MetaMask breaks ground with wallet-native stablecoin mUSD

MetaMask is expanding its role in crypto finance with mUSD, a dollar-pegged stablecoin issued by Bridge. The rollout comes as U.S. regulations sharpen and stablecoin adoption reaches new highs.

- MetaMask has launched mUSD, a dollar-pegged stablecoin issued with Bridge and M0.

- The asset will debut on Ethereum and Linea, with plans to integrate into the MetaMask Card.

- The move comes amid fresh U.S. regulatory clarity from the GENIUS Act, boosting stablecoin confidence.

On August 21, MetaMask, the self-custodial crypto wallet built by Consensys, announced the launch of MetaMask USD (mUSD), a native stablecoin developed in partnership with Bridge, a Stripe company, and infrastructure firm M0.

This move marks the first time a major non-custodial wallet has vertically integrated its own dollar-denominated asset, designed to be deeply embedded across its ecosystem from onboarding to spending.

According to the press release, mUSD will initially launch on Ethereum and Consensys’s own Linea network, where it is expected to serve as a foundational asset for its growing DeFi ecosystem and eventually power real-world spending through the MetaMask Card by the end of the year.

A strategic pivot amid a regulatory sea change

By owning a U.S. dollar-pegged stablecoin within its wallet, MetaMask can streamline processes that have long been fragmented, such as fiat on-ramps and cross-chain swaps, while ensuring that liquidity and economic activity remain within its own ecosystem, particularly on its Linea network.

The timing is no coincidence. mUSD launch capitalizes on newfound regulatory clarity provided by the passage of the U.S. GENIUS Act. The legislation establishes the first federal framework for payment stablecoins, creating a clear path for compliant issuance and operation by aligning previously disparate state and federal regulations. This regulatory green light has unleashed a wave of institutional confidence, de-risking the stablecoin market for major players like MetaMask and its partners.

A trillion-dollar opportunity

Market dynamics are pulling in the same direction, with MetaMask’s confidence echoed by traditional finance giants. In a recent report, Goldman Sachs analysts said the current $271 billion stablecoin market is poised for explosive growth, identifying a total addressable market in the trillions of dollars, primarily driven by global payments.

They note that regulatory legitimacy, precisely what the GENIUS Act provides, is the key catalyst that will unlock this value, moving stablecoins beyond crypto trading into mainstream consumer and business payments. MetaMask’s integration with the MetaMask Card, allowing mUSD to be spent at millions of Mastercard merchants, is a direct play for this very opportunity.

Bunları da Bəyənə Bilərsiniz

Fed Governor Lisa Cook Under Fire: DOJ Official Urges Powell to Act

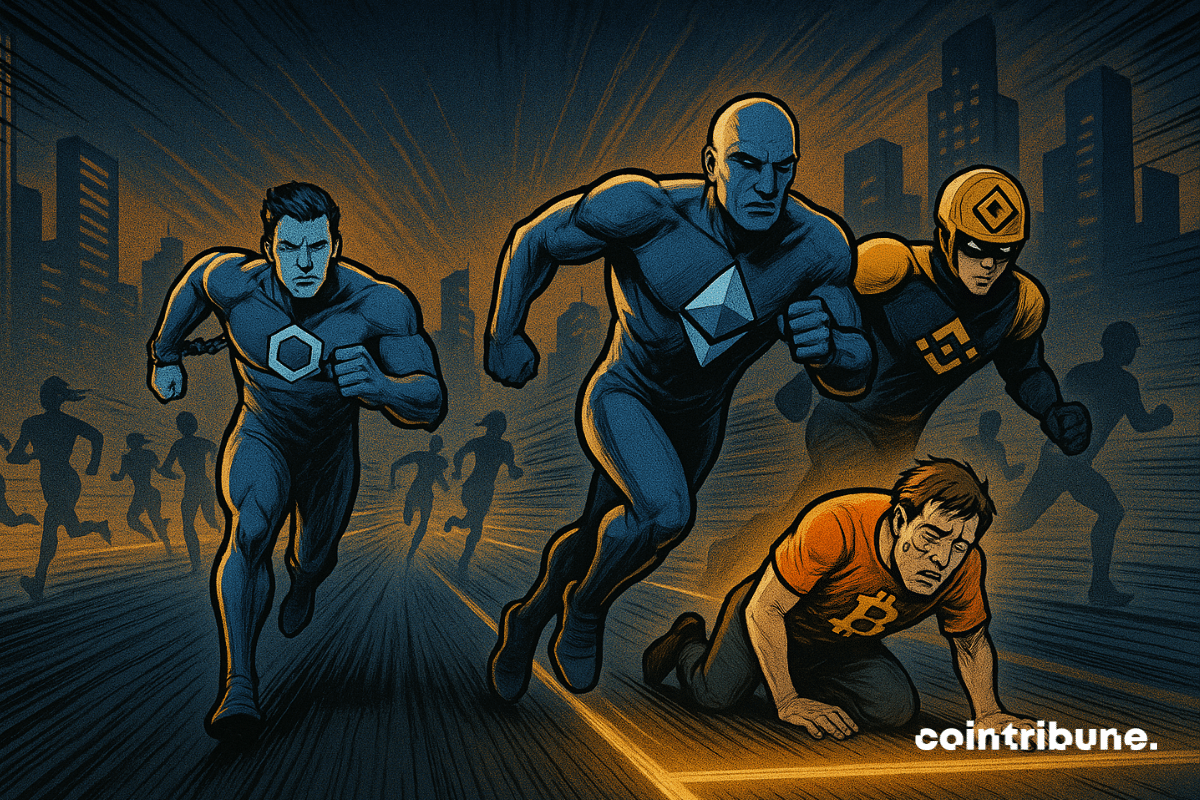

Market Shifts: Altcoins Surge as Bitcoin Slows