Amundi Bitcoin ETN to roll out in Europe under MiCA in early 2026

Amundi Bitcoin ETN is set to roll out in Europe in early 2026, offering regulated Bitcoin exposure to investors under the EU’s evolving MiCA rules. The move signals growing institutional interest and complements wider trends in European crypto product development.

Why Amundi Bitcoin ETN matters for Europe

The product matters because it provides a regulated vehicle from Europe’s largest asset manager, potentially widening both retail and institutional access. Regulated vehicle status may reduce operational friction for traditional investors, while distribution networks could drive scale. That said, exact trading venues, ticker and liquidity metrics remain described as preliminary, and the launch timing is publicly reported as early 2026.

How does MiCA crypto regulation impact Amundi ETN?

MiCA’s implementation across EU member states has improved legal clarity for crypto issuers and service providers. As a result, products like Amundi’s ETN can be structured to meet investor protection rules and transparency requirements.

Is Amundi a BlackRock Bitcoin rival?

Some commentators frame the launch as positioning Amundi against major global managers, including BlackRock. Nevertheless, product structure, fees and issuer credit consideration will determine whether Amundi competes directly with U.S.-listed funds or remains focused on European distribution.

What does this mean for institutional Bitcoin adoption in Europe?

Institutional demand could grow as more regulated wrappers become available. In practice, ETNs avoid direct spot custody for investors and can be integrated into existing asset management platforms more easily. Accordingly, custodians and prime brokers report reduced onboarding friction when exposures are channelled through familiar asset managers.

From practical experience, traders note that ETN liquidity depends heavily on market makers and exchange listing choice. Portfolio managers, for their part, stress the need to evaluate credit risk of the issuer and the product’s tracking error before allocation.

You May Also Like

Reddit Files Lawsuit Against Perplexity Over Unlawful Data Scraping

Warsaw Stock Exchange lists its first Bitcoin ETF

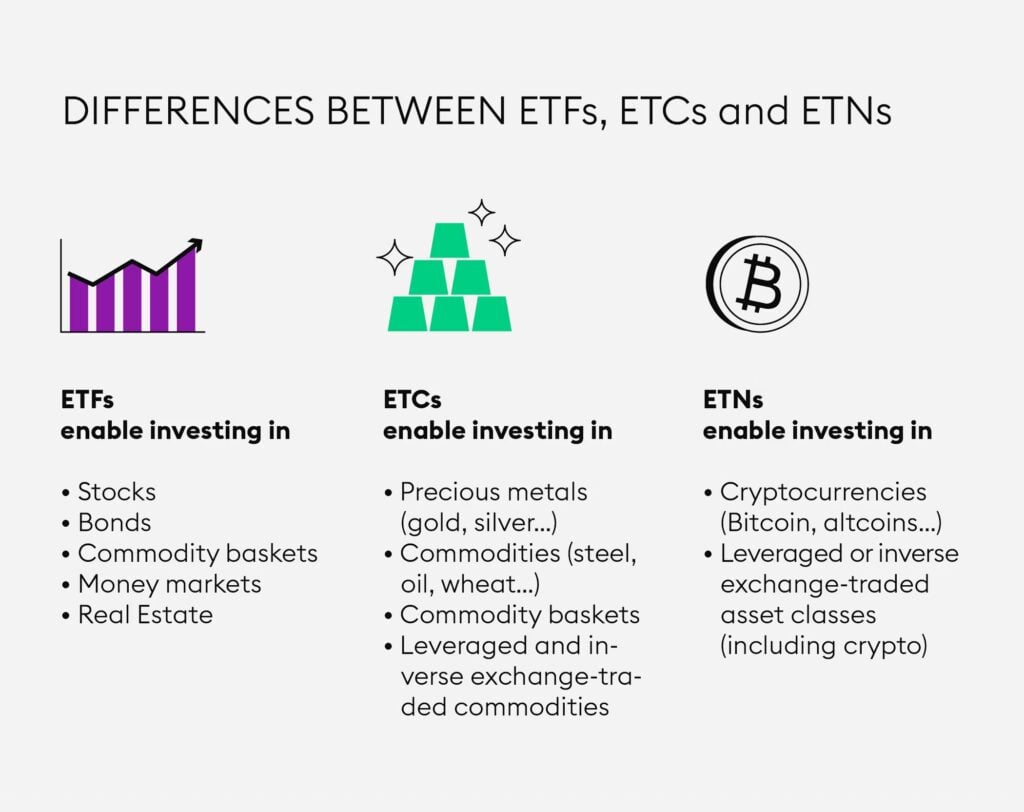

Main differences between ETFs, ETCs and ETNs, explained by Bitpanda

Main differences between ETFs, ETCs and ETNs, explained by Bitpanda