Unicoin SEC Lawsuit: Urgent Bid for Dismissal

BitcoinWorld

Unicoin SEC Lawsuit: Urgent Bid for Dismissal

The cryptocurrency world is buzzing with the latest development concerning the Unicoin SEC lawsuit. Unicoin is making a bold move, announcing its intention to ask a court to dismiss the lawsuit brought against it by the U.S. Securities and Exchange Commission (SEC). This action highlights a growing tension between crypto innovators and regulatory bodies, raising crucial questions about how digital assets are classified and overseen.

What’s Behind the Unicoin SEC Lawsuit Dismissal Bid?

Unicoin’s decision to seek dismissal stems from a fundamental disagreement with the SEC’s interpretation of its operations. The company argues that the agency misinterpreted its key disclosures, which are vital documents explaining its token and business model. Furthermore, Unicoin has made a serious accusation, claiming that then-SEC Chair Gary Gensler initiated a baseless lawsuit against it, driven by political reasons rather than legitimate regulatory concerns.

The SEC’s initial complaint against Unicoin was significant. The agency alleged that Unicoin deceived investors by making claims that its token was backed by real-world assets, including real estate. The SEC also contended that Unicoin raised over $100 million through the sale of unregistered securities, a major violation under U.S. law. This legal battle is shaping up to be a pivotal case for the future of asset-backed tokens.

Unicoin’s Defense: Misinterpretation or Misconduct?

At the heart of Unicoin’s defense is the assertion that the SEC simply misunderstood how its token and backing mechanisms operate. They believe their disclosures were clear, and the agency’s interpretation was flawed. This isn’t just a minor disagreement; it challenges the very foundation of the SEC’s case.

Key points from Unicoin’s perspective include:

- Misinterpreted Disclosures: Unicoin maintains that its public statements and documentation accurately reflected its token’s structure and backing. They argue the SEC failed to grasp these details correctly.

- Political Motivations: The claim of political motivations against a former SEC Chair adds another layer of complexity. If proven, it could significantly weaken the SEC’s standing in the case, suggesting an overreach of power.

The company aims to present compelling evidence to the court, demonstrating that the SEC’s allegations lack a solid legal basis. The outcome of this specific Unicoin SEC lawsuit will undoubtedly influence how similar cases are handled in the future.

The Stakes of the Unicoin SEC Lawsuit: What Does This Mean for Crypto?

This legal confrontation extends far beyond Unicoin itself. It represents a broader struggle within the cryptocurrency industry concerning regulatory clarity. The SEC’s stance on what constitutes a “security” in the digital asset space has been a consistent point of contention for many projects. If Unicoin succeeds in its dismissal bid, it could set an important precedent.

Consider these broader implications:

- Definition of Securities: The case could further clarify or complicate the definition of a security when applied to asset-backed tokens. This clarity is desperately needed by developers and investors alike.

- Regulatory Overreach: Unicoin’s accusation of political motives touches on concerns about potential regulatory overreach. A successful dismissal could encourage other projects to challenge SEC actions more aggressively.

- Investor Confidence: While legal battles can cause uncertainty, a clear resolution, especially one favoring the project, could boost investor confidence in properly structured asset-backed tokens.

The crypto community is watching closely, understanding that the resolution of the Unicoin SEC lawsuit could shape future regulatory landscapes for innovative blockchain projects.

Navigating Regulatory Waters: Lessons from the Unicoin SEC Lawsuit

For other crypto projects, the ongoing Unicoin SEC lawsuit offers valuable lessons. Operating in the rapidly evolving digital asset space requires a proactive and meticulous approach to compliance and disclosure. Here are some actionable insights:

- Crystal-Clear Disclosures: Ensure all project documentation, whitepapers, and public statements are unambiguous and legally sound. Anticipate potential misinterpretations and address them proactively.

- Robust Legal Counsel: Engage experienced legal professionals specializing in blockchain and securities law from the outset. Their expertise is invaluable in navigating complex regulatory frameworks.

- Engagement with Regulators: Where possible, seek to engage with regulatory bodies to understand their perspectives and ensure compliance, even if formal guidance is still developing.

By taking these steps, projects can better prepare for potential scrutiny and mitigate risks, ultimately fostering a more secure and compliant ecosystem.

