XRP Price Rebounds as Sentiment Shifts: Is a 2026 Rally in Play?

The post XRP Price Rebounds as Sentiment Shifts: Is a 2026 Rally in Play? appeared first on Coinpedia Fintech News

Ripple’s native token, XRP is once again at a familiar crossroads. After weeks of choppy price action and fading momentum, XRP price is showing early signs of potential rally ahead. During the intraday session, XRP staged a modest rebound of over 2% as price held above key support levels. While the move is not dramatic, ETF flows and on-chain sentiment are beginning to diverge from the chart, a combination that often signals early positioning rather than short-term noise.

ETF Flows and On-Chain Data Signal Accumulation

On-chain data from Santiment suggests that market fear around XRP has resurfaced across social and trading activity, with negative crowd sentiment climbing back to levels typically seen near local bottoms. Historically, such spikes in pessimism have tended to coincide with accumulation phases rather than extended sell-offs, especially when broader structural demand remains intact.

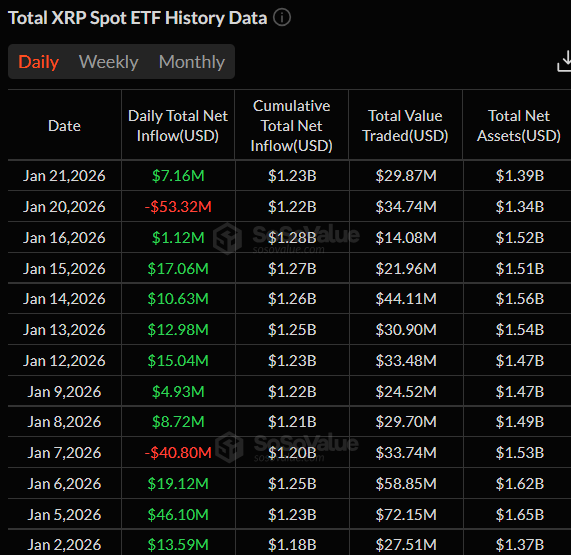

That structural demand is now clearly visible in ETF positioning. According to U.S spot XRP ETF flow data, institutional products currently hold approximately $1.39 billion in total net assets, while cumulative net inflows stand near $1.23 billion. Although the market recorded a notable $53.3 million outflow on January 20, the broader trend remains decisively positive. The past two weeks alone saw strong inflows, highlighting consistent institutional dip-buying behaviour.

XRP Price Holds Key Support as Structure Stays Intact

XRP price is currently consolidating above the former accumulation band between $1.30 and $1.90, which acts as the core structural support area. Looking at the higher timeframes, XRP price has broken out of a multi-year descending wedge (2020-2024), completing a long accumulation phase and delivering a 600%+ expansion from the $0.60 breakout region. This move confirms that XPR is now trading above a multi-year breakout zone, with its higher-timeframe bullish structure still intact.

As long as XRP token holds above the $1.80 region, the long-term trend remains technically bullish. A closer look at the short-term chart highlights that XRP has shifted its structure now and buyers have made their grip now. If XRP price decisively breaks the $2 hurdle, the next upside targets are $3.50 as the first major expansion level, followed by $5 as the next high-timeframe liquidity zone. On the other side, $1.30-$1.50 would act as a demand zone in case of retracement ahead.

As retail sentiment turns cautious and institutions continue building exposure, XRP’s price action suggests the market may be cooling for its next structural breakout rather than rolling over. In classic market cycles, this combination of fearful sentiment, rising institutional positioning, and strong price action often marks the transition from consolidation to expansion, not the end of the trend.

