Bitcoin (BTC) Price: Exchange Outflows Jump 59% as Buying Pressure Rises

TLDR

- Bitcoin traded around $89,000 on Monday after dropping 2% last week, stuck in tight ranges due to low trading volume

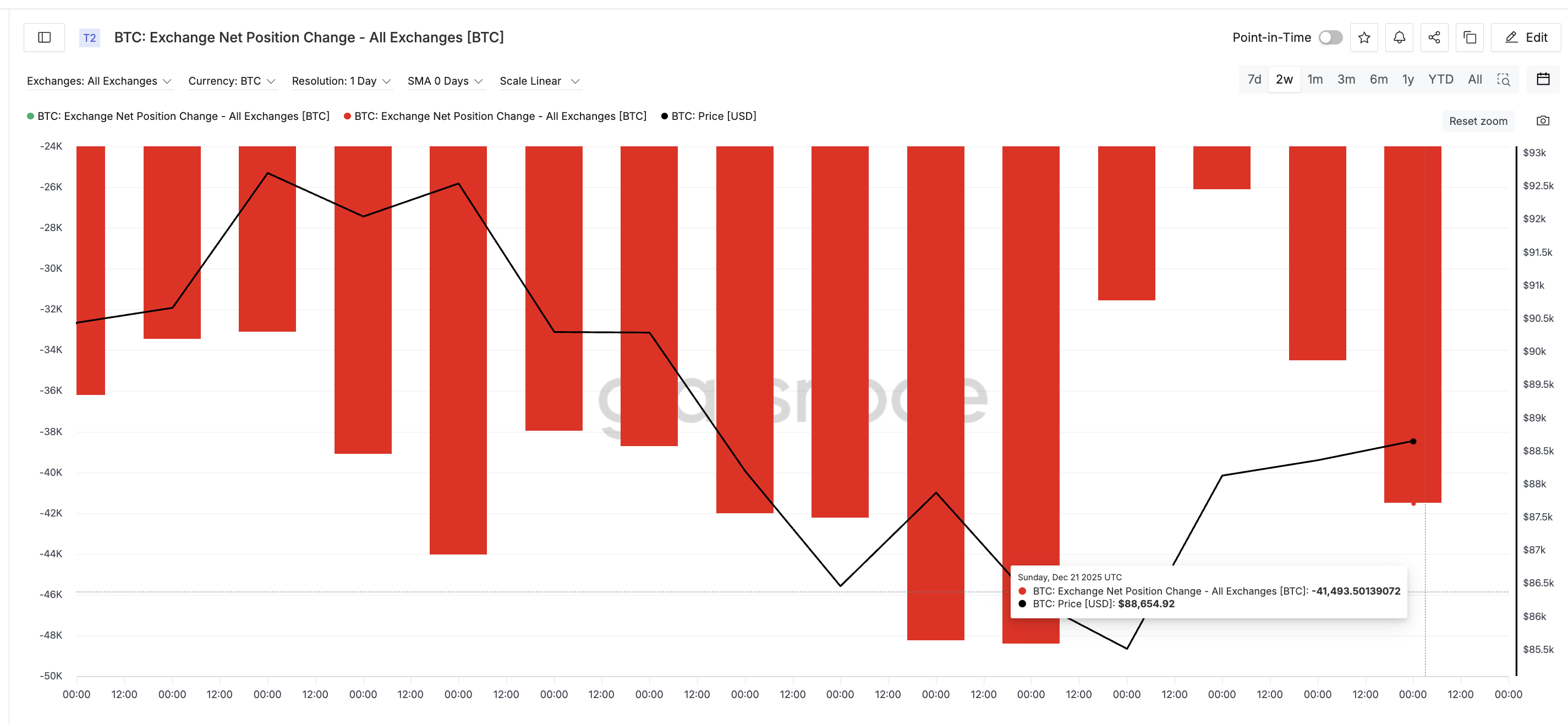

- Exchange outflows jumped 59% from December 19 to 21, moving from 26,098 BTC to 41,493 BTC, showing increased spot buying

- The number of wallets holding at least 1,000 BTC started rising again after dropping on December 17

- Hong Kong’s insurance regulator proposed new rules allowing insurers to invest in crypto assets with a 100% risk charge

- Bitcoin faces key resistance at $89,250 and support at $87,590, with potential targets at $96,700 if resistance breaks

Bitcoin traded at $89,089.92 on Monday morning, holding near recent levels after posting a 2% decline last week. The world’s largest cryptocurrency remains stuck in tight trading ranges as the year-end holiday period approaches.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The digital asset has struggled to break above the $90,000 level throughout December. Traders point to reduced demand from institutional investment vehicles and cautious positioning ahead of the holidays as reasons for the sluggish price action.

Bitcoin is up roughly 5% over the past 30 days. However, the past week showed mostly flat movement with little clear direction from either buyers or sellers.

Market conditions elsewhere improved on Monday. Gold reached fresh all-time highs driven by expectations that the Federal Reserve will cut interest rates in 2026 following softer inflation data. Stock markets also advanced, with Asian equities and U.S. futures opening higher.

The crypto market faces thin liquidity conditions typical of the late December period. Analysts cite slowing inflows to exchange-traded funds and mixed sentiment around digital assets as factors keeping prices range-bound.

Exchange Data Shows Rising Buying Activity

On-chain data reveals a sharp increase in coins leaving centralized exchanges. Exchange outflows measure how many bitcoins move off trading platforms, often indicating buyersare moving assets into self-custody.

Source; Glassnode

Source; Glassnode

On December 19, Bitcoin exchange outflows totaled roughly 26,098 BTC. By December 21, that figure had jumped to 41,493 BTC. This represents a 59% increase in net outflows over just two days.

The surge in exchange outflows suggests retail and mid-sized buyers are stepping into the market. This acceleration in spot buying activity comes alongside more gradual accumulation by larger holders.

Data tracking wallets holding at least 1,000 BTC shows the number of these entities started rising again after a drop on December 17. This metric tracks large holders often called whales. The count has been climbing gradually since December 20, though it remains slightly below recent six-month peaks.

Hong Kong Proposes Crypto Investment Rules for Insurers

Hong Kong’s Insurance Authority is proposing rules that would allow insurance companies to invest in cryptocurrencies and other alternative assets. The proposal, reported by Bloomberg News, comes as regulators seek to direct capital toward government priority sectors.

Under the plan, insurers would face a 100% risk charge on crypto asset holdings. This means they would need to hold capital equal to the full value of their crypto investments as a buffer against potential losses.

The proposal also covers stablecoin investments. These would face risk charges based on the fiat currency backing the stablecoin rather than a flat 100% charge.

The rules appeared in a December 4 presentation reviewed by Bloomberg. The regulatory change would represent a step toward mainstream institutional adoption of digital assets in one of Asia’s major financial centers.

Bitcoin currently faces resistance at the $89,250 level. This price point has capped upward moves since mid-December through multiple failed attempts to push higher. Support sits at $87,590, with further downside levels at $83,550 and $80,530 if selling pressure increases.

The post Bitcoin (BTC) Price: Exchange Outflows Jump 59% as Buying Pressure Rises appeared first on CoinCentral.

You May Also Like

New Gold Protocol's NGP token was exploited and attacked, resulting in a loss of approximately $2 million.

The Real Cost of AI? Beyond Originality, It’s Human Identity

![Which 10 Meme Coins Will Reach $1 in 2026? [Updated as of Dec 2025]](https://coinswitch.co/switch/wp-content/uploads/2025/12/Which-10-Meme-Coins-Will-Reach-1-in-2026-1024x576.png)