Beyond Cycles of Deviation: How Fair Principles Ensure a Stable Nash Equilibrium

Table of Links

Abstract and 1. Introduction

-

A free and fair economy: definition, existence and uniqueness

2.1 A free economy

2.2 A free and fair economy

-

Equilibrium existence in a free and fair economy

3.1 A free and fair economy as a strategic form game

3.2 Existence of an equilibrium

-

Equilibrium efficiency in a free and fair economy

-

A free economy with social justice and inclusion

5.1 Equilibrium existence and efficiency in a free economy with social justice

5.2 Choosing a reference point to achieve equilibrium efficiency

-

Some applications

6.1 Teamwork: surplus distribution in a firm

6.2 Contagion and self-enforcing lockdown in a networked economy

6.3 Bias in academic publishing

6.4 Exchange economies

-

Contributions to the closely related literature

-

Conclusion and References

Appendix

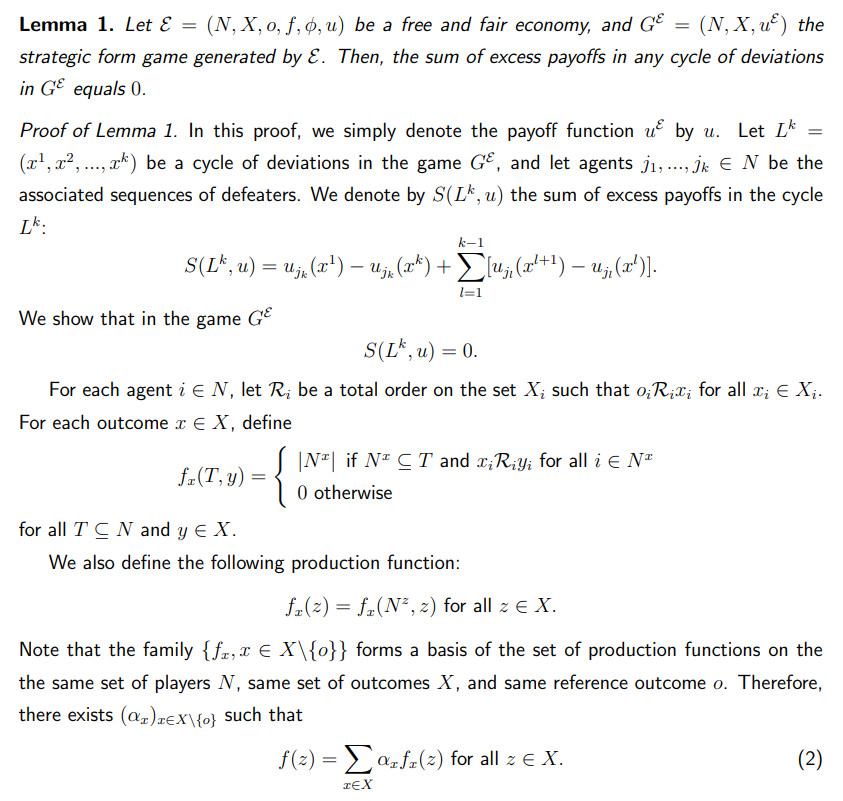

3.2 Existence of an equilibrium

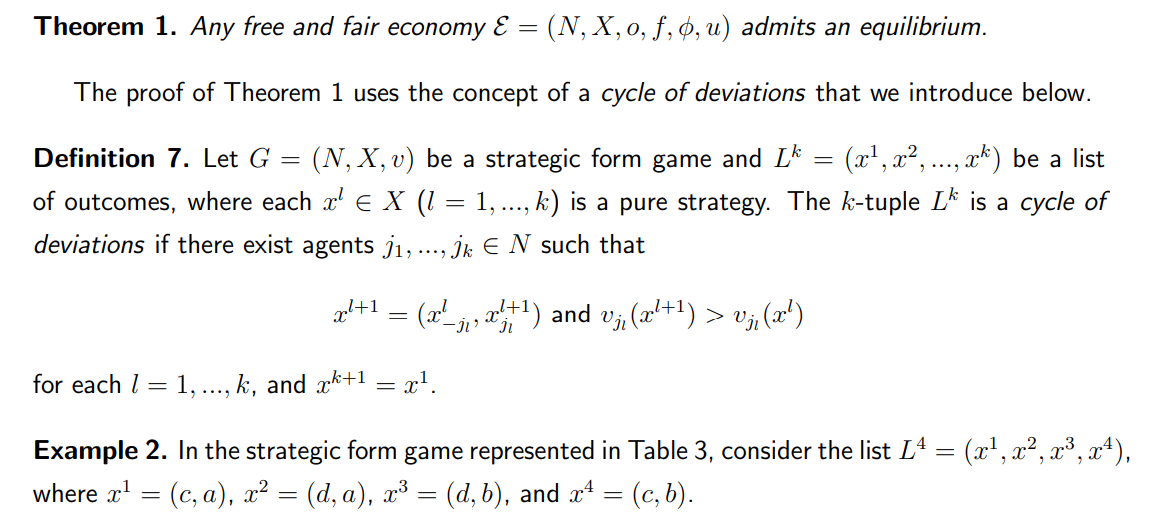

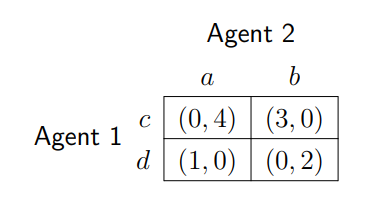

In this section, we state and prove our main result.

\

\

\

\

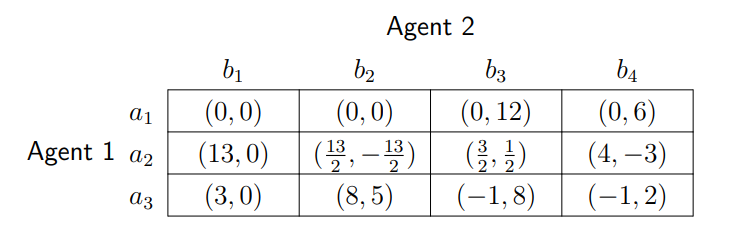

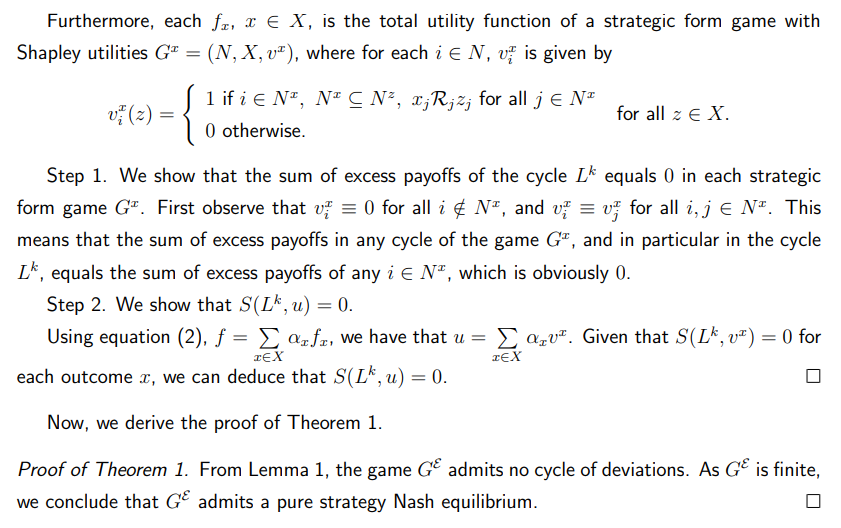

\ In the strategic form game in Table 4, the sum of excess payoffs in any cycle of outcomes equals 0. Therefore, the game does not admit a cycle of deviations. The profile x ∗ = (a2, b3) is the only pure strategy Nash equilibrium of the game.

