Major Banks Try to Avoid Trump’s Crosshairs – What This Means for Crypto?

Key Takeaways:

- Banks, including JPMorgan and Citigroup, are revising internal policies following pressure from Republican state governments.

- Texas and Oklahoma have barred certain financial institutions from state contracts over alleged bias against the fossil fuel and firearms industries.

- The Trump administration may issue an executive order restricting “debanking” on political or religious grounds.

JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo are taking steps to address concerns raised by Republican-led states over alleged political bias, according to a Wall Street Journal report published on June 24.

The banks have held meetings with officials in Texas and Oklahoma to respond to accusations that they limit services to industries such as fossil fuels and firearms. Some of these states have blacklisted banks from contracts over policies perceived as discriminatory.

Banks Scale Back “Woke” Policies

“I’m not asking them to be MAGA banks,” said Todd Russ, Oklahoma’s state treasurer. “I want them to manage my portfolio and stay out of these political ideologies. I think they realize that’s a fair place to be.”

Citigroup recently ended a policy that restricted business with firearms vendors selling to buyers under 21, a move discussed during a meeting with Texas Governor Greg Abbott. JPMorgan and others have updated their policies to clarify that they do not base decisions on political views.

Banks have also withdrawn from climate alliances targeted by Republican officials. Goldman Sachs, Morgan Stanley, and others are reevaluating restrictions on coal-related activities. Bank of America lifted a ban on coal financing last year.

At the federal level, the Trump administration is reportedly considering an executive order to prevent “debanking” based on political or religious views. This order could impact banks’ ability to engage in government business, including selling Treasury bonds.

In Congress, Republican senators have proposed legislation barring regulators from using reputational risk as a factor in exams. The Federal Reserve recently announced it would no longer apply that standard, following direction from Trump-aligned officials.

Trump Expands Crypto Push

Against the backdrop of rising tensions between major financial institutions and Republican leadership, Trump’s expanding crypto activity introduces another potential fault line. By backing a Bitcoin-Ethereum ETF under the Truth Social brand, his media group is positioning itself at odds with institutions under scrutiny for ESG-linked decisions or perceived political biases.

Unlike traditional banks now adjusting policies to avoid state blacklists, Trump’s ventures are embracing digital assets with overt political branding.

This contrast may appeal to constituents who feel underserved or penalized by large financial firms. It also offers an alternative infrastructure where political affiliation and crypto access intersect more directly.

Bunları da Bəyənə Bilərsiniz

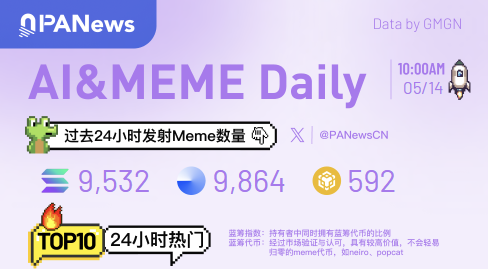

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.5.14)

Sending Bitcoin to Mars is now theoretically possible: Researchers