PEPE Price Is Running Out of Room – Here’s What’s Happening

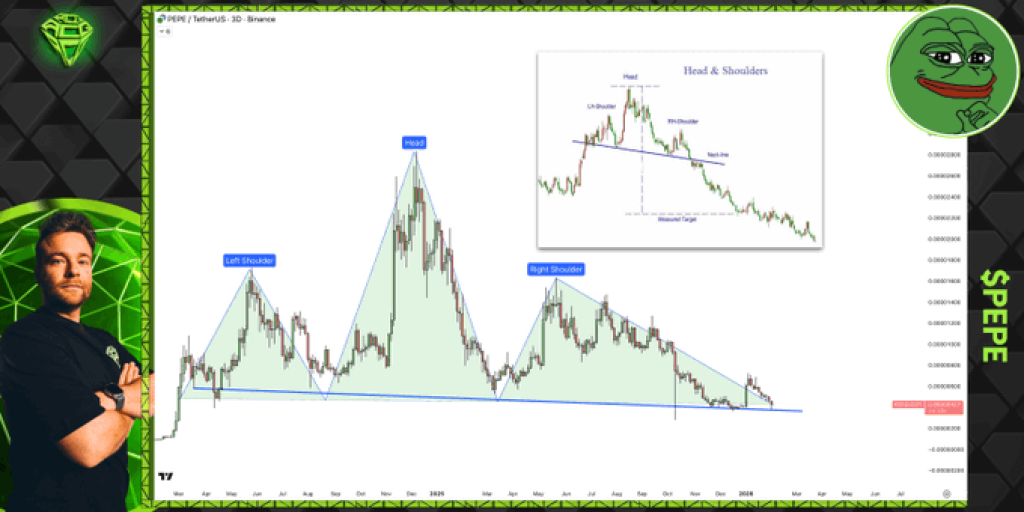

The PEPE price is trading near a tight area on the chart, and it no longer has much space to move without choosing a direction. After months of steady fading, the structure has compressed, and traders are watching closely for the next move.

Crypto analyst Sjuul flagged the setup and warned that PEPE is close to breaking down. He pointed to the size of the structure that has formed over time and hinted that the downside could be sharp if support fails.

What the PEPE Chart Shows

The PEPE price has spent a long period printing lower highs. Each bounce has been weaker than the last, and sellers have stepped in sooner on every rally. However, price has leaned on the same support zone again and again.

This has created a narrowing range. When the PEPE price keeps pressing against support without a strong bounce, that level weakens. Buyers step back. Sellers gain confidence. That is where PEPE sits now.

The chart also shows fading demand. Volume has thinned, and upside follow-through has been limited. These are not signs of strong buying interest.

Source: X/Sjuul

Source: X/Sjuul

Here’s Why Traders Are Paying Attention to PEPE

Large chart structures matter because they store pressure. The longer price moves sideways under resistance, the bigger the reaction tends to be once it breaks.

If the PEPE price slips below the current support zone, there is little nearby structure to slow it down. That is what makes traders uneasy. The risk is not the move itself, but how fast it could happen.

On the other hand, holding support would delay the move. It would give buyers time to regroup and keep price boxed in for longer. Right now, the chart does not show clear strength from either side.

Read Also: The Math Says Bitcoin Is Deeply Mispriced

What Comes Next for PEPE Price

Everything comes down to support. A clean break below it would likely bring a sharp continuation lower. A hold keeps price stuck in place but does not solve the broader weakness.

For now, the PEPE price is at a decision point. The range is tight, volatility is compressed, and patience is thinning. When price finally moves, it is unlikely to be subtle.

PEPE is running out of room on the chart. Sellers have pressed price lower for months, and support is under stress. Traders are not guessing the direction. They are waiting for confirmation.

Until price proves otherwise, risk remains elevated. In setups like this, the chart usually speaks first.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post PEPE Price Is Running Out of Room – Here’s What’s Happening appeared first on CaptainAltcoin.

You May Also Like

Why a $58,000 bitcoin is the key number for crypto investors right now

Copy linkX (Twitter)LinkedInFacebookEmail