\ Note that the game in Table 4 is generated from a free and fair economy. From Definition 7, a sufficient condition for a finite strategic form game to admit a pure strategy Nash equilibrium is the absence of a cycle of deviations. The sum of excess payoffs in any cycle of deviations has to be strictly positive, as illustrated in Table 3 in Example 2. Such an example of a cycle of deviations can not be constructed in a strategic form game generated from a free and fair economy (see Table 4 in Example 2). We prove that in a strategic form game generated by a free and fair economy, the sum of excess payoffs in any cycle of deviations equals 0.

\

\

\ The principles of market justice that define a free and fair economy are only sufficient conditions for the existence of a pure strategy Nash equilibrium. However, an economy that violates the fair principles may not have a pure strategy Nash equilibrium.

\

:::info Authors:

(1) Ghislain H. Demeze-Jouatsa, Center for Mathematical Economics, University of Bielefeld (demeze jouatsa@uni-bielefeld.de);

(2) Roland Pongou, Department of Economics, University of Ottawa (rpongou@uottawa.ca);

(3) Jean-Baptiste Tondji, Department of Economics and Finance, The University of Texas Rio Grande Valley (jeanbaptiste.tondji@utrgv.edu).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

Bunları da Bəyənə Bilərsiniz

South Korea's IBK Corporate Bank and Shinhan Financial have both applied for Korean won stablecoin trademarks

XRP Price Prediction: Ripple Uncertainty Has Holders Pivoting To A New ETH Layer 2 Token For Gains