A $2.5B Stablecoin Deal? Coinbase and Mastercard Are Going Head-to-Head for BVNK

Coinbase and Mastercard are in advanced talks to buy BVNK, a London-based stablecoin firm. The deal, reported by Fortune, is worth between $1.5 billion and $2.5 billion.

If completed, it would be the largest stablecoin acquisition so far. Sources say Coinbase currently has the upper hand. The potential deal highlights the growing stablecoin market expansion reshaping finance worldwide.

BVNK Strengthens Stablecoin Infrastructure

BVNK, founded in 2021, has become a leading name in stablecoin infrastructure. The company enables businesses to integrate stablecoins into payments, cross-border transfers, and global treasury systems.

Its clients include financial institutions looking for faster and cheaper settlement options. The company raised $50 million in a round led by Haun Ventures, with backing from Coinbase Ventures, Tiger Global, Visa, and Citi Ventures. BVNK was valued at about $750 million.

Source: X

Source: X

Increasing Market Competition

If the Coinbase and Mastercard acquisition is finalized, it would surpass Stripe’s $1.1 billion purchase of Bridge earlier this year. This shows how competitive the stablecoin infrastructure sector has become.

Also Read: Why Citi Ventures’ BVNK Investment Could Be the Turning Point for Stablecoins

Stablecoins now sit at the center of payment innovation and digital finance. The stablecoin market expansion has encouraged established firms to buy proven technology rather than develop new systems internally.

Regulation Boosts Market Growth

The stablecoin market expansion gained momentum after the US GENIUS Act was signed into law in July. The act, endorsed by President Donald Trump, created a federal framework for stablecoin issuance and transparency.

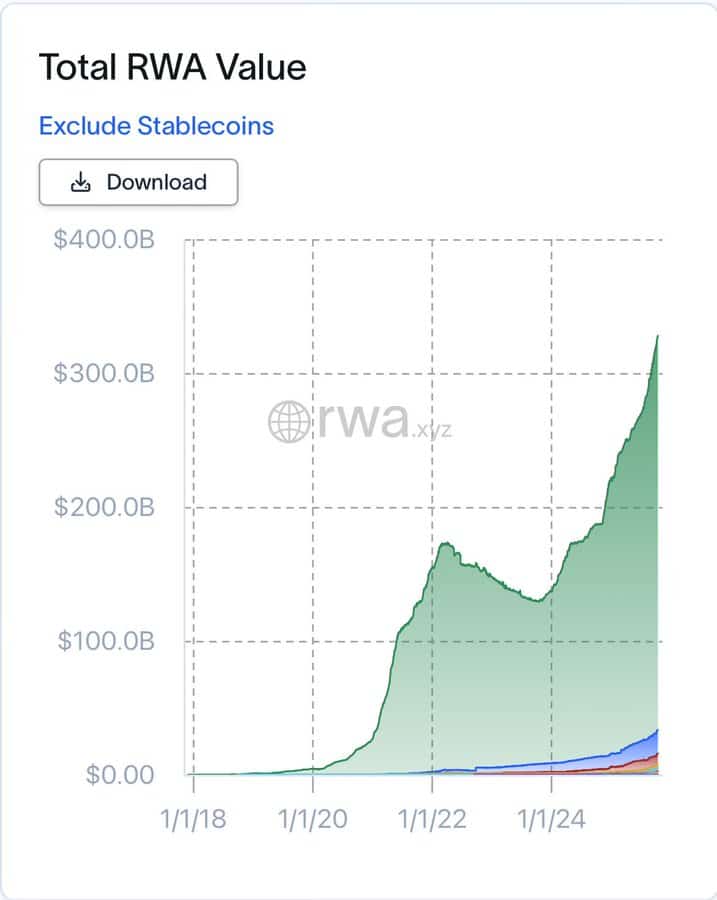

According to DeFiLlama, the total stablecoin market has exceeded $304 billion. Analysts expect this clarity to drive further global growth in the stablecoin market expansion, particularly among banks and fintech innovators.

