Bitcoin and Ethereum exchange inflows have dropped to a 1-year low indicating reduced selling pressure and investor reluctance to exit positions ahead of a potential U.S. Federal Reserve rate cut, with on-chain data revealing exchange inflows falling to a 7-day moving average of 25K BTC from 51K BTC in July.Bitcoin and Ethereum exchange inflows have dropped to a 1-year low indicating reduced selling pressure and investor reluctance to exit positions ahead of a potential U.S. Federal Reserve rate cut, with on-chain data revealing exchange inflows falling to a 7-day moving average of 25K BTC from 51K BTC in July.

Bitcoin & Ethereum Inflows Hit 1-Year Low as Crypto Investors Brace for Fed Decision – BTC Eyes $120K

Bitcoin and Ethereum exchange inflows have dropped to a 1-year low indicating reduced selling pressure and investor reluctance to exit positions ahead of a potential U.S. Federal Reserve rate cut, with on-chain data revealing exchange inflows falling to a 7-day moving average of 25K BTC from 51K BTC in July.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

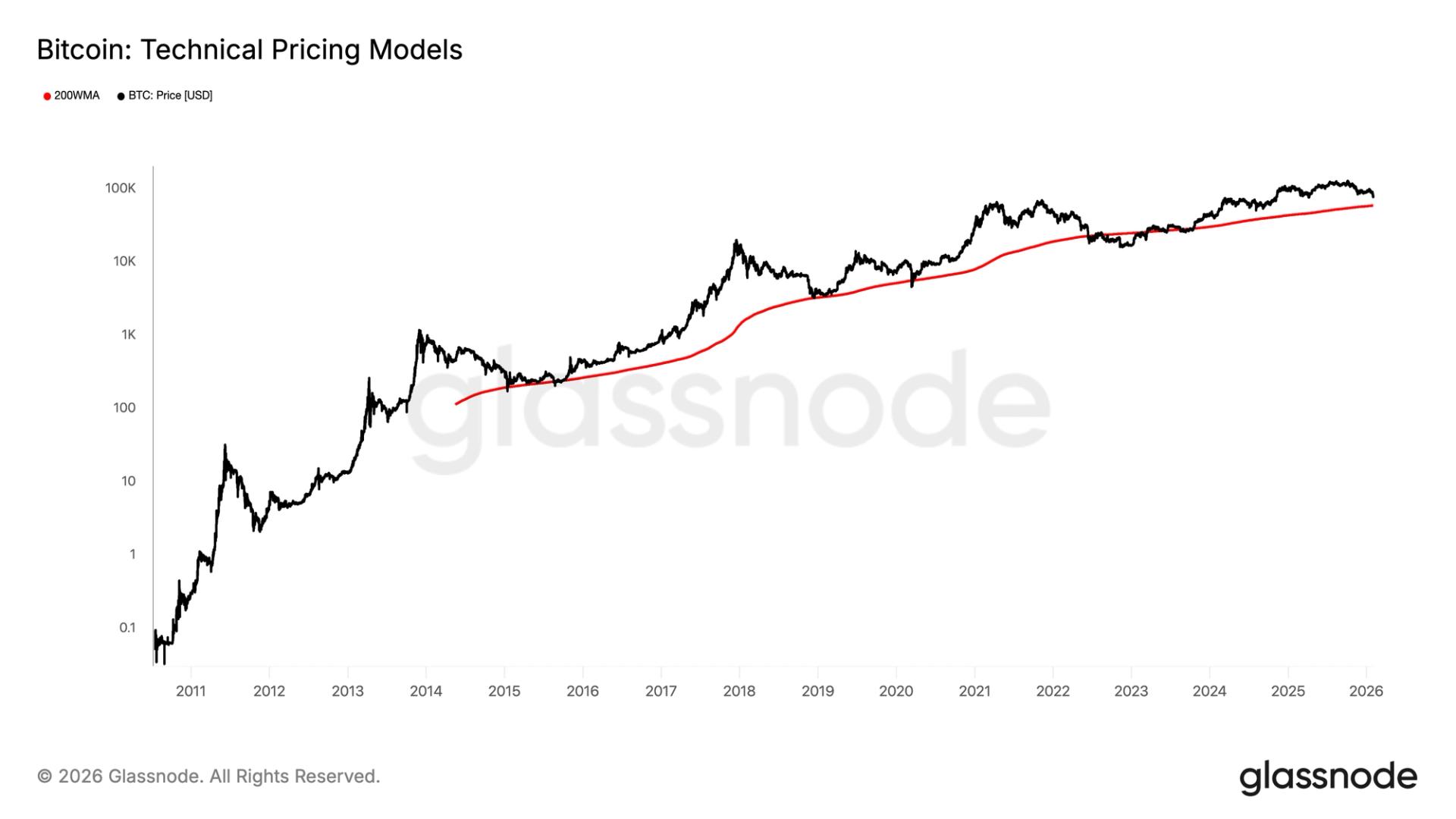

Why a $58,000 bitcoin is the key number for crypto investors right now

Markets

Share

Share this article

Copy linkX (Twitter)LinkedInFacebookEmail

Share

Coindesk2026/02/03 00:38

Ondo Finance launches USDY yieldcoin on Stellar network

The post Ondo Finance launches USDY yieldcoin on Stellar network appeared on BitcoinEthereumNews.com. Key Takeaways Ondo Finance has launched its USDY yieldcoin on the Stellar blockchain network. USDY is Ondo’s flagship yieldcoin focused on real-world asset expansion. Ondo Finance launched its USDY yieldcoin on the Stellar blockchain network today. USDY is described as Ondo’s flagship yieldcoin and represents the company’s expansion of real-world assets onto the Stellar platform. The launch aims to provide yield access across global economies through Stellar’s international network infrastructure. The deployment connects traditional finance with blockchain-based solutions by bringing real-world asset exposure to Stellar’s ecosystem. Ondo Finance positions the move as part of efforts to broaden access to yield-generating opportunities worldwide. Source: https://cryptobriefing.com/ondo-finance-usdy-yieldcoin-stellar-launch/

Share

BitcoinEthereumNews2025/09/18 03:58

Virtune AB (Publ) (“Virtune”) has completed the monthly rebalancing for January 2026 of its Virtune Crypto Altcoin Index ETP

Stockholm, 2nd of February 2026 – Virtune AB (Publ) ("Virtune") today announces that it has completed the monthly rebalancing of the Virtune Crypto Altcoin Index

Share

CryptoReporter2026/02/02 22:54