Strategy ($MSTR) Bought 855 Bitcoin Ahead of Weekend Market Crash, Holdings Hover Near Breakeven

Bitcoin Magazine

Strategy ($MSTR) Bought 855 Bitcoin Ahead of Weekend Market Crash, Holdings Hover Near Breakeven

Strategy (MSTR) added 855 bitcoin to its balance sheet for approximately $75.3 million last week, paying an average price of $87,974 per BTC, according to a filing published Monday.

The purchase came just days before bitcoin’s sharp sell-off, which briefly pushed prices below $75,000 over the weekend. Despite the timing, the acquisition represents a relatively small addition for the company, which has routinely purchased hundreds of millions — or even billions — of dollars’ worth of bitcoin in recent weeks.

Led by Executive Chairman Michael Saylor, Strategy now holds a total of 713,502 BTC, acquired for roughly $54.26 billion at an average price of $76,052 per coin.

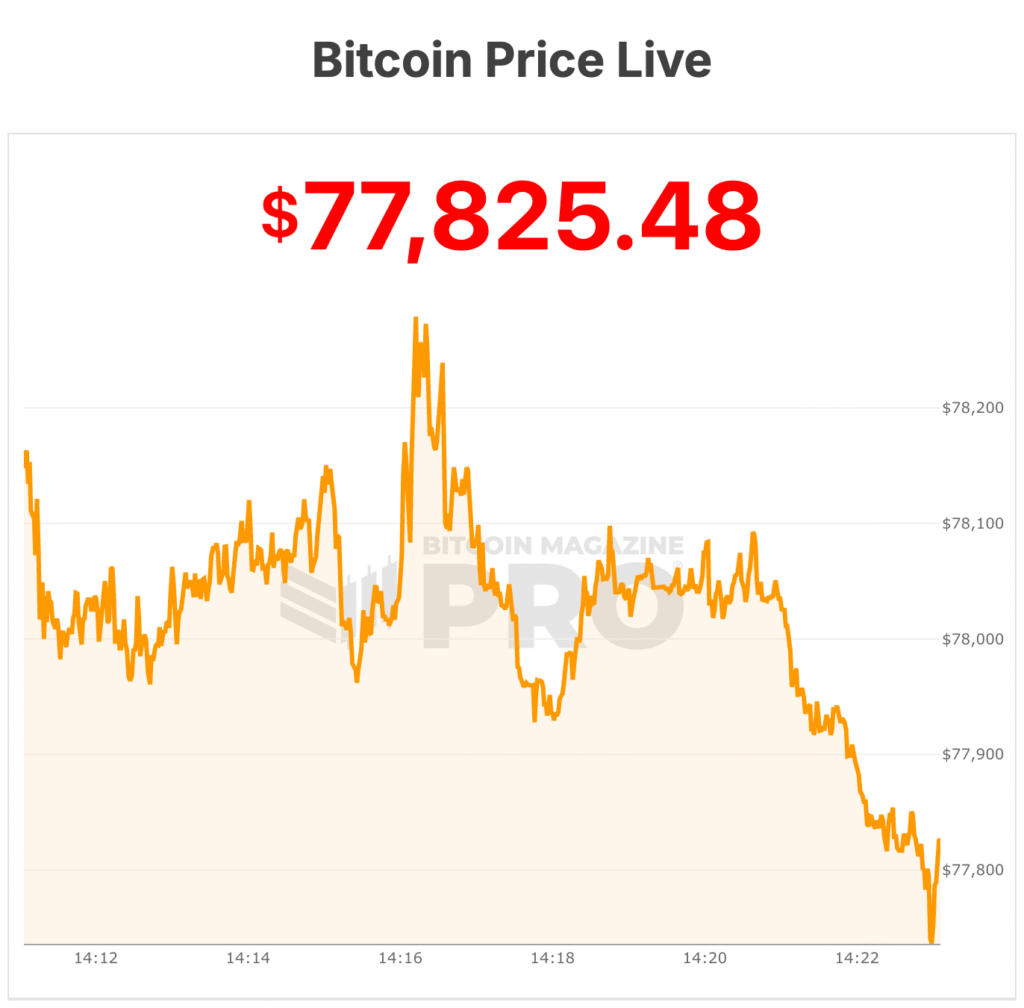

With bitcoin trading just above $77,000 at the time of writing, the firm’s treasury is marginally above breakeven after more than five years of accumulation.

Last week’s purchase was fully funded through the sale of common stock, consistent with Strategy’s ongoing capital-raising strategy to finance bitcoin acquisitions.

Bitcoin and Strategy’s stock drop

Bitcoin’s weekend drop briefly placed Strategy’s treasury underwater, according to Bitcoin Magazine Pro data.

Bitcoin fell to a low of roughly $74,500 during early Asian trading on Feb. 1 and into Feb. 2, pushing the company’s unrealized losses close to $1 billion at the session low before narrowing significantly as prices rebounded.

Losses were estimated at around $150 million as BTC recovered to the mid-$75,000 range.

Strategy remains the world’s largest corporate bitcoin holder and has shown no signs of slowing its accumulation.

Saylor has hinted at further purchases in 2026, following the firm’s largest buy of the year on Jan. 20, when it acquired more than 22,000 BTC.

To support continued buying, Strategy recently increased the dividend on its Series A Perpetual Stretch Preferred Stock to 11.25%. Proceeds from preferred share sales have financed more than 27,000 BTC in recent acquisitions.

Strategy shares fell over 7% in premarket trading Monday to $138.49, marking a new multi-year low as bitcoin’s volatility weighed on sentiment across crypto-exposed equities.

Bitcoin is trading at $77,822, with 24-hour volume totaling $86 billion. The asset is down about 1% on the day, sitting roughly 1% below its seven-day high of $78,611 and around 4% above its seven-day low of $74,592.

BTC’s circulating supply stands at 19,982,656 coins, with a fixed maximum supply of 21 million. The total Bitcoin market capitalization is approximately $1.56 trillion, reflecting a 1% decline over the past 24 hours.

This post Strategy ($MSTR) Bought 855 Bitcoin Ahead of Weekend Market Crash, Holdings Hover Near Breakeven first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Why a $58,000 bitcoin is the key number for crypto investors right now

Copy linkX (Twitter)LinkedInFacebookEmail