US Court Sentences Chinese National to Nearly 4 Years for $37M Crypto Fraud

A Chinese national received a 46-month (Nearly 4 years) federal prison sentence for his role in laundering over $36.9 million stolen from American victims through a sophisticated crypto investment scam operated from Cambodia.

According to a DOJ release, Jingliang Su, 45, was also ordered to pay $26,867,242 in restitution following his guilty plea to conspiracy to operate an illegal money transmitting business.

United States District Judge R. Gary Klausner handed down the sentence, marking another victory in the Justice Department’s escalating campaign against international scam center operations.

Romance Scams and Fake Trading Platforms Trap Victims

The fraud began with overseas co-conspirators contacting U.S. victims through unsolicited social media interactions, telephone calls, text messages, and online dating services.

After gaining their targets’ trust, the scammers promoted fraudulent digital asset investments that appeared legitimate.

Co-conspirators created fake websites that resembled legitimate cryptocurrency trading platforms and convinced victims to send funds to these counterfeit sites.

The scammers would then falsely inform victims that their investments were appreciating in value, when in fact the money had already been stolen.

“This defendant and his co-conspirators scammed 174 Americans out of their hard-earned money,” said Assistant Attorney General A. Tysen Duva of the Justice Department’s Criminal Division.

“In the digital age, criminals have found new ways to weaponize the internet for fraud.”

$37M Laundered Through Bahamas to Cambodia

The stolen funds followed a carefully orchestrated path designed to obscure their criminal origins.

More than $36.9 million in victim funds were transferred from U.S. bank accounts controlled by co-conspirators to a single account at Deltec Bank in the Bahamas.

Su and other co-conspirators then directed Deltec Bank to convert the victim funds into the stablecoin Tether (USDT) and transfer the converted cryptocurrency to a digital asset wallet controlled in Cambodia.

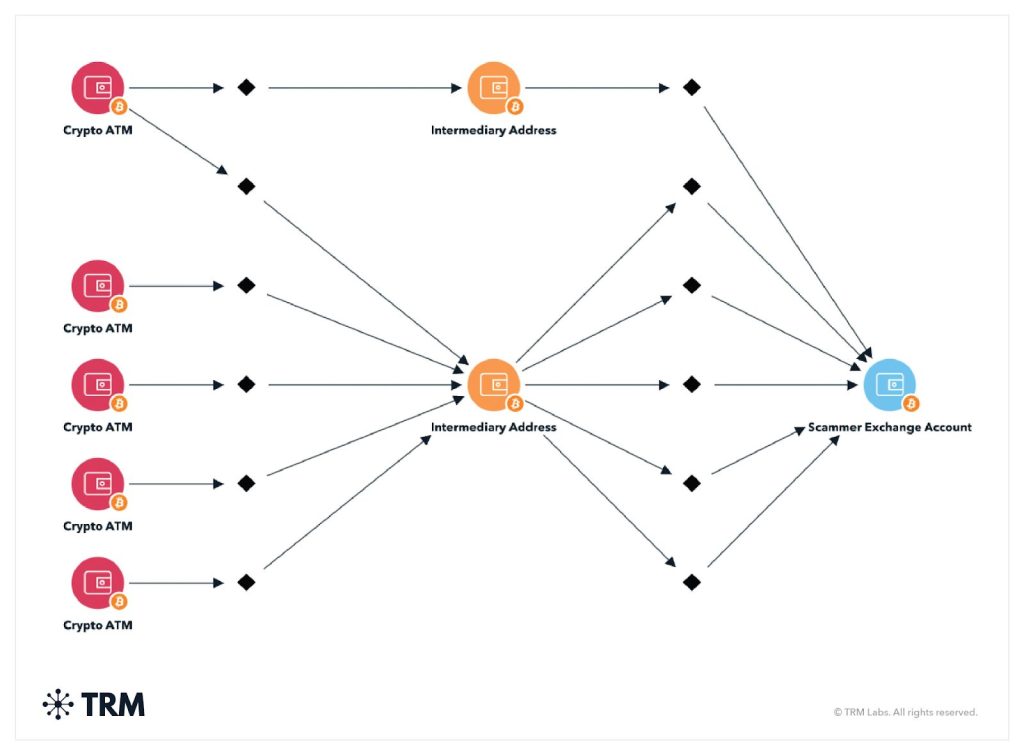

Source: TRM Labs

Source: TRM Labs

From there, Cambodian-based co-conspirators distributed the USDT to leaders of scam centers throughout the region.

“New investment opportunities may sound intriguing, but they have a dark side: attracting criminals who, in this case, stole and then laundered tens of millions of dollars from their victims,” said First Assistant United States Attorney Bill Essayli.

“I encourage the investing public to be cautious. An ounce of prevention is worth a pound of cure.”

Eight Defendants Sentenced as Crackdown Intensifies

Su has been in federal custody since December 2024 and is one of eight co-conspirators who have pleaded guilty so far.

Jose Somarriba and ShengSheng He each pleaded guilty to conspiracy to operate an unlicensed money transmitting business, receiving sentences of 36 months and 51 months in prison, respectively.

The sentencing is the latest outcome of the Criminal Division’s ongoing work to investigate, disrupt, and bring to justice individuals who facilitate scam center operations worldwide.

DOJ’s Broader War on Crypto Crime

Su’s case arrives amid intensifying federal enforcement against cryptocurrency-related fraud.

Just one day earlier, the US Department of Justice completed the forfeiture of more than $400 million in assets tied to Helix, a darknet cryptocurrency mixer used to launder proceeds from illegal online marketplaces between 2014 and 2017.

According to the DOJ Criminal Division Fraud Section 2025 Year in Review, published on January 23, prosecutors accused 265 defendants of a cumulative alleged loss in fraud cases exceeding $16 billion, nearly twice the amount reported the previous year.

The DOJ noted that cryptocurrency is increasingly becoming a preferred payment rail, laundering mechanism, and asset category for illicit funds.

The Criminal Division plans to leverage its network of International Computer Hacking and Intellectual Property prosecutors strategically posted worldwide to coordinate with foreign law enforcement partners.

Since 2020, the Computer Crime and Intellectual Property Section has secured convictions of more than 180 cybercriminals and court orders for the return of over $350 million in victim funds.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

Fed rate decision September 2025

![Top Crypto Saving Accounts in Europe 2026 [Regulated and Trusted]](https://images.cryptodaily.co.uk/space/755img.png)