Solana Mobile Launches SKR Token Airdrop for Seeker Smartphone Users

- Solana Mobile has launched its native SKR utility and governance token, airdropping nearly 2 billion tokens to over 100,000 Seeker phone users and 188 developers.

- The SKR token features a 10 billion fixed supply and a linear inflation model starting at 10% annually, which rewards early participants who stake to ecosystem “Guardians.”

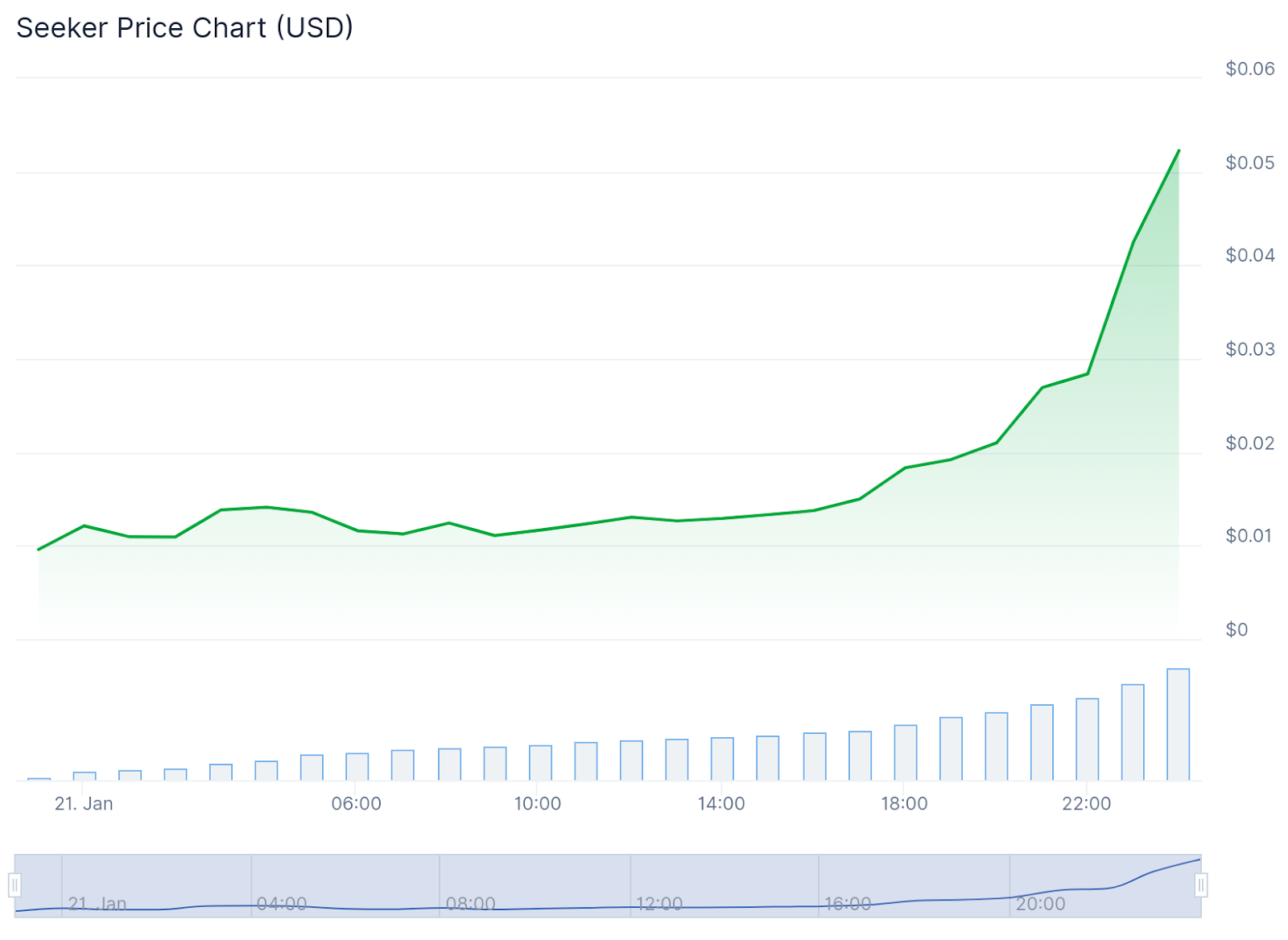

- Launched at $0.006, the token surged over 400% to $0.05 on its first day as the Seeker ecosystem transitioned into its “Season 2” incentive phase.

Solana Mobile has begun distributing nearly 2 billion tokens to users and developers of its Web3 smartphone, marking the launch of the Seeker token (SKR) and the start of a new incentive system tied to its mobile ecosystem.

The airdrop applies to owners of the Solana Seeker phone and participating developers, and eligible users have 90 days to claim the tokens, which can be staked immediately for rewards.

The airdrop covers at least 100,000 users and 188 developers, with the tokens valued at about US$26.6 million (AU$40.7 million) at launch.

After claiming their allocation, users can stake SKR through Solana Mobile’s staking system. The company said staking rewards begin immediately, with token inflation events scheduled every 48 hours and no commission applied at launch.

Read more: Analyst: Why Chainlink Matters More Than Most Investors Realise

SKR Token Launches

The SKR token was announced a month ago, confirmed by Solana co-founder Anatoly Yakovenko.

It is the utility and governance token for the Solana Mobile platform. It has a fixed supply of 10 billion tokens and is issued as a Solana Program Library (SPL) asset, the standard token format on the Solana blockchain.

The idea behind the token is relatively simple: to support governance, rewards, security initiatives and access to platform features, while aligning incentives across users and developers.

The Seeker smartphone, launched in August 2025, is an Android-based device built specifically for crypto use. It is the successor to the Solana Saga, Solana Mobile’s first phone, released in 2022. The Seeker includes a native decentralised app store and deep integration with the Solana ecosystem.

Trading data shows strong early market activity. SKR began trading around 2:00 am UTC and rose roughly 440% to US$0.05 (AU$0.74) according to CoinGecko.

Read more: How Zero-Knowledge Proofs Are Turning Bitcoin into a Settlement Layer

The post Solana Mobile Launches SKR Token Airdrop for Seeker Smartphone Users appeared first on Crypto News Australia.

You May Also Like

Crypto Market Faces Instability Amidst Intensive Sell-Off

Waarom datacenter stroom nu een crypto macrofactor wordt