Galaxy Digital, Multicoin Capital And Jump Crypto Partner To Start A $1B Solana Treasury Firm, Bloomberg Says

Crypto giants Galaxy Digital, Multicoin Capital and Jump Crypto are joining forces to raise $1 billion and form a Solana treasury company.

According to an Aug. 25 Bloomberg report that cited sources familiar with the matter, the three companies aim to create the largest SOL treasury firm. They have also tapped Cantor Fitzgerald, who has over $14.8 billion in assets under management (AUM), as the lead banker.

As part of the planned treasury, the three companies will look to buy out a company that is already publicly listed. The Solana Foundation, a non-profit dedicated to the growth of the Solana blockchain, is also backing the initiative.

Growing Number Of Companies Adding Solana To Their Reserves

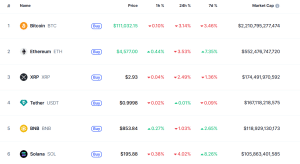

Bitcoin (BTC) and Ethereum (ETH) have been the most popular cryptos for companies looking to build their own digital asset reserves.

That trend started when Strategy began acquiring Bitcoin back in 2020. Through a series of acquisitions since then, the firm has become the largest Bitcoin treasury company with 629,376 BTC on its balance sheets, according to Bitcoin Treasuries.

Other firms have followed Strategy’s method of funding Bitcoin purchases through debt financing. 301 companies now hold 3.68 million BTC collectively on their balance sheets. This is after fourteen new companies joined the trend in the last month.

Some firms have also started to build a treasury around altcoin leader Ethereum (ETH). Most notably, Bitmine Immersion Technologies and SharpLink Gaming are the largest corporate ETH holders.

Bitmine currently holds 1.5 million ETH valued at $6.96 billion at current prices, data from StrategicETHReserve shows. Meanwhile, SharpLink Gaming holds 740.8K ETH worth $3.38 billion.

While BTC and ETH have remained popular choices for companies looking to build a digital asset treasury, some firms have also started to stockpile the smaller-capped altcoin SOL.

Largest cryptos by market cap (Source: CoinMarketCap)

The largest SOL treasury firm is Upexi Inc. It announced on Aug. 5 that its Solana holdings surpassed 2 million SOL, worth about $400 million at current prices. Another company, DeFi Development Corp, holds between 1.2 million and 1.3 million SOL.

Other companies such as Sol Strategies, Classover Holdings Inc, Torrent Capital, and SOL Global Investments also hold the altcoin on their balance sheets.

Sol Strategies, a dedicated Solana-focused investment company, holds between 260,000 and 395,000 SOL, while Classover Holdings has around 52,000 SOL on its balance sheets.

Torrent Capital and SOL Global Investments both have holdings of around 40,000 SOL.

The total holdings of those firms is 3,715,814 SOL, according to data from CoinGecko. The value of their total holdings stands at over $727 million.

Firms Also Rush To Offer A Solana ETF

Companies are not just looking to create Solana treasuries, several firms have also filed for a spot SOL ETF (exchange-traded fund).

That follows the successful approval and launches of US spot Bitcoin and spot Ethereum ETFs last year. These products have seen billions of dollars in cumulative inflows.

Asset management firm VanEck pioneered the SOL ETF race when it filed with the US Securities and Exchange Commission (SEC) in the middle of 2024. It has since amended its S-1s to address staking language.

Others followed, with 21Shares, Bitwise, Grayscale, Canary Capital, Franklin Templeton, Fidelity and Coinshares all filing S-1 forms with the regulator for their own spot Solana ETFs. Many of these applications have also been amended to address staking.

The final decision for the spot SOL ETF filings is anticipated by October 2025.

Earlier this year in June, Bloomberg ETF analyst Eric Balchunas predicted a potential “Alt Coin ETF Summer.” Him and his colleague, James Seyffart, also predicted a 90% probability that spot Solana ETFs will get approved this year.

While US spot Solana ETFs may not have been approved yet, the REX-Osprey Solana + Staking ETF was listed on the Cboe BZX Exchange and is currently trading. This is after the fund’s issuer was informed by the SEC that it had “no further comments,” giving it the greenlight to proceed.

The issuer took advantage of a regulatory workaround that was made possible by structuring the fund under the Investment Company Act of 1940.

Bunları da Bəyənə Bilərsiniz

ETHZilla Announces $250M Share Buyback While Holding Half-Billion in Ethereum – Here’s Why

Invest in the Best Crypto to Buy Today: BullZilla, Pepe, and Bonk – Why BullZilla is About to Change the Meme Coin Game?