Source:rwa.xyz

Source:rwa.xyz

Banks Enter the Arena

Traditional financial institutions are now joining the race. Citigroup CEO Jane Fraser said in August that the bank is exploring a Citi stablecoin. JPMorgan also launched JPMD deposit tokens for institutional blockchain transactions.

These developments show that the stablecoin market expansion is spreading beyond crypto-native firms. Banks want to achieve faster settlements and 24/7 operations. Their entry into the market shows that stablecoins are moving into mainstream finance.

Regulation Challenges Emerge

The Bank of England recently proposed limits on stablecoin holdings. It suggested caps between £10,000 and £20,000 for individuals and up to £10 million for businesses. The plan sparked public criticism and debate within the industry.

Many believe such limits could slow innovation and weaken the UK’s role in the stablecoin market expansion. Policymakers now face the task of balancing innovation with financial oversight as the market continues to evolve.

DeFi Platforms Driving Adoption

Decentralized finance platforms are also fueling the stablecoin market expansion. Crypto.com partnered with Morpho, a top DeFi lending protocol, to launch stablecoin lending markets on the Cronos blockchain.

The integration allows users to deposit wrapped Bitcoin or Ethereum and borrow stablecoins directly. This partnership shows how centralized and decentralized systems are merging. It also highlights how DeFi innovation supports the broader stablecoin market expansion.

Global Market Outlook

The stablecoin market expansion is showing strong global momentum. With blockchain technology maturing, stablecoins are becoming a key tool for payments and cross-border transfers.

Businesses and banks now view them as a bridge between traditional systems and digital assets. Coinbase and Mastercard’s interest in BVNK reinforces this transition. If successful, the acquisition could reshape how global finance operates.

Conclusion

The possible acquisition of BVNK by Coinbase and Mastercard marks a major step in the stablecoin market expansion. It reflects the merging of crypto technology with established financial networks.

Stablecoins hold promise as the future of digital finance, given that regulation remains unfinished and institutional buyers establish more interest in it. However, the new transparency and efficiency concerns will only proceed to shape the industry growth in the future.

Also Read: Will the Stablecoin Revolution Kill Fiat or Turbocharge Traditional Finance?

Summary

Coinbase and Mastercard are in advanced conversations in London-based BVNK in a transaction worth as much as $2.5 billion, and this represents a significant movement in the growth of the stablecoin market.

As the processes of global regulation and DeFi adoption have begun to pick up momentum and institutions start to take an interest, stablecoins are now the center of innovation in digital payments.

Appendix: Glossary of Key Terms

Stablecoin: A digital asset pegged to a fiat currency like the US dollar to reduce volatility.

BVNK: A London-based fintech firm offering stablecoin infrastructure for payments and treasury systems.

Coinbase: A major cryptocurrency exchange and blockchain technology company.

Mastercard: A global payments network expanding into blockchain and digital assets.

GENIUS Act: US legislation providing a federal framework for stablecoin regulation and transparency.

DeFi: Financial systems built on blockchain without central intermediaries.

Bridge: A stablecoin startup acquired by Stripe, marking fintech’s entry into stablecoin innovation.

Frequently Asked Questions About Stablecoin Expansion

1- What does stablecoin market expansion mean?

It refers to the rapid global growth and adoption of stablecoins across payment systems and financial institutions.

2- Why are Coinbase and Mastercard pursuing BVNK?

They aim to strengthen their presence in the expanding stablecoin ecosystem and gain access to BVNK’s payment infrastructure.

3- How big is the stablecoin market?

According to DeFiLlama, the market is valued at over $304 billion.

4- What role do regulations play?

The US GENIUS Act and similar frameworks give stability and boost institutional trust, supporting global expansion.

Read More: A $2.5B Stablecoin Deal? Coinbase and Mastercard Are Going Head-to-Head for BVNK">A $2.5B Stablecoin Deal? Coinbase and Mastercard Are Going Head-to-Head for BVNK

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

New Gold Protocol's NGP token was exploited and attacked, resulting in a loss of approximately $2 million.