Crypto Markets Flash Altseason Signals as Bitcoin Loses Grip on Dominance

TLDR

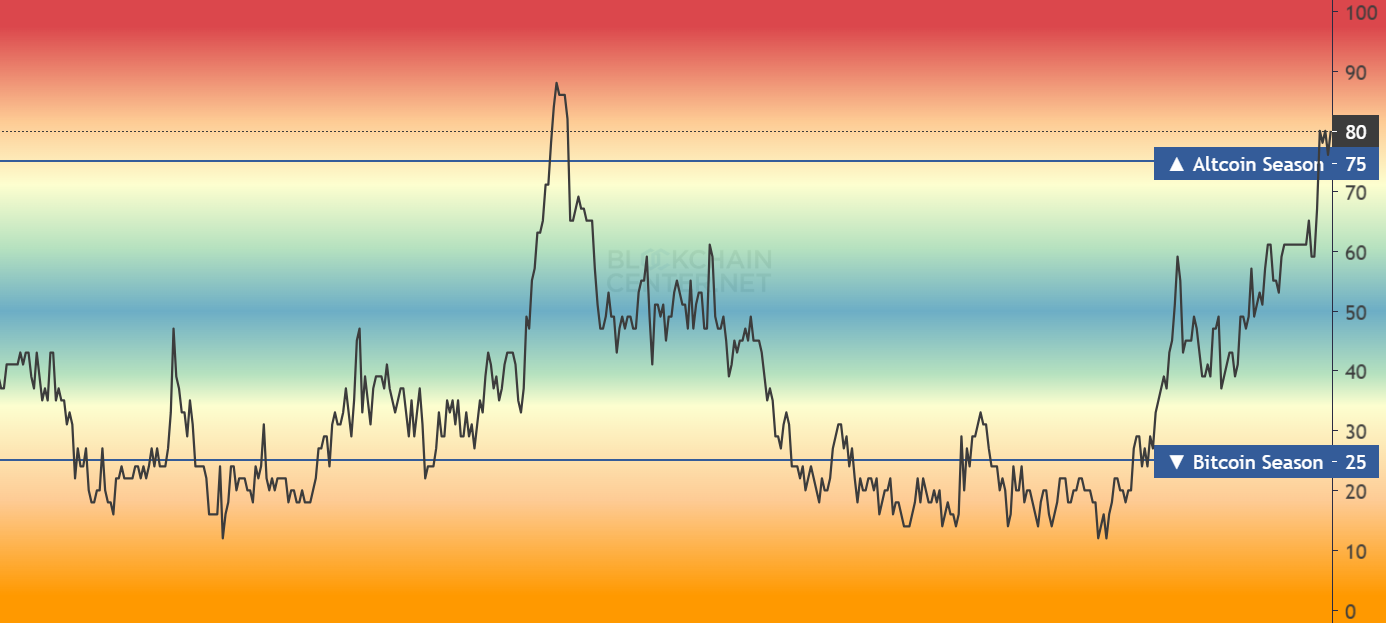

- Altcoin Season Index reached 67% in 2025, the highest level this year, with 75% needed to officially signal altcoin season

- Bitcoin dominance (BTC.D) shows a bear flag breakdown on weekly charts, indicating market share is rotating from Bitcoin to altcoins

- Only 8 more of the top 100 altcoins need to outperform Bitcoin over 90 days to trigger official altcoin season

- Previous altcoin seasons featured massive gains like Dogecoin’s 36,000% rally and Shiba Inu’s historic performance

- Technical analysis suggests altcoin trading pairs may show relative strength as Bitcoin dominance trends lower

The cryptocurrency market is showing early signs of a potential altcoin season as key indicators reach their highest levels of 2025. Market data reveals growing momentum for alternative cryptocurrencies over Bitcoin.

The Altcoin Season Index currently sits at 80%, marking the highest reading for 2025. This index measures the performance of the top 100 altcoins against Bitcoin over a 90-day rolling period to determine market sentiment shifts.

Source: BlockchainCenter

Source: BlockchainCenter

The index calculates what percentage of the top 100 altcoins are outperforming Bitcoin during this timeframe. When 75% of these altcoins outperform Bitcoin over 90 days, markets officially enter altcoin season territory.

Bitcoin Dominance Shows Technical Weakness

Technical analysis of Bitcoin dominance (BTC.D) reveals a bear flag breakdown pattern on weekly charts. This pattern typically signals continued weakness in Bitcoin’s market share relative to other cryptocurrencies.

According to crypto analyst TATrader_Alan, this breakdown indicates ongoing altseason momentum. The technical pattern suggests capital rotation from Bitcoin toward alternative cryptocurrencies continues to build.

Bitcoin dominance measures Bitcoin’s market capitalization as a percentage of the total cryptocurrency market. When this metric declines, it typically indicates altcoins are gaining ground relative to Bitcoin.

The bear flag pattern represents a continuation of a downtrend after a period of consolidation. This technical formation often precedes further declines in the measured asset.

Historical Context and Market Performance

Previous altcoin seasons have produced extraordinary returns for alternative cryptocurrencies. The last major altcoin season featured Dogecoin’s 36,000% price increase and Shiba Inu’s historic rally.

