'Serious implications' as wealth gap and 'asset bubble' balloon under Trump: reporter

Economics experts have recently been describing the U.S. economy as "K-shaped," meaning the rich are doing better and better while anyone making under a million dollars a year aren't doing as well. In fact, the wealthy are doing so well that they're spending enough to make the economy look stronger than it might actually be.

Speaking to CNN on Friday, senior markets reporter Madison Mills from Axios cited the top wage earners, those making over about $130,000 annually, account for 59 percent of the spending in the U.S. The other 80 percent of people, those making under about $62,000, only account for about 40 percent.

"What stands out to me about those numbers is how quickly they've gotten worse. Just about six months ago, the top earners were spending about half of all consumer spending, and it's already gotten up to 59 percent. So, we're seeing this wealth gap widened even further. And as you said, that can have serious implications for how we're viewing the economy," said Mills.

CNN host John Berman commented that when the president announces 4 percent economic growth, it might be great, but it's not giving the full picture.

"Consumer spending is the biggest driver of GDP of economic growth," Mills explained. "So, if you just look at consumer spending on a headline basis, it's looking pretty good because the rich people are spending a lot. You also have the AI companies spending a lot. So that's making that headline number appear better than it might actually be."

The stock market might be hitting record highs but you also have housing prices hitting record highs.

"That's increasing that wealth gap because the people who already owned those assets are getting richer all the time because they're invested," Mills continued. "Meantime, people who didn't have a chance to get in there are faring even worse. At the same time, you have these big tech companies who have more cash flow than we've seen companies have ever in history, spending billions and now expected to be trillions of dollars on AI and that also fuels the economy."

It means that it leads to an "asset bubble" so it makes it more difficult to accurately calculate the actual health of the U.S. economy.

- YouTube youtu.be

- george conway

- noam chomsky

- civil war

- Kayleigh mcenany

- Melania trump

- drudge report

- paul krugman

- Lindsey graham

- Lincoln project

- al franken bill maher

- People of praise

- Ivanka trump

- eric trump

You May Also Like

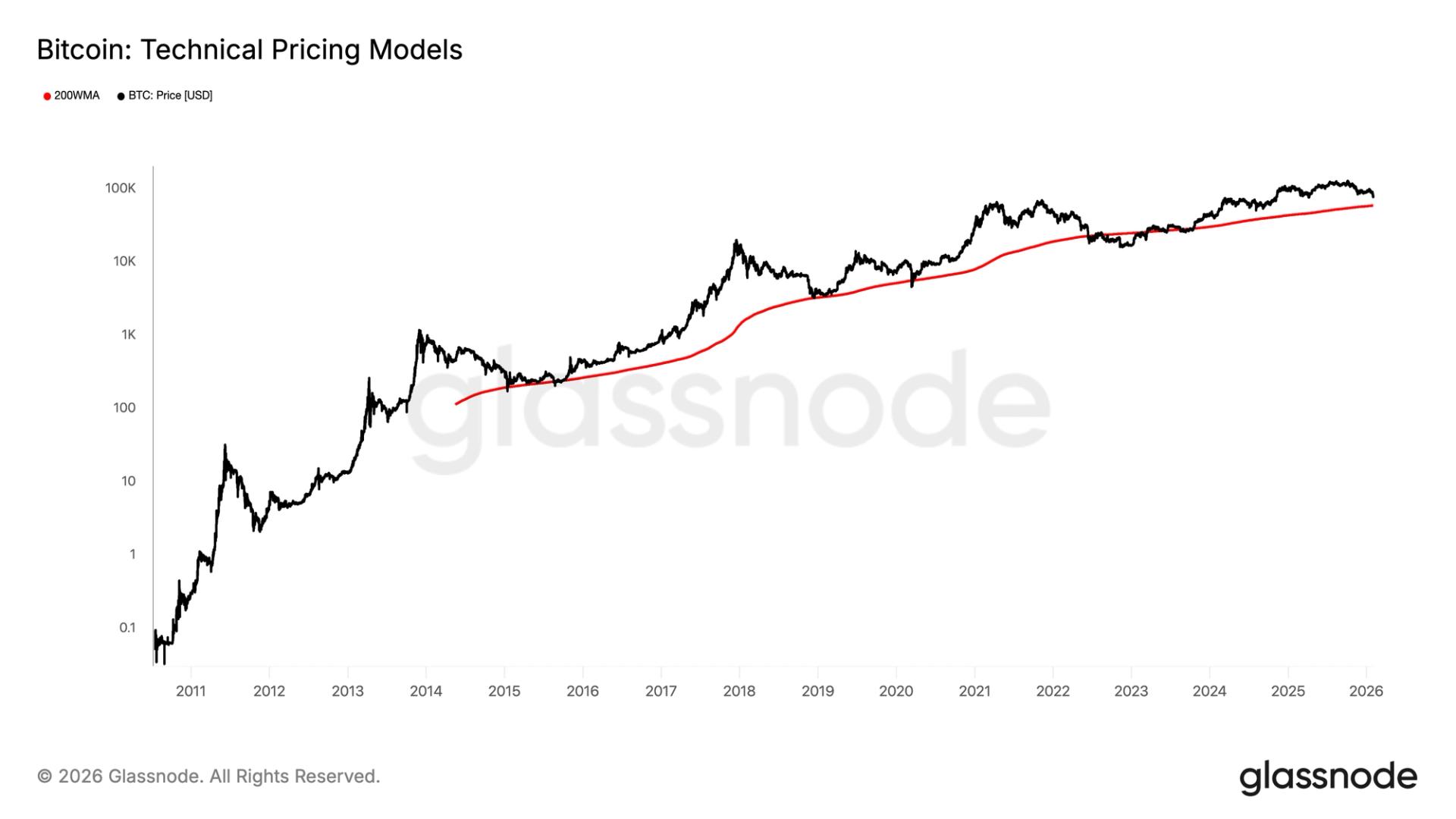

Why a $58,000 bitcoin is the key number for crypto investors right now

Copy linkX (Twitter)LinkedInFacebookEmail