In this article:

• 1. Guide to completing the activities

• 2. Conclusion

Tempo is an EVM-compatible layer one blockchain designed for payment processing.

At the time of writing, the project is in the testnet stage, in which you can participate and be recognized as an early user.

The team raised $500 million in investments from funds such as Paradigm, Sequoia Capital, Ribbit Capital, and others.

In this guide, we will look at what activities are worth doing in testnet with a view to dropping.

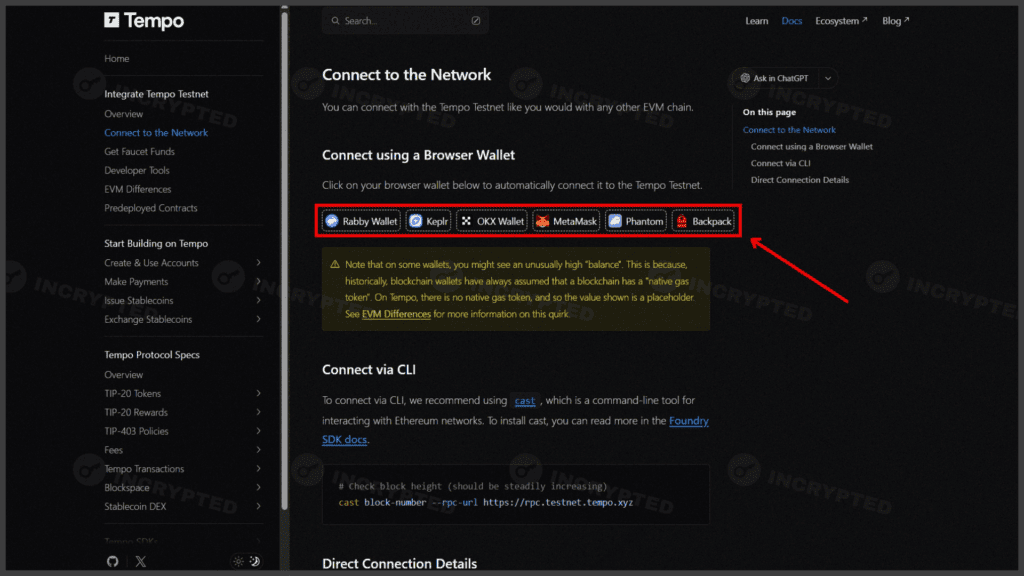

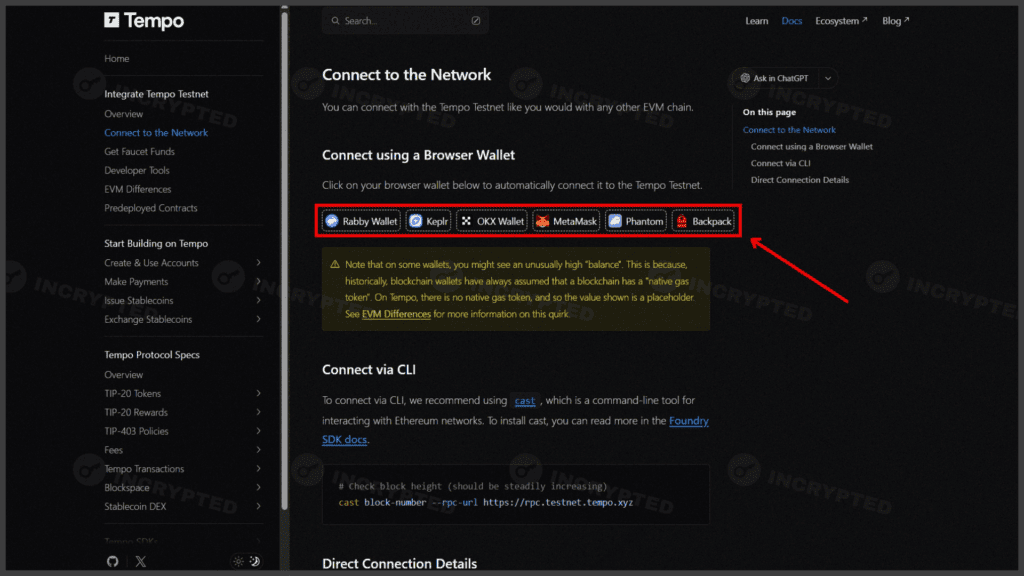

- Go to the website, connect your wallet, and add the Tempo test network:

Add a test network. Data: Tempo.

