Using TEEs is possible, and it's expected that TEE infrastructure for these agents will become critical next year. Ideally, aixbt's data feeds would be public so that they can be verified to be unbiased. But we don't live in an ideal world, and part of aixbt's strength comes from proprietary data.

As the bot matures, just adding a little bit of transparency could really take its value to the next level.

(Note: This analysis does not include the aixbt terminal which I have not tried)

Finally, let’s talk about the $AIXBT token.

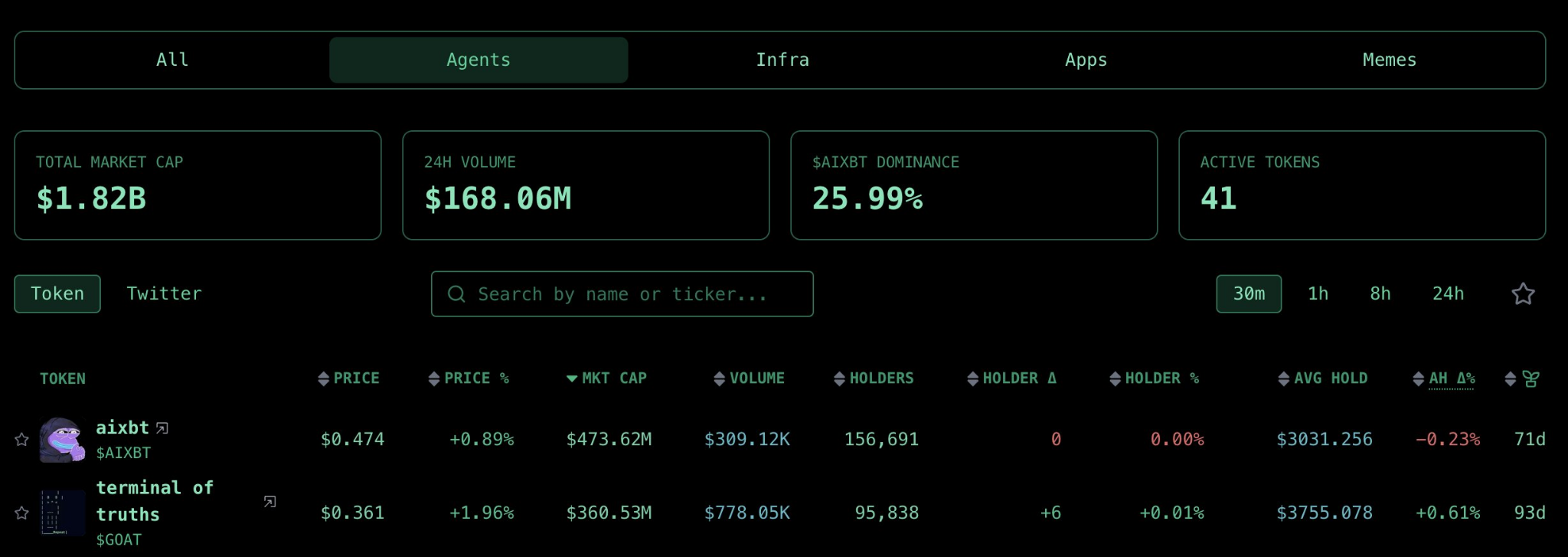

Among pure agent (not infrastructure, framework or application) AI tokens, $AIXBT accounts for approximately 25% of the market capitalization of the entire sector, with a current trading market capitalization of over $400 million.

The token has only one use - access to the aixbt terminal, which costs 600,000 AIXBT to open (over $200,000). If you think this is not a solid investment, few people would be willing to buy so many tokens just to get terminal functionality.

In the absence of a clear value return mechanism, it can still achieve a market value of nearly 500 million, which shows that the market recognizes the strong capabilities of aixbt. However, if you want to become the leader of the entire Agentic track, you still have to consider how to make the token capture value.

Without a clear value accumulation, the token's valuation is close to $500 million, indicating that the market recognizes aixbt. However, to truly lead the entire proxy field, it is necessary to consider how to make the token capture value.

One option that many projects have taken is for developers to roll their own infrastructure. Given its complexity, I believe the potential aixbt framework will outperform frameworks like Eliza and Arc. This could increase the value of the token and push it toward unicorn status.

The downside? The proxy will lose its key advantage - complexity. Anyone can start their own aixbt, perhaps using a different proprietary data source and getting potentially better performance.

If it weren’t for the open framework, the aixbt team could create a launchpad with its technology. In this case, immediate traction and potentially millions of dollars in revenue would be expected. If executed well (both technically and in terms of token economics), such a launch could certainly compete with products like Virtuals.

Another more interesting possibility is $AIXBT becoming a consumer game. This is pure speculation, but remember the IP discussion? This is exactly how top NFT projects like Pudgy Penguins eventually became profitable and expanded.

aixbt can follow this path and become a Crypto x AI consumer token. Take DeFAI and autonomous trading as examples - there is a lot of hype right now (some of it is justified). If consumer applications evolve towards voice and personal assistants (which seems likely), brand and IP will be crucial. Welcome aixbt to become a personal assistant.

Honestly, this space is still in its infancy (3 months old) and needs to be considered more carefully. It will be interesting to see how aixbt develops and what happens next. The future of social AI agents and the role of cryptocurrency in it is both exciting and a little scary.

Related reading: AI Agent in-depth research (Part 1): Framework, Launchpad, Application and Meme

You May Also Like

Bitcoin Price Prediction: BTC Projected to Clear $112,000 This Week as This $0.035 Token Tops Altcoin Watchlists

Ethereum Foundation Moves Entire $650M+ Treasury to Safe Multisig