In conclusion, Unicoin’s bold move to seek dismissal of the SEC lawsuit marks a significant moment in cryptocurrency regulation. The company’s arguments—centered on alleged misinterpretations of disclosures and claims of political motivation—challenge the very basis of the SEC’s enforcement action. The outcome of this case will not only determine Unicoin’s future but also send powerful signals across the entire digital asset industry regarding regulatory boundaries and the treatment of innovative token structures. It’s an urgent situation that demands attention from all stakeholders in the crypto space, as it could redefine how asset-backed tokens are perceived and regulated moving forward.

Frequently Asked Questions About the Unicoin SEC Lawsuit

- What is Unicoin’s main argument for dismissing the SEC lawsuit?

Unicoin argues that the U.S. Securities and Exchange Commission misinterpreted its key disclosures and that the lawsuit itself was politically motivated by then-SEC Chair Gary Gensler. - What were the SEC’s initial allegations against Unicoin?

The SEC alleged that Unicoin deceived investors by claiming its token was backed by real-world assets like real estate and that it raised over $100 million through the sale of unregistered securities. - How could the outcome of this lawsuit impact the wider crypto industry?

The outcome could set a significant precedent for how asset-backed tokens are classified and regulated, potentially influencing the definition of a “security” in the digital asset space and challenging perceived regulatory overreach. - What lessons can other crypto projects learn from the Unicoin SEC lawsuit?

Projects should prioritize crystal-clear disclosures, engage robust legal counsel specializing in blockchain and securities law, and consider proactive engagement with regulators to ensure compliance.

This developing story about the Unicoin SEC lawsuit is critical for anyone interested in the future of cryptocurrency regulation. We encourage you to share this article with your network on social media to spark further discussion and keep the community informed about these important legal challenges shaping the digital asset landscape!

To learn more about the latest crypto market trends, explore our article on key developments shaping cryptocurrency regulation.

This post Unicoin SEC Lawsuit: Urgent Bid for Dismissal first appeared on BitcoinWorld and is written by Editorial Team

Bunları da Bəyənə Bilərsiniz

Analysts Eye Mirror Chain as the Passive Income Blockchain That Could Mint Millionaires for Life

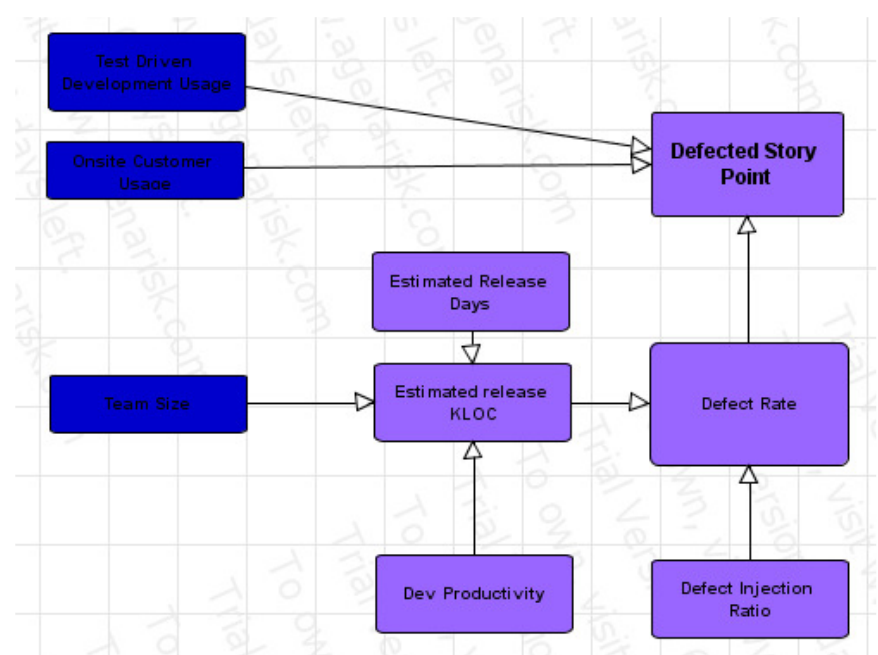

The Defected Story Points Model in Extreme Programming