The Role of Reference Points in Achieving Equilibrium Efficiency in Fair and Socially Just Economies

Table of Links

Abstract and 1. Introduction

-

A free and fair economy: definition, existence and uniqueness

2.1 A free economy

2.2 A free and fair economy

-

Equilibrium existence in a free and fair economy

3.1 A free and fair economy as a strategic form game

3.2 Existence of an equilibrium

-

Equilibrium efficiency in a free and fair economy

-

A free economy with social justice and inclusion

5.1 Equilibrium existence and efficiency in a free economy with social justice

5.2 Choosing a reference point to achieve equilibrium efficiency

-

Some applications

6.1 Teamwork: surplus distribution in a firm

6.2 Contagion and self-enforcing lockdown in a networked economy

6.3 Bias in academic publishing

6.4 Exchange economies

-

Contributions to the closely related literature

-

Conclusion and References

Appendix

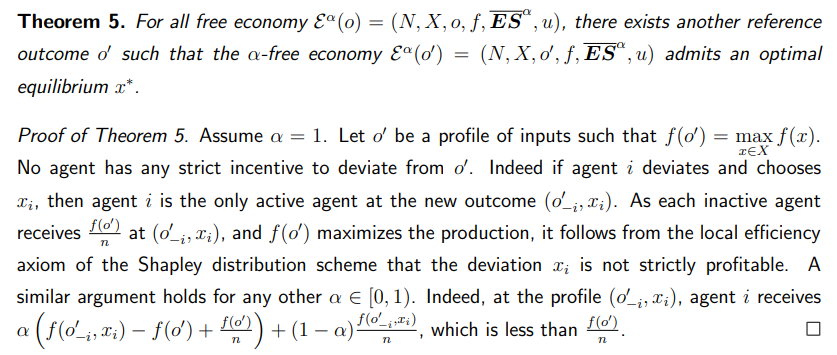

5.2 Choosing a reference point to achieve equilibrium efficiency

\

\ Remark that this result holds for any value of α, including for α = 1, which corresponds to a situation where the tax rate is zero. In that case, the entire surplus of the economy is distributed following the Shapley value. The analysis implies that if an economy can choose its reference point, it can always do so to lead to equilibrium efficiency.

\

:::info Authors:

(1) Ghislain H. Demeze-Jouatsa, Center for Mathematical Economics, University of Bielefeld (demeze jouatsa@uni-bielefeld.de);

(2) Roland Pongou, Department of Economics, University of Ottawa (rpongou@uottawa.ca);

(3) Jean-Baptiste Tondji, Department of Economics and Finance, The University of Texas Rio Grande Valley (jeanbaptiste.tondji@utrgv.edu).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

You May Also Like

Michael Saylor Pushes Digital Capital Narrative At Bitcoin Treasuries Unconference

Stellar (XLM) Price Analysis for February 1