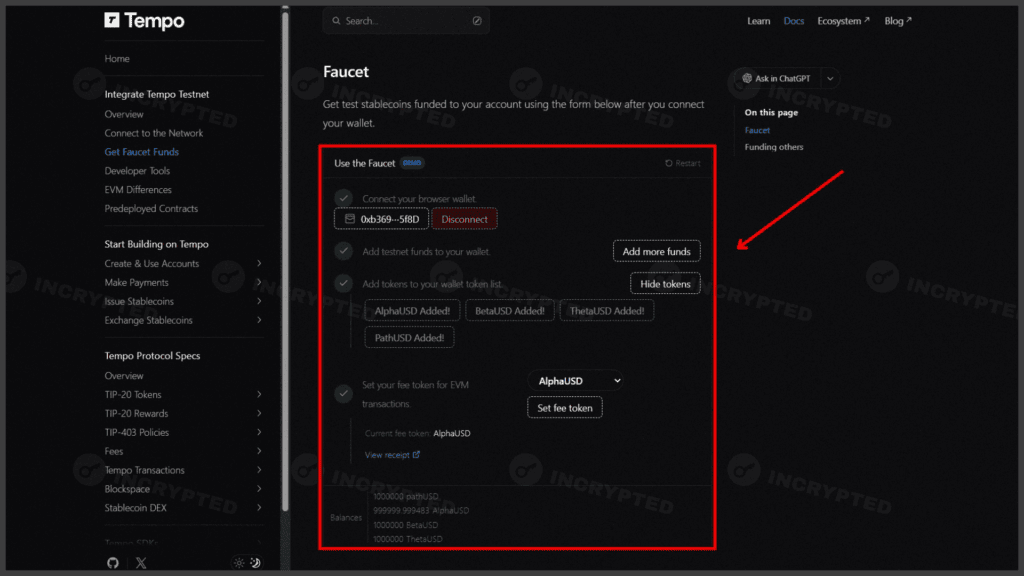

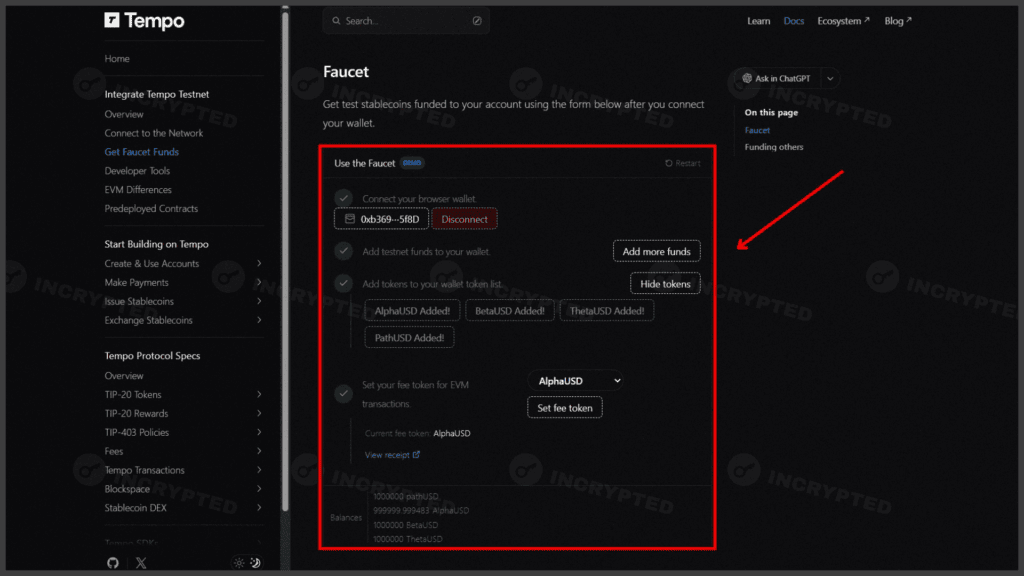

- Request test tokens from the faucet on the page:

Requesting test tokens. Data: Tempo.