During that period, Shiba Inu temporarily surpassed Dogecoin in market capitalization. The DeFi summer phenomenon also emerged, propelling tokens like Fantom, Polygon, and Uniswap into prominence.

These historical examples demonstrate the potential magnitude of altcoin rallies during official altcoin seasons. Market participants often see massive gains concentrated in shorter timeframes during these periods.

The current market setup mirrors conditions that preceded previous altcoin seasons. Trading volumes and on-chain metrics support the technical indicators pointing toward altcoin strength.

Altcoin trading pairs against Bitcoin may show increased relative strength as dominance continues declining. ETH/BTC and SOL/BTC pairs represent examples of potential beneficiaries from this trend.

The cryptocurrency market has experienced a recovery over recent weekends that contributed to the Altcoin Season Index reaching 2025 highs. This recovery has helped push more altcoins into outperforming Bitcoin over the 90-day measurement period.

The post Crypto Markets Flash Altseason Signals as Bitcoin Loses Grip on Dominance appeared first on CoinCentral.

Bunları da Bəyənə Bilərsiniz

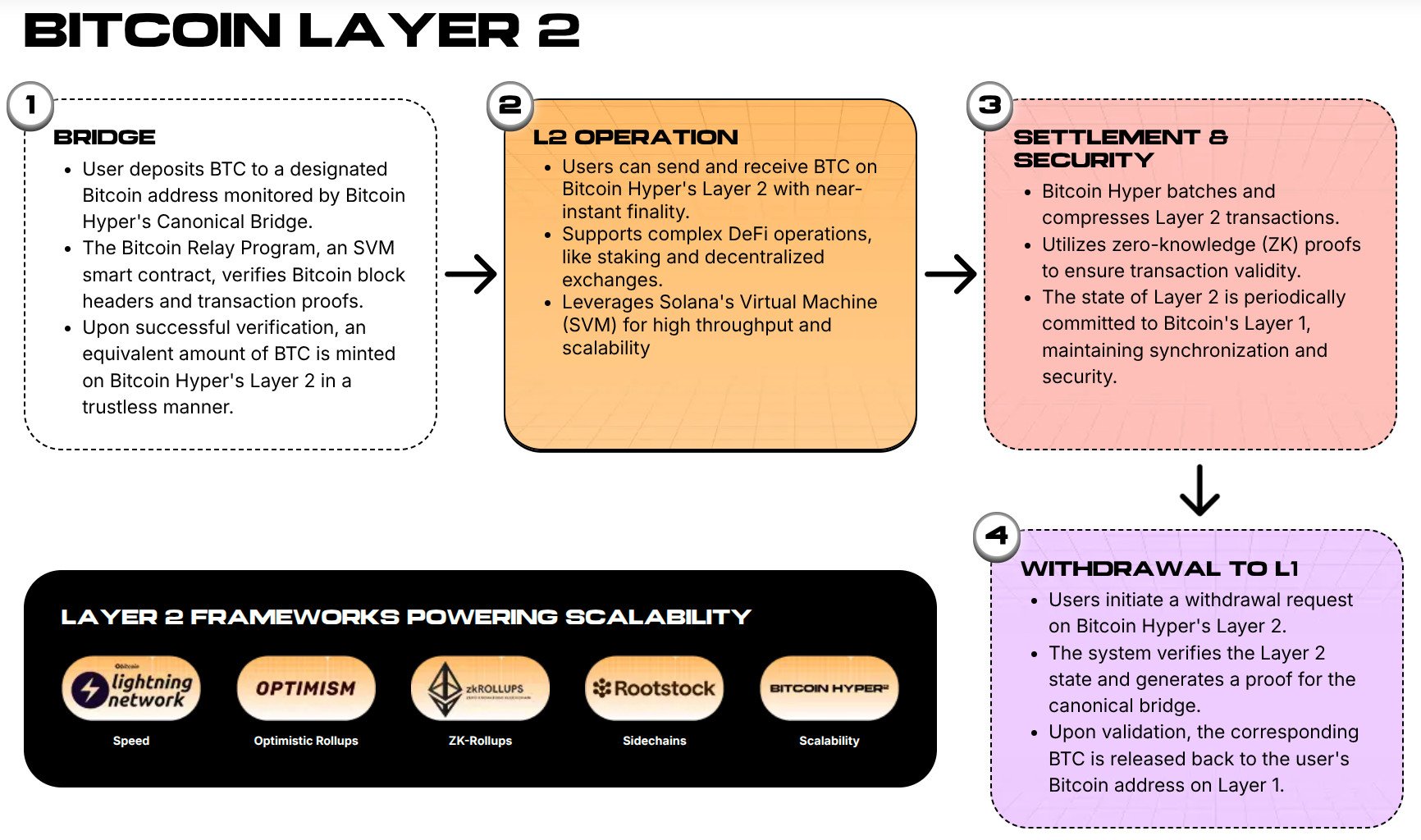

Bitcoin Hyper Presale Hits $16M As Whales Buy $64K, Is This the Next Crypto to Explode?

Recession Cancelled? Experts Weigh In