You May Also Like

Flora Growth Announces $401M Funding to Boost AI Zero Gravity (0G) Coin Treasury

Highlights: Flora Growth announces $401M PIPE financing round aimed at establishing an AI Zero Gravity (0G) coin treasury. DeFi Development Corp. led the fundraising exercise with strong support from other companies. Flora Growth will rebrand to ZeroStack following the successful completion of the PIPE financing round. One of the world’s leading decentralised artificial intelligence (AI) treasury companies, Flora Growth, has announced the pricing of a $401 million private investment in public equity (PIPE) round. According to a September 19 press release, the move aims to fund the firm’s treasury strategy centred on AI Zero Gravity (0G) tokens. Upon completion of the PIPE round, Flora Growth will rebrand to ZeroStack, while still maintaining its current market ticker symbol, FLGC. Notably, the financing round is expected to close on or before September 26, 2025, pending customary approvals. Flora Growth Corp. (NASDAQ: FLGC) announced a $401 million PIPE financing led by Defi Development Corp., Hexstone Capital, and CSAPL. 0G Co-Founder Michael Heinrich will become Executive Chairman. The deal is expected to close on September 26. The company will adopt $0G as its… — Wu Blockchain (@WuBlockchain) September 19, 2025 Flora Growth Announces $401M PIPE with Strong Backing from Leading Crypto Firms DeFi Development Corp. (DFDV), the first treasury firm focused on Solana (SOL), led the financing round with a $22.88 million investment. Other partners included Hexstone Capital, Dispersion Capital, Blockchain Builders Fund, Carlsberg SE Asia PTE Ltd (CSAPL), Abstract Ventures, Salt, and Dao5. The fundraising exercise has already generated $35 million in cash commitments and $366 million worth of in-kind digital assets. Flora Growth sold its common shares and pre-funded warrants to investors at $25.19 per share. The company also pegged 0G tokens contribution at $3 per coin, adding that investors paying either cash or 0G tokens will also receive pre-funded warrants, exercisable once shareholder approval is granted. A big NASDAQ company (Flora Growth) just announced they’re raising $401 million. ︎ They plan to buy and hold $0G tokens as part of their company’s savings/treasury. Flora’s deal values $0G at around $3 per token for their planned purchase. Right now $0G is trading below… pic.twitter.com/qhOa3uT5ii — Jimmywontgiveup(Ø,G) (@jimmywontgiveup) September 20, 2025 Flora Growth Plans to Hold SOL in Its Treasury Flora Growth noted that it plans to hold part of its treasury in SOL. Joseph Onorati, the CEO of DeFi Development Corp., spoke on the partnership.“We’re thrilled to partner with FLGC on this fundraiser and look forward to driving a deep collaboration between 0G and Solana,” the CEO stated. Daniel Reis-Faria, Flora Growth’s incoming Chief Executive Officer (CEO), also spoke on the company’s latest initiative. He explained that the move encompasses financial restructuring and support for adopting AI infrastructures. The CEO commented: “This treasury strategy offers institutional investors equity-based exposure, enabling transparent, verifiable, large-scale, cost-efficient, and privacy-first AI development.” A Brief 0G Token Overview, Highlighting Reasons for Flora Growth’s Interest 0G is gaining significant traction, which has made experts describe the token as a breakthrough in decentralised AI. 0G’s model trained a 107 billion AI parameter model, representing a 357x improvement over Google’s DiLoCo research, challenging the idea that huge centralised data centres are needed for such projects. The 0G network proved that a decentralised network is highly effective for cost-effective computations, with transparent and privacy-first solutions. Unlike other AI blockchains, 0G integrated its computation, storage, and training marketplace into one platform, attracting Web2 and Web3 developers. In related news, Crypto2Community reported that Brera Holdings, an Ireland-based company, completed a $300 million PIPE financing round for a Solana-focused treasury on September 19. The fundraising program was led by Pulsar Group, a blockchain advisory firm based in the UAE. It received strong backing from the Solana Foundation, RockawayX, and ARK Invest. Like Flora Growth, Brera Holdings also rebranded to Solmate. eToro Platform Best Crypto Exchange Over 90 top cryptos to trade Regulated by top-tier entities User-friendly trading app 30+ million users 9.9 Visit eToro eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.