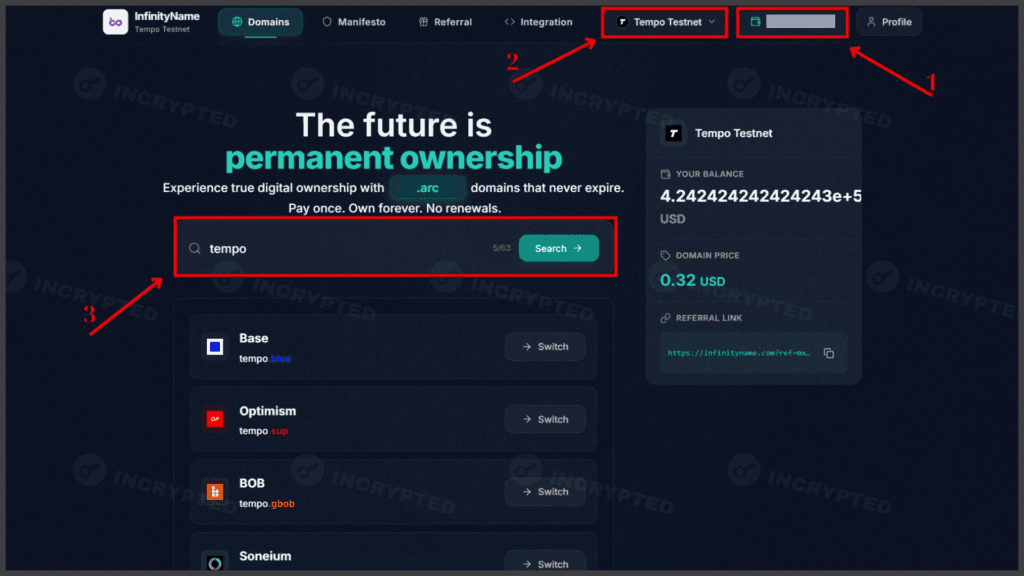

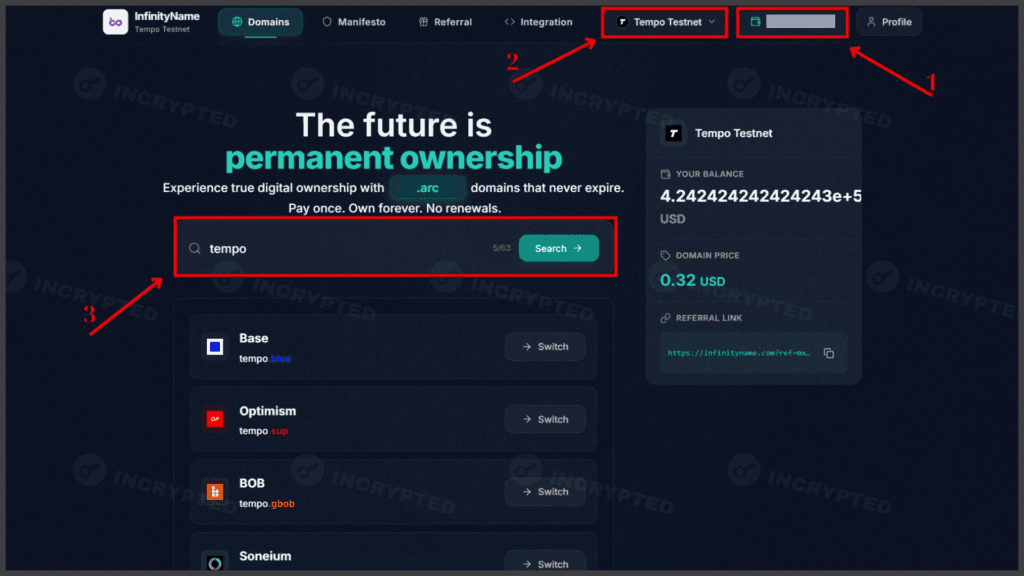

- We purchase a domain in the Tempo test network on the website:

We are purchasing a domain. Details: InfinityName.

- We deploy the contract on the website and send the GM to the Tempo network from there:

Deploy contract. Data: OnchainGM.

- We create and mint NFTs on the website:

Creating an NFT. Data: Nfts2me.

The project is in its early stages, with few activities on the testnet so far. However, the funds, the amount of investment attracted, and the project’s active X (Twitter) account indicate its market significance.

Follow the project on social media so you don’t miss any important updates.

Highlights:

- be active on Testnet;

- $500 million in investments attracted.

If you have any questions while completing the activities, you can ask them in our Telegram chat.

Useful links: Website | X

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Add a test network. Data: Tempo.

Add a test network. Data: Tempo.

Requesting test tokens. Data: Tempo.

Requesting test tokens. Data: Tempo.

We are purchasing a domain. Details: InfinityName.

We are purchasing a domain. Details: InfinityName.

Deploy contract. Data: OnchainGM.

Deploy contract. Data: OnchainGM.

Creating an NFT. Data: Nfts2me.

Creating an NFT. Data: Nfts2me.