Traders Hold Positions Despite November’s $2 Billion Crypto Leverage Wipeout

The post Traders Hold Positions Despite November’s $2 Billion Crypto Leverage Wipeout appeared first on Coinpedia Fintech News

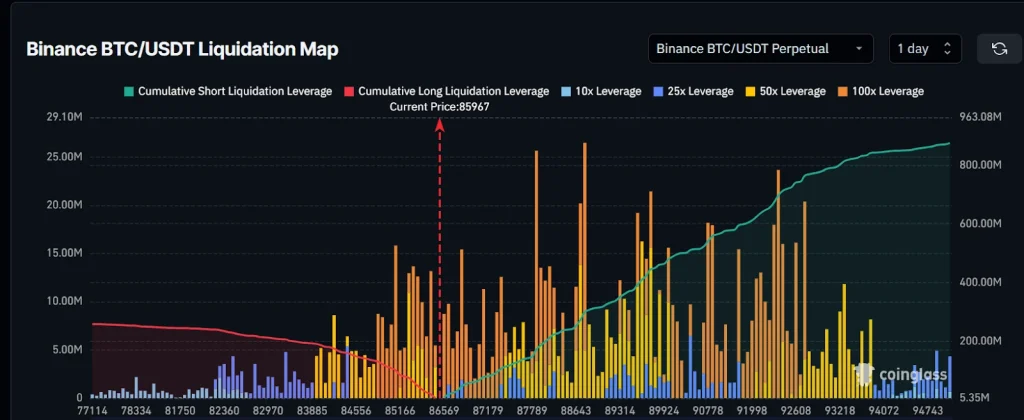

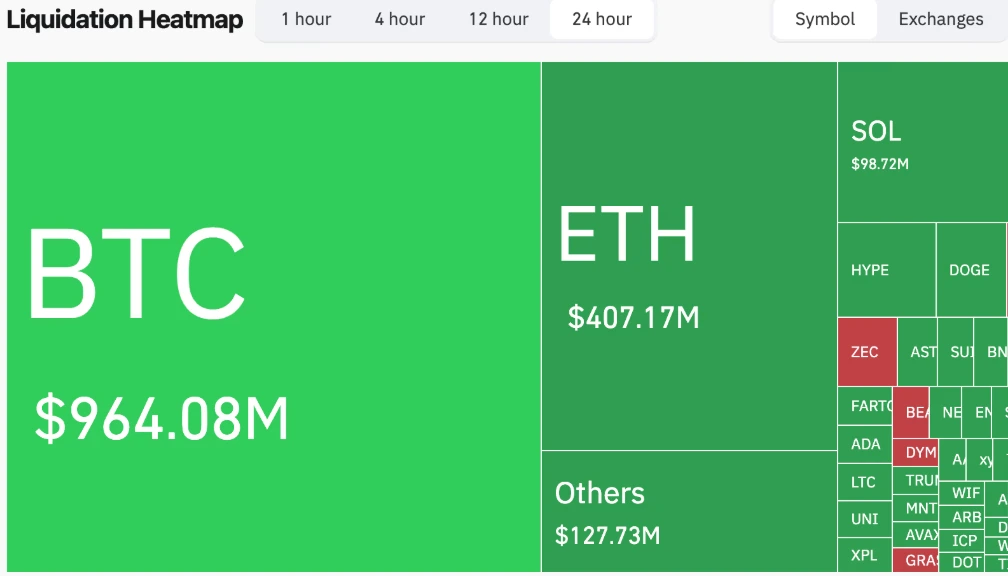

The crypto market experienced another turbulence on November 21, when $2 billion worth of leverage positions were liquidated in just 24 hours. Nearly 396,000 traders were liquidated, the highest single-day record of 2025, as Bitcoin led with over $960 million in liquidations.

The wipeout followed a turbulent month marked by fading bullish momentum, macro uncertainty, and declining risk appetite. Bitcoin plunged from around $92,000 early in the day to intraday lows near $80,600-$81,600 before a partial recovery to about $84,500, a net decline of roughly 8-9%.

Ethereum fell by over 10-14% from $3,000+ to below $2,750 (hitting $2,703 lows), while Solana slid 10%+. Data from Coinglass shows that the Crypto Fear & Greed Index reached an extreme fear level of 11, a level once witnessed two years ago when FTX collapsed.

Liquidations Surge, But Positioning Remains Resilient

Data from CoinGlass shows that the bulk of November’s liquidations were driven by overleveraged long positions, particularly during sharp intraday drawdowns. On several days, such as November 20, liquidation volumes exceeded $200 million, underscoring how quickly risk can multiply when leverage builds up during periods of optimism.

Source: Coinglass

Source: Coinglass

However, more data reveal interesting findings about open interest in November. Analysis shows a 17% drop in aggregate perpetual and futures open interest from the late‑October peak into the first November liquidation cluster, especially on Binance, OKX, and Bybit. After this first wave, open interest stopped falling in tandem with price and liquidations and instead moved sideways for the rest of the month, indicating that many traders opted to maintain exposure rather than exit entirely.

This behavior contrasts with earlier market cycles, where liquidation events of similar magnitude often coincided with a mass drop in open interest and prolonged declines in derivatives participation. For example, during the October 10 market crash, open interest fell sharply by almost 37%, as Bitcoin price tumbled from $124.67K to $110.78K on October 12.

Source: Coinglass

Source: Coinglass

Behavioral Data Points To Growing Risk Awareness

Data from Leverage.Trading provides additional context. In its November 2025 Crypto Leverage Risk Report, the publisher observed a sharp increase in the use of risk-management tools during the volatility.

According to the report, traders increasingly checked margin call checks, liquidation thresholds, and funding costs even as prices fell, a pattern suggesting that participants were recalibrating exposure rather than exiting positions. The data shows how traders are shifting away from reactive trading toward more deliberate risk management strategies during periods of stress.

That trend aligns with broader market observations. Funding rates, which were high and persistently positive through late October, cooled progressively through November as liquidation cascades forced deleveraging. This shift to negative rates made it affordable for remaining traders to hold positions, thus discouraging further forced closes and stabilizing participation.

Ethereum And Altcoins Feel The Pressure

While Bitcoin experienced much of the initial shock, Ethereum and other altcoins also took a hit. On November 21 alone, more than $400 million in Ethereum positions were liquidated, with long positions accounting for the majority of losses. Solana followed with $100 million liquidations at $121.92–122.27 price levels, where most stop-losses were clustered.

What November’s Market Takeaway Suggests

The November wipeout reinforces a key theme emerging in crypto derivatives markets: leverage is still widely used, but it is being approached more cautiously. Traders appear more willing to absorb volatility, hedge risk, or adjust margin levels rather than reflexively closing positions at the first sign of stress.

For market observers, this behaviour hints at a gradual maturation of derivatives trading. Large liquidation events no longer automatically signal surrender; instead, they may represent a resetting of excess risk while participation remains intact.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement