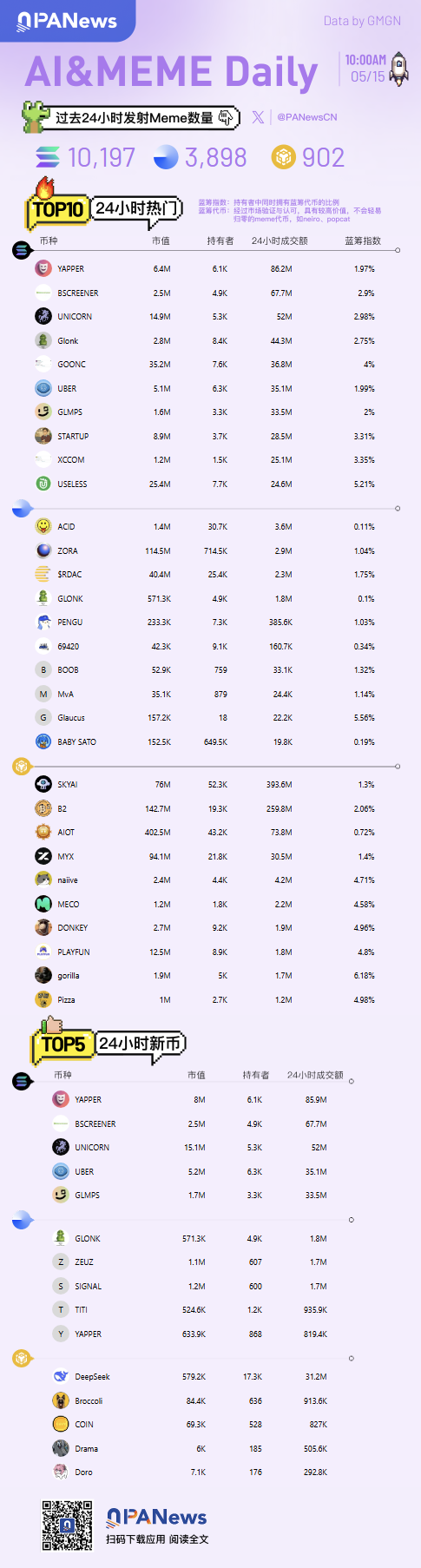

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.5.15)

2025/05/15 10:04

What happened in the past 24 hours? Take a look at the picture review of "Ai&Meme Daily"!

🗓5/15 Update:

believe is in full swing, SOL is back with prosperity

$LAUNCHCOIN exceeds 370 million

$YAPPER is an AI application for making high-quality funny videos

$unicorn ai narrative, founder's response

$STARTUP him calls

⚠ Tips: PVP is high risk, be cautious and always DYOR!

Məsuliyyətdən İmtina: Bu saytda yenidən yayımlanan məqalələr ictimai platformalardan götürülmüşdür və yalnız məlumat xarakteri daşıyır. MEXC-in baxışlarını əks etdirməyə bilər. Bütün hüquqlar orijinal müəlliflərə məxsusdur. Hər hansı bir məzmunun üçüncü tərəfin hüquqlarını pozduğunu düşünürsünüzsə, zəhmət olmasa, service@support.mexc.com ilə əlaqə saxlayaraq silinməsini tələb edin. MEXC məzmunun dəqiqliyinə, tamlığına və ya vaxtında yenilənməsinə dair heç bir zəmanət vermir və təqdim olunan məlumatlar əsasında görülən hərəkətlərə görə məsuliyyət daşımır. Məzmun maliyyə, hüquqi və ya digər peşəkar məsləhət xarakteri daşımır və MEXC tərəfindən tövsiyə və ya təsdiq kimi qəbul edilməməlidir.

Bunları da Bəyənə Bilərsiniz

Centrifuge COO Jürgen Blumberg: “DeFi Is Having Its ETF Moment”

After more than two decades scaling exchange-traded funds (ETFs) and capital markets businesses at Goldman Sachs, Invesco, and BlackRock, Jürgen Blumberg has joined Centrifuge as chief operating officer. Centrifuge is a DeFi platform for tokenizing real-world assets (RWAs) and using them as collateral in decentralized lending. Blumberg believes the decentralized finance sector is now experiencing a turning point—one that mirrors the transformative rise of ETFs in traditional finance. From ETFs to DeFi Disruption Asked why he chose this moment to leave traditional finance for DeFi, Blumberg frames it in the context of what he calls the industry’s “ETF moment.” He sees clear parallels between the early skepticism around ETFs and the current perceptions of DeFi, noting that both began as disruptive innovations challenging entrenched systems. “I was always fascinated by the markets—how order books work, how instruments exchange on different venues,” Blumberg says. “The first five years of my career were in trading, and then I moved into my first ETF role. Even back then, I was convinced ETFs would replace mutual funds. It took 15 years, but now ETFs as a category are bigger than mutual funds.” He sees parallels between ETFs’ early days and the current DeFi sector : “ETFs were a new technology in traditional finance. Today, DeFi is a completely new ecosystem aiming to disrupt, offering solutions to the cost, time, and access limitations of traditional products. In DeFi, everybody can access markets—24/7.” Clearing Misconceptions About DeFi Blumberg explains that many in traditional finance view DeFi as volatile or risky, but that perception overlooks its structural advantages. “Those who take the time to understand DeFi will see it’s similar to traditional finance—just with different terminology. TVL is the same as AUM, liquidity pools are like exchanges, and derivatives exist on both sides. It’s a fascinating world with the power to disrupt how things are done today.” Tokenization: Not All Tokens Are Equal Recalling an old ETF industry saying—“not every ETF is created equal”—Blumberg applies it to tokenization. The phrase means that while all ETFs fall under the same general category, their structure, risk profile, and quality can vary. “There are tokens that are derivative structures and not fully backed by the underlying asset. Then there are fund tokens, like ours, that are fully backed, giving holders direct access to the assets. Just because something is called a token doesn’t mean it carries the same structure or risk.” Global Regulatory Competition and Centrifuge’s Growth Blumberg also sees regulatory momentum happening worldwide. “At the moment, progress is coming from the U.S. But Europe is moving forward too—Luxembourg is making progress, the EU has MiCA , and many ETP issuers choose Switzerland as their domicile. In Asia, Hong Kong and Singapore are advancing in certain areas. There’s a global competition to attract the smartest ideas and allow controlled innovation.” Centrifuge, he adds, is on the cusp of major progress. “We’re approaching the $1 billion TVL mark. With partnerships such as S&P and others we’ll soon announce, we’re well positioned to keep growing.” ONE. BILLION. DOLLARS. TVL.🔥 The flywheel is spinning. We've been heads down building since 2017, and now our onchain ecosystem has hit its first billion. The first billy was the hardest. The next ones are inevitable. 🚀 Onwards and upwards!!! pic.twitter.com/Ip4pq0qDzY — Centrifuge (@centrifuge) August 12, 2025 For Blumberg, the decisive reason to leave the security of large financial institutions was his conviction that the most meaningful innovation in the next decade will come from startups, not incumbents.

Paylaşın

CryptoNews2025/08/14 00:07

Coinbase partners with Squads to accelerate USDC adoption on Solana

Coinbase is teaming up with Squads to bolster the adoption of the USDC stablecoin on the Solana blockchain. Squads, a decentralized finance layer on Solana (SOL), announced the strategic partnership with Coinbase on Aug. 13, noting the collaboration aims at…

Paylaşın

Crypto.news2025/08/14 02:02

3 key reasons Cardano could hit new highs in 2025, and 1 other coin to watch closely

Cardano gains momentum as ADA builds quietly, while another under-the-radar project heats up for a potential breakout. #partnercontent

Paylaşın

Crypto.news2025/08/14 01:50